Question

a) You are currently long on a portfolio of stocks that has a beta of 1.60. Given recent uncertainties, you intend to reduce the

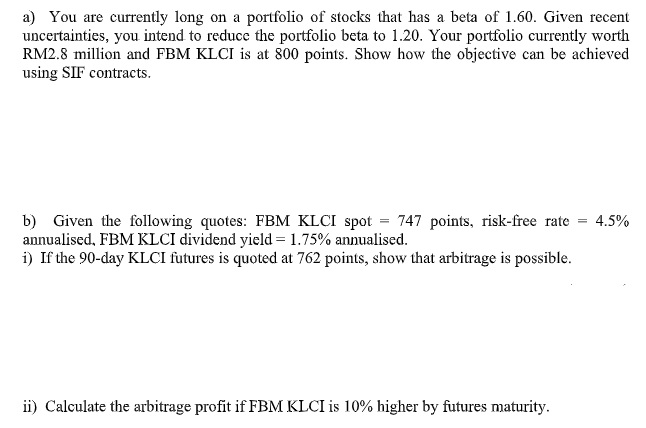

a) You are currently long on a portfolio of stocks that has a beta of 1.60. Given recent uncertainties, you intend to reduce the portfolio beta to 1.20. Your portfolio currently worth RM2.8 million and FBM KLCI is at 800 points. Show how the objective can be achieved using SIF contracts. b) Given the following quotes: FBM KLCI spot = 747 points, risk-free rate annualised, FBM KLCI dividend yield = 1.75% annualised. i) If the 90-day KLCI futures is quoted at 762 points, show that arbitrage is possible. = 4.5% ii) Calculate the arbitrage profit if FBM KLCI is 10% higher by futures maturity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics Today The Micro View

Authors: Roger LeRoy Miller

20th Edition

0135888123, 9780135888124

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App