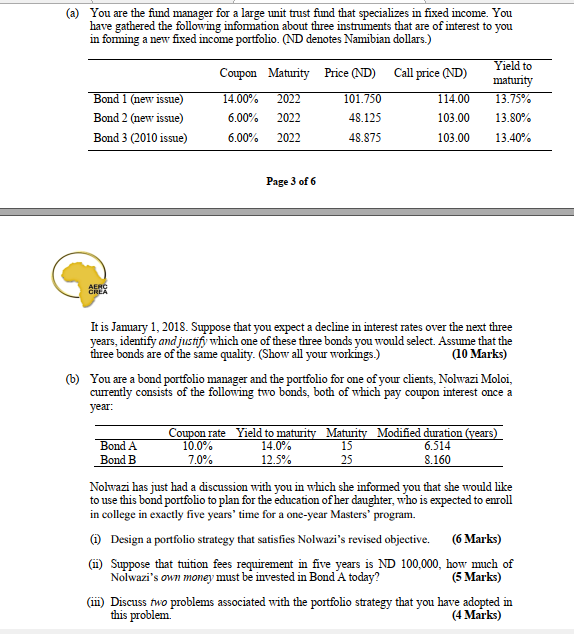

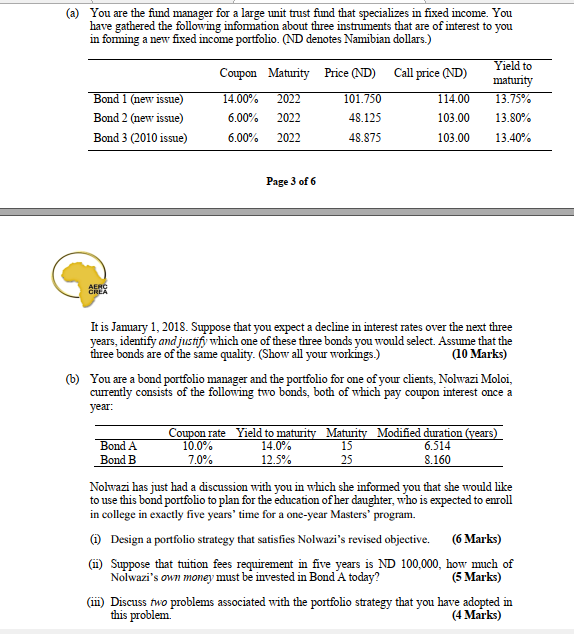

(a) You are the find manager for a large unit trust find that specializes in fixed income. You have gathered the following information about three instruments that are of interest to you in forming a new fixed income portfolio. (ND denotes Namibian dollars.) Coupon Maturity Price (ND) Call price (ND) 2022 Bond 1 (new issue) Bond 2 (new issue) Bond 3 (2010 issue) 14.00% 6.00% 101.750 48.125 114.00 103.00 Yield to maturity 13.75% 13.80% 13.40% 2022 2022 6.00% 48.875 103.00 Page 3 of 6 AERC CREA Bond A 10.0% 15 25 It is January 1, 2018. Suppose that you expect a decline in interest rates over the next three years, identify and justify which one of these three bonds you would select. Assume that the three bonds are of the same quality. (Show all your workings.) (10 Marks) 6) You are a bond portfolio manager and the portfolio for one of your clients, Nolwazi Moloi, currently consists of the following two bonds, both of which pay coupon interest once a year: Coupon rate Yield to maturity Maturity Modified duration (years) 14.0% 6.514 Bond B 7.0% 12.5% 8.160 Nolwazi has just had a discussion with you in which she informed you that she would like to use this bond portfolio to plan for the education of her daughter, who is expected to enroll in college in exactly five years' time for a one-year Masters' program. (1) Design a portfolio strategy that satisfies Nolwazi's revised objective. (6 Marks) (m) Suppose that tuition fees requirement in five years is ND 100,000, how much of Nolwazi's own money must be invested in Bond A today? (5 Marks) (ii) Discuss two problems associated with the portfolio strategy that you have adopted in this problem. (4 Marks) (a) You are the find manager for a large unit trust find that specializes in fixed income. You have gathered the following information about three instruments that are of interest to you in forming a new fixed income portfolio. (ND denotes Namibian dollars.) Coupon Maturity Price (ND) Call price (ND) 2022 Bond 1 (new issue) Bond 2 (new issue) Bond 3 (2010 issue) 14.00% 6.00% 101.750 48.125 114.00 103.00 Yield to maturity 13.75% 13.80% 13.40% 2022 2022 6.00% 48.875 103.00 Page 3 of 6 AERC CREA Bond A 10.0% 15 25 It is January 1, 2018. Suppose that you expect a decline in interest rates over the next three years, identify and justify which one of these three bonds you would select. Assume that the three bonds are of the same quality. (Show all your workings.) (10 Marks) 6) You are a bond portfolio manager and the portfolio for one of your clients, Nolwazi Moloi, currently consists of the following two bonds, both of which pay coupon interest once a year: Coupon rate Yield to maturity Maturity Modified duration (years) 14.0% 6.514 Bond B 7.0% 12.5% 8.160 Nolwazi has just had a discussion with you in which she informed you that she would like to use this bond portfolio to plan for the education of her daughter, who is expected to enroll in college in exactly five years' time for a one-year Masters' program. (1) Design a portfolio strategy that satisfies Nolwazi's revised objective. (6 Marks) (m) Suppose that tuition fees requirement in five years is ND 100,000, how much of Nolwazi's own money must be invested in Bond A today? (5 Marks) (ii) Discuss two problems associated with the portfolio strategy that you have adopted in this problem. (4 Marks)