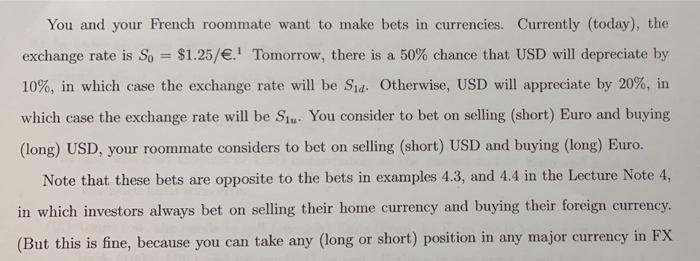

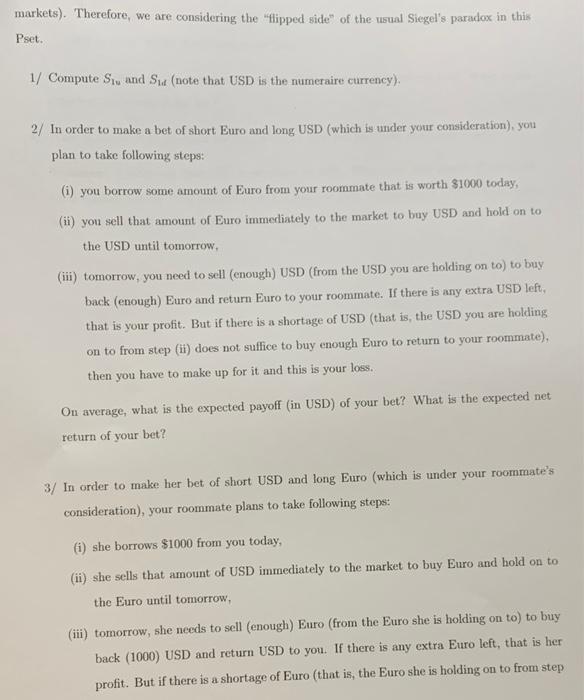

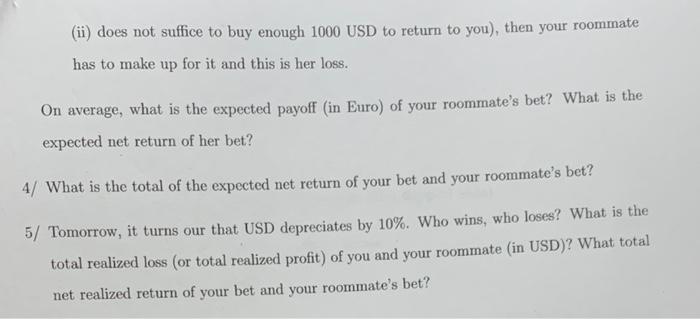

a You and your French roommate want to make bets in currencies. Currently (today), the exchange rate is So $1.25/.! Tomorrow, there is a 50% chance that USD will depreciate by 10%, in which case the exchange rate will be Sid. Otherwise, USD will appreciate by 20%, in which case the exchange rate will be Slu. You consider to bet on selling (short) Euro and buying (long) USD, your roommate considers to bet on selling (short) USD and buying (long) Euro. Note that these bets are opposite to the bets in examples 4.3, and 4.4 in the Lecture Note 4, in which investors always bet on selling their home currency and buying their foreign currency. (But this is fine, because you can take any (long or short) position in any major currency in FX markets). Therefore, we are considering the "flipped side" of the usual Siegel's paradox in this Pset. 1/ Compute Siv and Su (note that USD is the numeraire currency), 2/ In order to make a bet of short Euro and long USD (which is under your consideration), you plan to take following steps: (i) you borrow some amount of Euro from your roommate that is worth $1000 today, (ii) you sell that amount of Euro immediately to the market to buy USD and hold on to the USD until tomorrow, (iii) tomorrow, you need to sell (enough) USD (from the USD you are holding on to) to buy back (enough) Euro and return Euro to your roommate. If there is any extra USD left, that is your profit. But if there is a shortage of USD (that is, the USD you are holding on to from step (ii) does not suffice to buy enough Euro to return to your roommate), then you have to make up for it and this is your loss. On average, what is the expected payoff (in USD) of your bet? What is the expected net return of your bet? 3/ In order to make her bet of short USD and long Euro (which is under your roommate's consideration), your roommate plans to take following steps: (i) she borrows $1000 from you today, (ii) she sells that amount of USD immediately to the market to buy Euro and hold on to the Euro until tomorrow, (iii) tomorrow, she needs to sell (enough) Euro (from the Euro she is holding on to) to buy back (1000) USD and return USD to you. If there is any extra Euro left, that is her profit. But if there is a shortage of Euro (that is, the Euro she is holding on to from step (ii) does not suffice to buy enough 1000 USD to return to you), then your roommate has to make up for it and this is her loss. On average, what is the expected payoff (in Euro) of your roommate's bet? What is the expected net return of her bet? 4/ What is the total of the expected net return of your bet and your roommate's bet? 5/ Tomorrow, it turns our that USD depreciates by 10%. Who wins, who loses? What is the total realized loss (or total realized profit) of you and your roommate (in USD)? What total net realized return of your bet and your roommate's bet? a You and your French roommate want to make bets in currencies. Currently (today), the exchange rate is So $1.25/.! Tomorrow, there is a 50% chance that USD will depreciate by 10%, in which case the exchange rate will be Sid. Otherwise, USD will appreciate by 20%, in which case the exchange rate will be Slu. You consider to bet on selling (short) Euro and buying (long) USD, your roommate considers to bet on selling (short) USD and buying (long) Euro. Note that these bets are opposite to the bets in examples 4.3, and 4.4 in the Lecture Note 4, in which investors always bet on selling their home currency and buying their foreign currency. (But this is fine, because you can take any (long or short) position in any major currency in FX markets). Therefore, we are considering the "flipped side" of the usual Siegel's paradox in this Pset. 1/ Compute Siv and Su (note that USD is the numeraire currency), 2/ In order to make a bet of short Euro and long USD (which is under your consideration), you plan to take following steps: (i) you borrow some amount of Euro from your roommate that is worth $1000 today, (ii) you sell that amount of Euro immediately to the market to buy USD and hold on to the USD until tomorrow, (iii) tomorrow, you need to sell (enough) USD (from the USD you are holding on to) to buy back (enough) Euro and return Euro to your roommate. If there is any extra USD left, that is your profit. But if there is a shortage of USD (that is, the USD you are holding on to from step (ii) does not suffice to buy enough Euro to return to your roommate), then you have to make up for it and this is your loss. On average, what is the expected payoff (in USD) of your bet? What is the expected net return of your bet? 3/ In order to make her bet of short USD and long Euro (which is under your roommate's consideration), your roommate plans to take following steps: (i) she borrows $1000 from you today, (ii) she sells that amount of USD immediately to the market to buy Euro and hold on to the Euro until tomorrow, (iii) tomorrow, she needs to sell (enough) Euro (from the Euro she is holding on to) to buy back (1000) USD and return USD to you. If there is any extra Euro left, that is her profit. But if there is a shortage of Euro (that is, the Euro she is holding on to from step (ii) does not suffice to buy enough 1000 USD to return to you), then your roommate has to make up for it and this is her loss. On average, what is the expected payoff (in Euro) of your roommate's bet? What is the expected net return of her bet? 4/ What is the total of the expected net return of your bet and your roommate's bet? 5/ Tomorrow, it turns our that USD depreciates by 10%. Who wins, who loses? What is the total realized loss (or total realized profit) of you and your roommate (in USD)? What total net realized return of your bet and your roommate's bet