Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) You would like to sell enough shares of stock today to generate $10,000 to use as part of a down payment on a

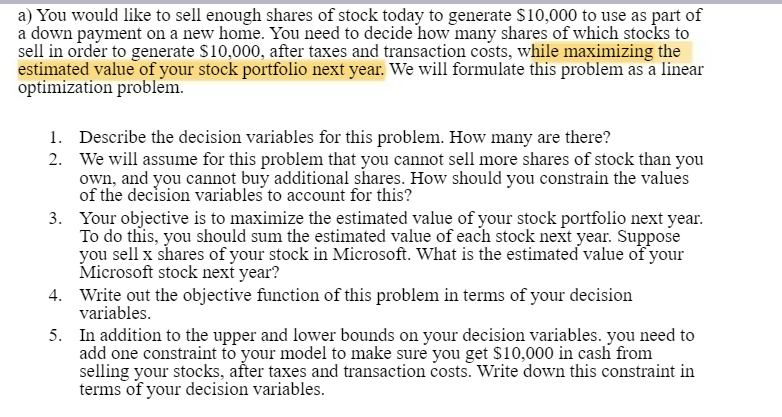

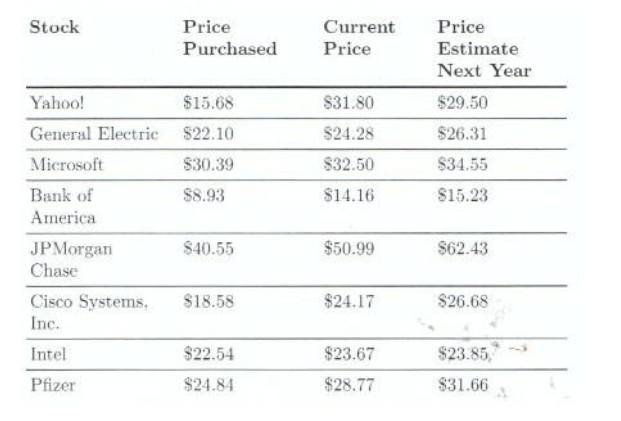

a) You would like to sell enough shares of stock today to generate $10,000 to use as part of a down payment on a new home. You need to decide how many shares of which stocks to sell in order to generate $10,000, after taxes and transaction costs, while maximizing the estimated value of your stock portfolio next year. We will formulate this problem as a linear optimization problem. 1. Describe the decision variables for this problem. How many are there? 2. We will assume for this problem that you cannot sell more shares of stock than you own, and you cannot buy additional shares. How should you constrain the values of the decision variables to account for this? 3. Your objective is to maximize the estimated value of your stock portfolio next year. To do this, you should sum the estimated value of each stock next year. Suppose you sell x shares of your stock in Microsoft. What is the estimated value of your Microsoft stock next year? 4. Write out the objective function of this problem in terms of your decision variables. 5. In addition to the upper and lower bounds on your decision variables. you need to add one constraint to your model to make sure you get $10,000 in cash from selling your stocks, after taxes and transaction costs. Write down this constraint in terms of your decision variables. Stock Price Current Price Purchased Price Estimate Next Year Yahoo! $15.68 $31.80 $29.50 General Electric $22.10 $24.28 $26.31 Microsoft $30.39 $32.50 $34.55 Bank of $8.93 $14.16 $15.23 America JPMorgan $40.55 $50.99 $62.43 Chase Cisco Systems, $18.58 $24.17 $26.68 Inc. Intel $22.54 $23.67 $23.85, Pfizer $24.84 $28.77 $31.66

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started