Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) You will receive $1,000 from your parents as a birthday gift in half year. You have decided to invest it at 5% per

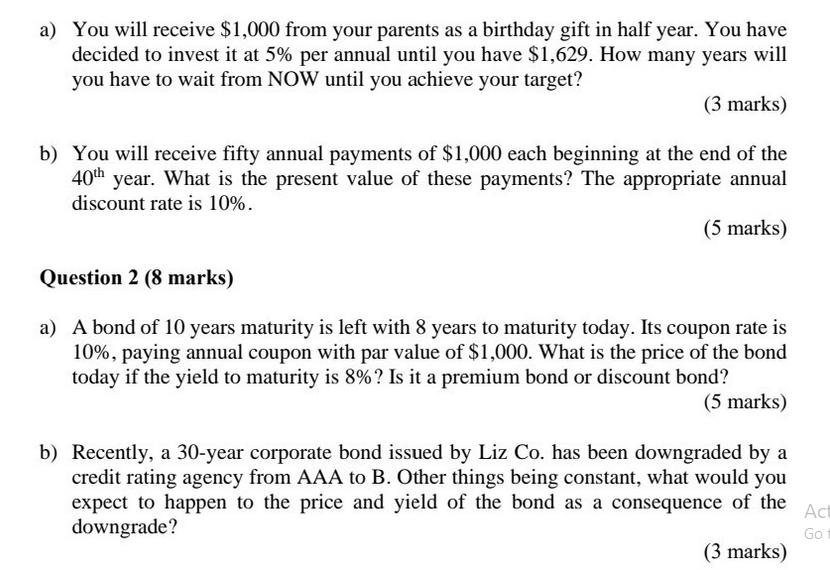

a) You will receive $1,000 from your parents as a birthday gift in half year. You have decided to invest it at 5% per annual until you have $1,629. How many years will you have to wait from NOW until you achieve your target? (3 marks) b) You will receive fifty annual payments of $1,000 each beginning at the end of the 40th year. What is the present value of these payments? The appropriate annual discount rate is 10%. (5 marks) Question 2 (8 marks) a) A bond of 10 years maturity is left with 8 years to maturity today. Its coupon rate is 10%, paying annual coupon with par value of $1,000. What is the price of the bond today if the yield to maturity is 8%? Is it a premium bond or discount bond? (5 marks) b) Recently, a 30-year corporate bond issued by Liz Co. has been downgraded by a credit rating agency from AAA to B. Other things being constant, what would you expect to happen to the price and yield of the bond as a consequence of the downgrade? Act Go (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the number of years required to achieve the target we can use the formula for compound interest Future Value Present Value 1 Interest R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started