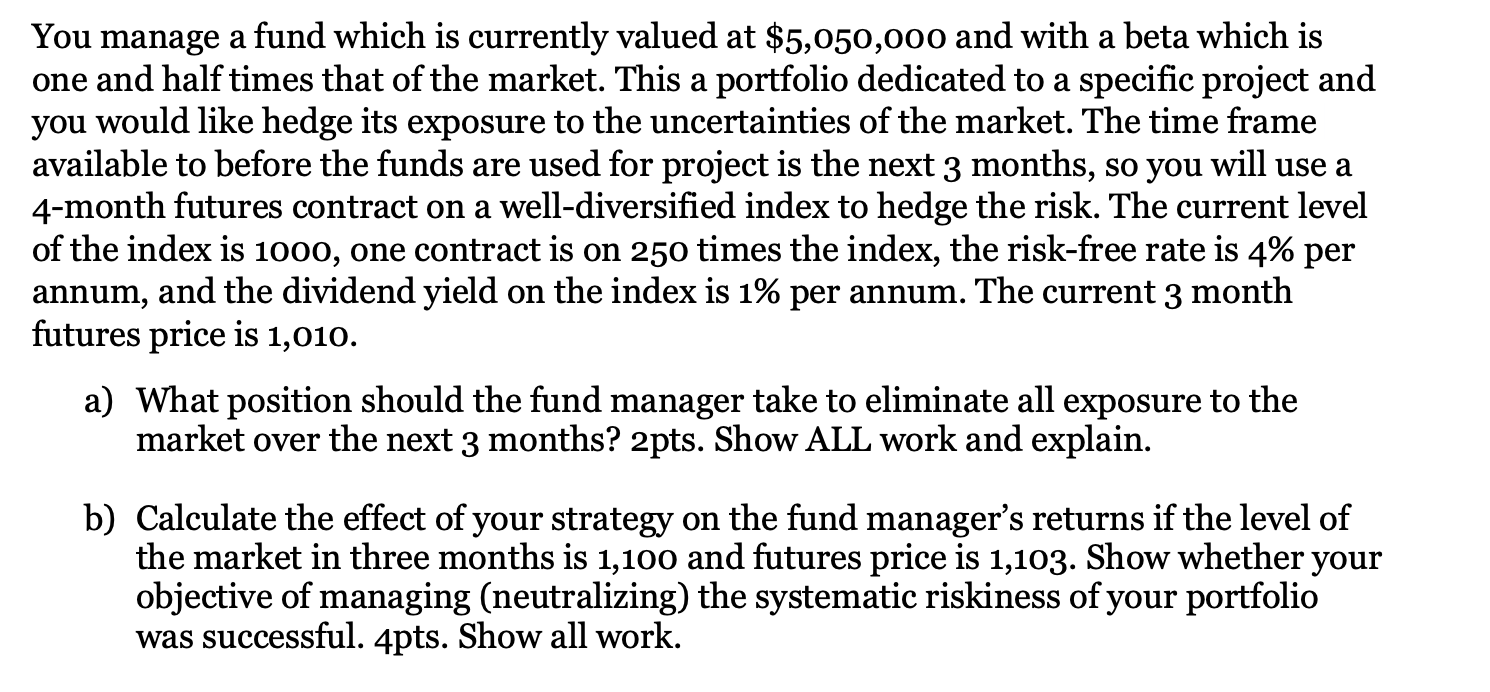

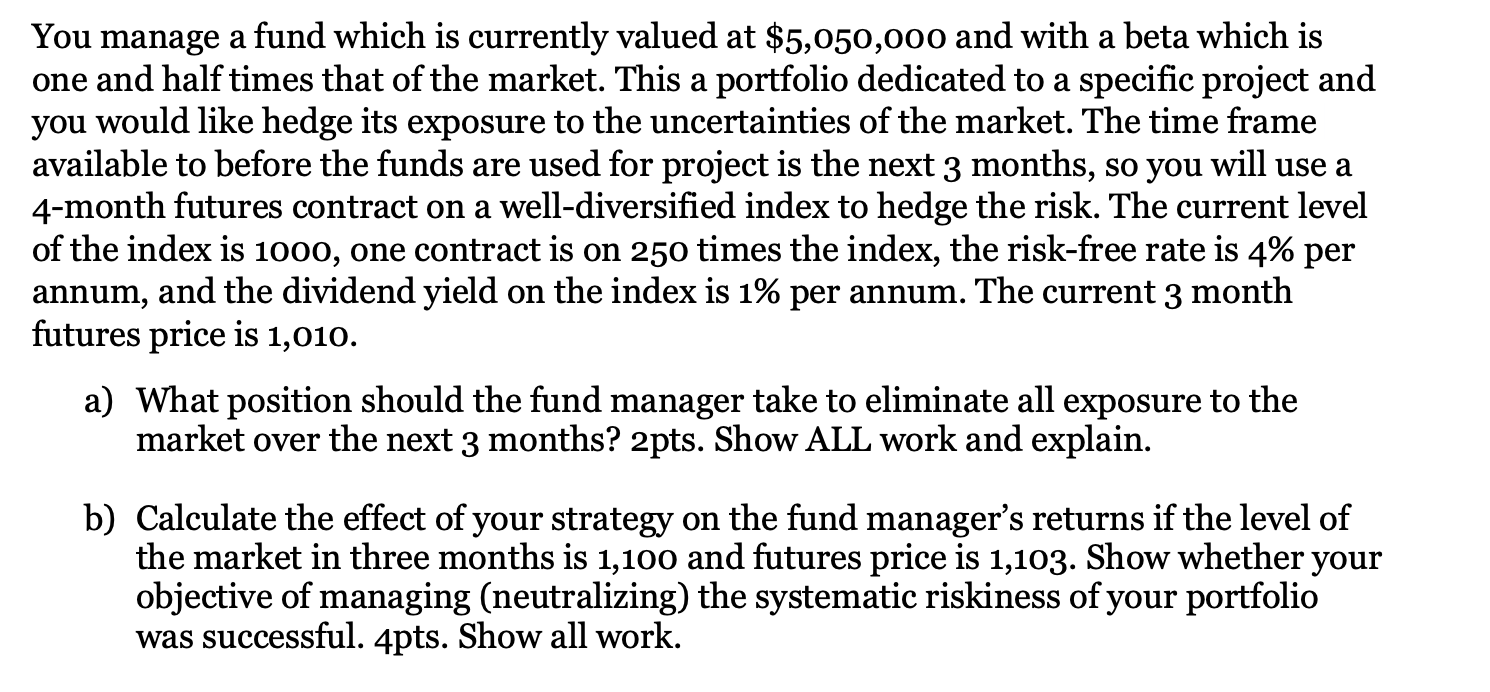

a You manage a fund which is currently valued at $5,050,000 and with a beta which is one and half times that of the market. This a portfolio dedicated to a specific project and you would like hedge its exposure to the uncertainties of the market. The time frame available to before the funds are used for project is the next 3 months, so you will use a 4-month futures contract on a well-diversified index to hedge the risk. The current level of the index is 1000, one contract is on 250 times the index, the risk-free rate is 4% per annum, and the dividend yield on the index is 1% per annum. The current 3 month futures price is 1,010. a) What position should the fund manager take to eliminate all exposure to the market over the next 3 months? 2pts. Show ALL work and explain. b) Calculate the effect of your strategy on the fund manager's returns if the level of the market in three months is 1,100 and futures price is 1,103. Show whether your objective of managing (neutralizing) the systematic riskiness of your portfolio was successful. 4pts. Show all work. a You manage a fund which is currently valued at $5,050,000 and with a beta which is one and half times that of the market. This a portfolio dedicated to a specific project and you would like hedge its exposure to the uncertainties of the market. The time frame available to before the funds are used for project is the next 3 months, so you will use a 4-month futures contract on a well-diversified index to hedge the risk. The current level of the index is 1000, one contract is on 250 times the index, the risk-free rate is 4% per annum, and the dividend yield on the index is 1% per annum. The current 3 month futures price is 1,010. a) What position should the fund manager take to eliminate all exposure to the market over the next 3 months? 2pts. Show ALL work and explain. b) Calculate the effect of your strategy on the fund manager's returns if the level of the market in three months is 1,100 and futures price is 1,103. Show whether your objective of managing (neutralizing) the systematic riskiness of your portfolio was successful. 4pts. Show all work