Answered step by step

Verified Expert Solution

Question

1 Approved Answer

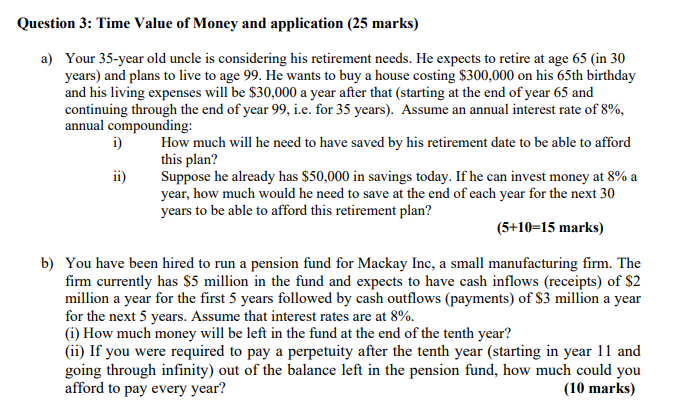

a ) Your 3 5 - year old uncle is considering his retirement needs. He expects to retire at age 6 5 ( in 3

a Your year old uncle is considering his retirement needs. He expects to retire at age in

years and plans to live to age He wants to buy a house costing $ on his th birthday

and his living expenses will be $ a year after that starting at the end of year and

continuing through the end of year ie for years Assume an annual interest rate of

annual compounding:

i How much will he need to have saved by his retirement date to be able to afford

this plan?

ii Suppose he already has $ in savings today. If he can invest money at a

year, how much would he need to save at the end of each year for the next

years to be able to afford this retirement plan?

marks

b You have been hired to run a pension fund for Mackay Inc, a small manufacturing firm. The

firm currently has $ million in the fund and expects to have cash inflows receipts of $

million a year for the first years followed by cash outflows payments of $ million a year

for the next years. Assume that interest rates are at

i How much money will be left in the fund at the end of the tenth year?

ii If you were required to pay a perpetuity after the tenth year starting in year and

going through infinity out of the balance left in the pension fund, how much could you

afford to pay every year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started