Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a). XYZ Plastics Company has been dumping in the local council waste collection centre some 40,000Kg of unusable chemicals each year. In addition to being

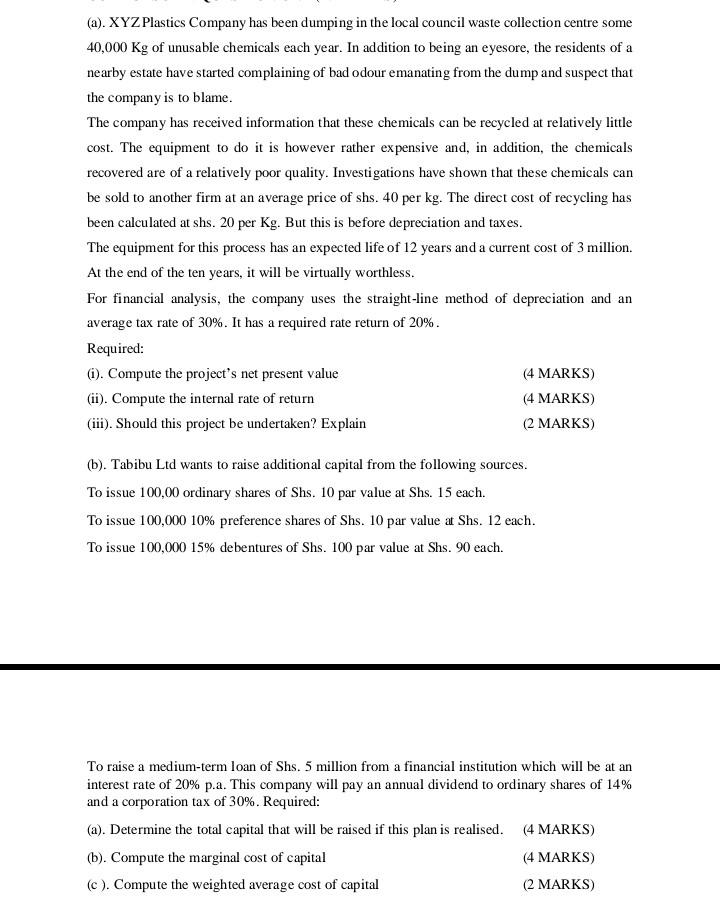

(a). XYZ Plastics Company has been dumping in the local council waste collection centre some 40,000Kg of unusable chemicals each year. In addition to being an eyesore, the residents of a nearby estate have started complaining of bad odour emanating from the dump and suspect that the company is to blame. The company has received information that these chemicals can be recycled at relatively little cost. The equipment to do it is however rather expensive and, in addition, the chemicals recovered are of a relatively poor quality. Investigations have shown that these chemicals can be sold to another firm at an average price of shs. 40 per kg. The direct cost of recycling has been calculated at shs. 20 per Kg. But this is before depreciation and taxes. The equipment for this process has an expected life of 12 years and a current cost of 3 million. At the end of the ten years, it will be virtually worthless. For financial analysis, the company uses the straight-line method of depreciation and an average tax rate of 30%. It has a required rate return of 20%. Daminar- (b). Tabibu Ltd wants to raise additional capital from the following sources. To issue 100,00 ordinary shares of Shs. 10 par value at Shs. 15 each. To issue 100,00010% preference shares of Shs. 10 par value at Shs. 12 each. To issue 100,00015% debentures of Shs. 100 par value at Shs. 90 each. To raise a medium-term loan of Shs. 5 million from a financial institution which will be at an interest rate of 20% p.a. This company will pay an annual dividend to ordinary shares of 14% and a corporation tax of 30%. Required: (a). Determine the total capital that will be raised if this plan is realised. (4 MARKS) (b). Compute the marginal cost of capital (4 MARKS) (c). Compute the weighted average cost of capital (2 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started