Answered step by step

Verified Expert Solution

Question

1 Approved Answer

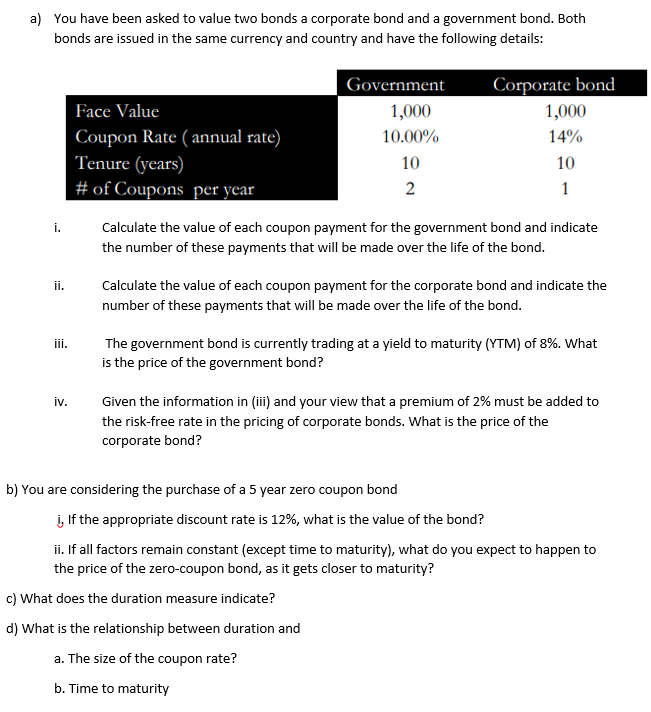

a) You have been asked to value two bonds a corporate bond and a government bond. Both bonds are issued in the same currency

a) You have been asked to value two bonds a corporate bond and a government bond. Both bonds are issued in the same currency and country and have the following details: Government Face Value 1,000 Coupon Rate (annual rate) 10.00% Tenure (years) 10 # of Coupons per year 2 i. Corporate bond 1,000 14% 10 1 ii. iii. iv. Calculate the value of each coupon payment for the government bond and indicate the number of these payments that will be made over the life of the bond. Calculate the value of each coupon payment for the corporate bond and indicate the number of these payments that will be made over the life of the bond. The government bond is currently trading at a yield to maturity (YTM) of 8%. What is the price of the government bond? Given the information in (iii) and your view that a premium of 2% must be added to the risk-free rate in the pricing of corporate bonds. What is the price of the corporate bond? b) You are considering the purchase of a 5 year zero coupon bond i, If the appropriate discount rate is 12%, what is the value of the bond? ii. If all factors remain constant (except time to maturity), what do you expect to happen to the price of the zero-coupon bond, as it gets closer to maturity? c) What does the duration measure indicate? d) What is the relationship between duration and a. The size of the coupon rate? b. Time to maturity

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a i For the government bond The coupon payment is calculated by multiplying the face value by the coupon rate and dividing by the number of coupon payments per year Coupon payment Face Value Coupon Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started