Question

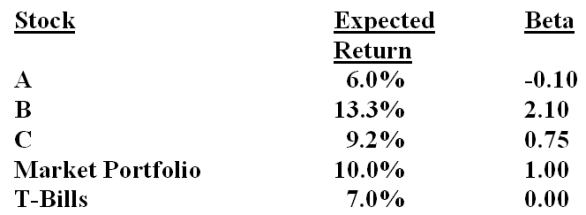

a) You are considering the three stocks given below (stocks A, B, and C): Calculate the expected return and beta of a portfolio equally weighted

a) You are considering the three stocks given below (stocks A, B, and C):

Calculate the expected return and beta of a portfolio equally weighted between stocks B and C. Demonstrate that holding stock A actually reduces risk by comparing the risk of a portfolio equally weighted between stock B and T-Bills with a portfolio equally weighted between stocks B and A.

Questions 4b), 4c) and 4d) are related.

Suppose that you have identified three important systematic risk factors given by exports, inflation, and industrial production. In the beginning of the year, growth in these three factors is estimated at -1%, 2.5%, and 3.5% respectively. However, actual growth in these factors turns out to be 1%, -2%, and 2%. The factor betas are given by bEX = 1.8, bI = 0.7, and bIP = 1.0.

b) If the expected return on the stock is 6%, and no unexpected news concerning the

stock surfaces, calculate the stock's total return.

c) Calculate the stock's total return if the company announces that an important patent filing has been granted sooner than expected and will earn the company 5% more in return.

d) Calculate the stock's total return if the company announces that they had an industrial accident and the operating facilities will close down for some time thus resulting in a loss by the company of 7% in return.

StockABCMarketPortfolioT-Bills0.00ReturnExpected6.0%13.3%9.2%10.0%7.0%Beta0.102.100.751.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started