Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) You are a financial consultant and an expert in contingent immunization strategies. A client has hired you to make sure her portfolio has a

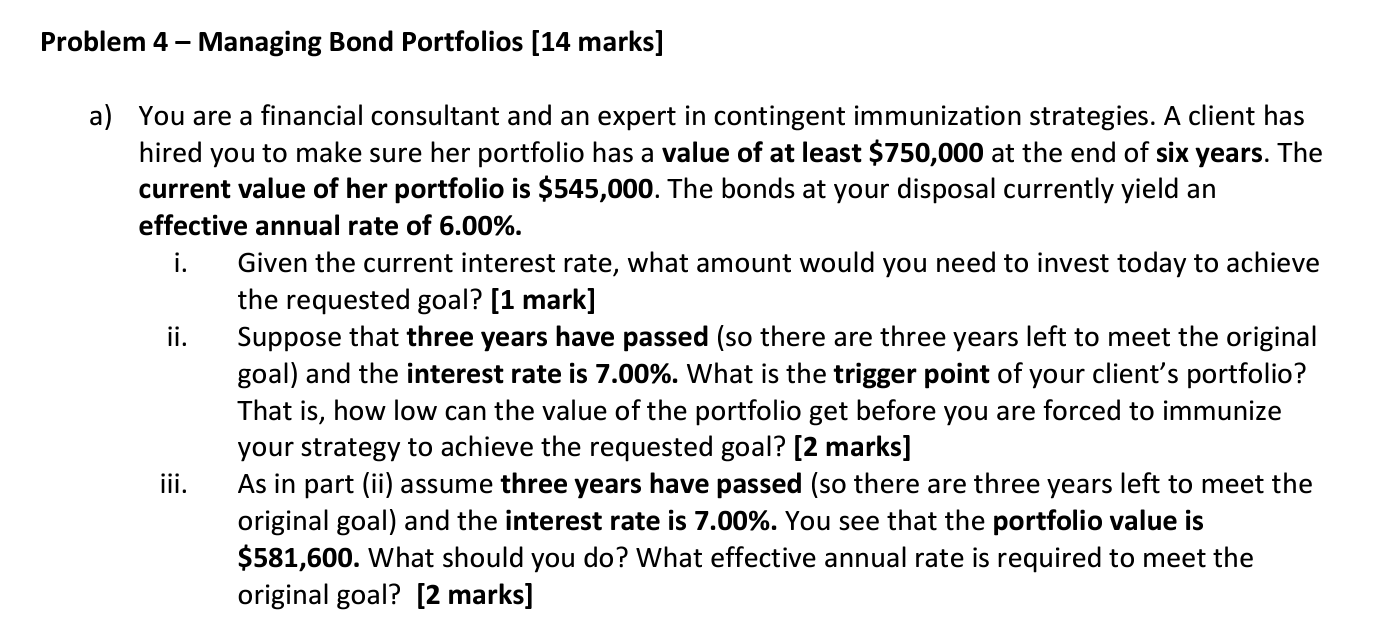

a) You are a financial consultant and an expert in contingent immunization strategies. A client has hired you to make sure her portfolio has a value of at least $750,000 at the end of six years. The current value of her portfolio is $545,000. The bonds at your disposal currently yield an effective annual rate of 6.00%. i. Given the current interest rate, what amount would you need to invest today to achieve the requested goal? [1 mark] ii. Suppose that three years have passed (so there are three years left to meet the original goal) and the interest rate is 7.00%. What is the trigger point of your client's portfolio? That is, how low can the value of the portfolio get before you are forced to immunize your strategy to achieve the requested goal? [2 marks] iii. As in part (ii) assume three years have passed (so there are three years left to meet the original goal) and the interest rate is 7.00%. You see that the portfolio value is $581,600. What should you do? What effective annual rate is required to meet the original goal? [2 marks]

a) You are a financial consultant and an expert in contingent immunization strategies. A client has hired you to make sure her portfolio has a value of at least $750,000 at the end of six years. The current value of her portfolio is $545,000. The bonds at your disposal currently yield an effective annual rate of 6.00%. i. Given the current interest rate, what amount would you need to invest today to achieve the requested goal? [1 mark] ii. Suppose that three years have passed (so there are three years left to meet the original goal) and the interest rate is 7.00%. What is the trigger point of your client's portfolio? That is, how low can the value of the portfolio get before you are forced to immunize your strategy to achieve the requested goal? [2 marks] iii. As in part (ii) assume three years have passed (so there are three years left to meet the original goal) and the interest rate is 7.00%. You see that the portfolio value is $581,600. What should you do? What effective annual rate is required to meet the original goal? [2 marks] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started