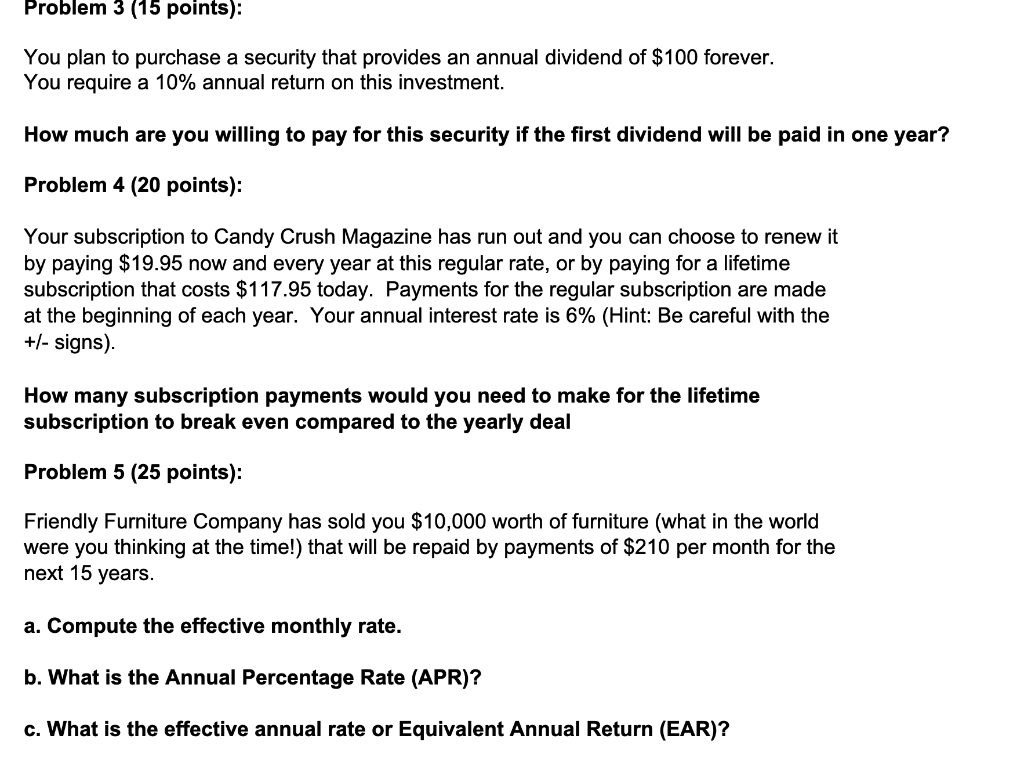

a. You and your spouse are making plans for retirement. You plan on living 30 years after you retire and would like to have $80,000 annually on which to live. Your first withdrawal will be made one year after you retire and you anticipate that your retirement account will earn 8% annually. What amount do you need in your retirement account the day you retire? b. Assume that your first withdrawal will be made the day you retire; however, you will still receive a total of 30 payments. Under this assumption, what amount do you now need in your retirement account the day you retire? Problem 2 (20 points): Your spouse wants to buy a 2022 Tesla Model X Performance sedan. The car costs $100,000 and would be financed with monthly payments over an 8-year period. The credit union is offering interest rates of 2.4%APR on monthly car loans. How much are the payments? Problem 3 (15 points): You plan to purchase a security that provides an annual dividend of $100 forever. You require a 10% annual return on this investment. How much are you willing to pay for this security if the first dividend will be paid in one year? Problem 4 (20 points): Your subscription to Candy Crush Magazine has run out and you can choose to renew it You plan to purchase a security that provides an annual dividend of $100 forever. You require a 10% annual return on this investment. How much are you willing to pay for this security if the first dividend will be paid in on Problem 4 (20 points): Your subscription to Candy Crush Magazine has run out and you can choose to renew it by paying $19.95 now and every year at this regular rate, or by paying for a lifetime subscription that costs $117.95 today. Payments for the regular subscription are made at the beginning of each year. Your annual interest rate is 6% (Hint: Be careful with the + (- signs). How many subscription payments would you need to make for the lifetime subscription to break even compared to the yearly deal Problem 5 (25 points): Friendly Furniture Company has sold you $10,000 worth of furniture (what in the world were you thinking at the time!) that will be repaid by payments of $210 per month for the next 15 years. a. Compute the effective monthly rate. b. What is the Annual Percentage Rate (APR)? c. What is the effective annual rate or Equivalent Annual Return (EAR)