Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A year ago, Lisa bought 100 shares of TD bank stock on margin at $80 per share. Initial margin is 50% and the maintenance

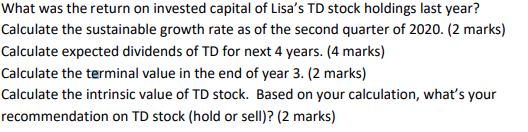

A year ago, Lisa bought 100 shares of TD bank stock on margin at $80 per share. Initial margin is 50% and the maintenance margin is 40%. TD Bank paid an annual dividend of C$3.06 per share last year. Interest rate for the margin loan is 5%. The stock price drops to $62 now after one year. Due to the high growth in business, TD's dividends are expected to grow by 10% for the next 3 years. From year 4 on, the dividends will grow constantly at the sustainable growth rate. TD bank follows a stable dividend payout ratio of 45%. As of the second quarter of 2020, The company has net profit margin of 27.5%, asset turnover of 0.0218 and equity multiplier of 17.84. The required rate of return of TD stock is 7.5%. What was the return on invested capital of Lisa's TD stock holdings last year? Calculate the sustainable growth rate as of the second quarter of 2020. (2 marks) Calculate expected dividends of TD for next 4 years. (4 marks) Calculate the terminal value in the end of year 3. (2 marks) Calculate the intrinsic value of TD stock. Based on your calculation, what's your recommendation on TD stock (hold or sell)? (2 marks)

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solutton a The inital Mavgin is 507 Share price is 80 am d NoOLShares l00 amount b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started