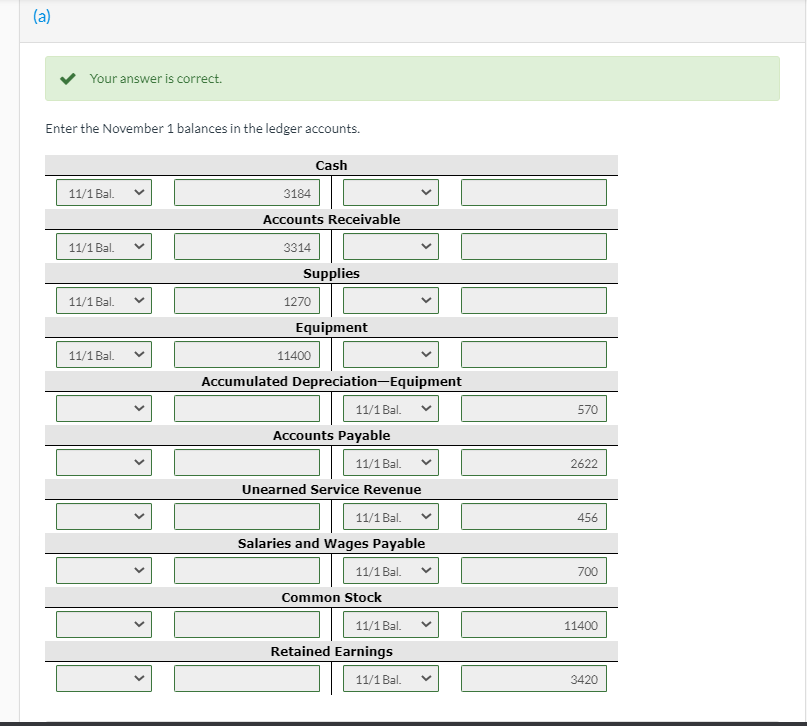

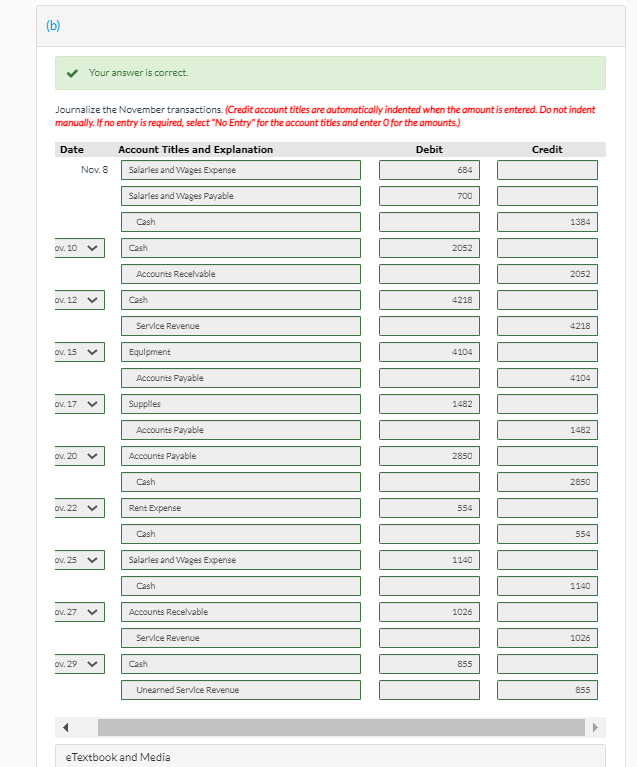

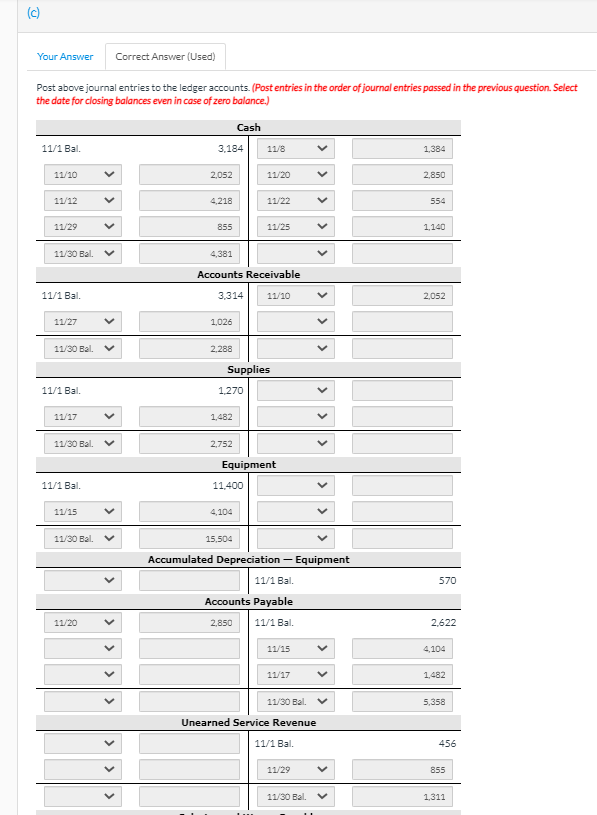

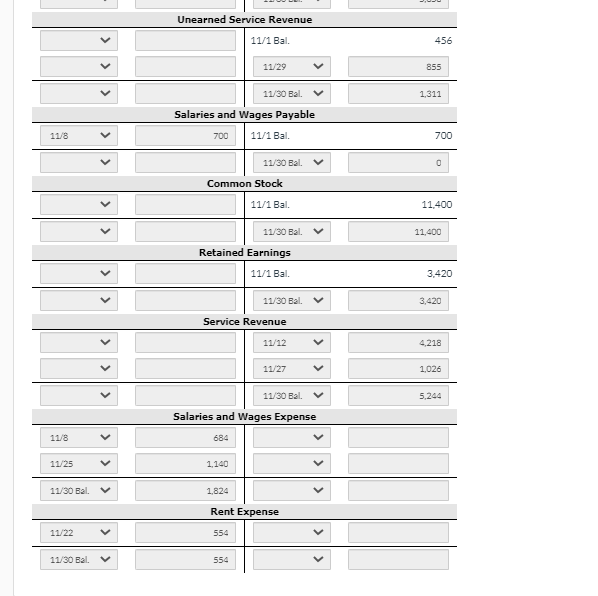

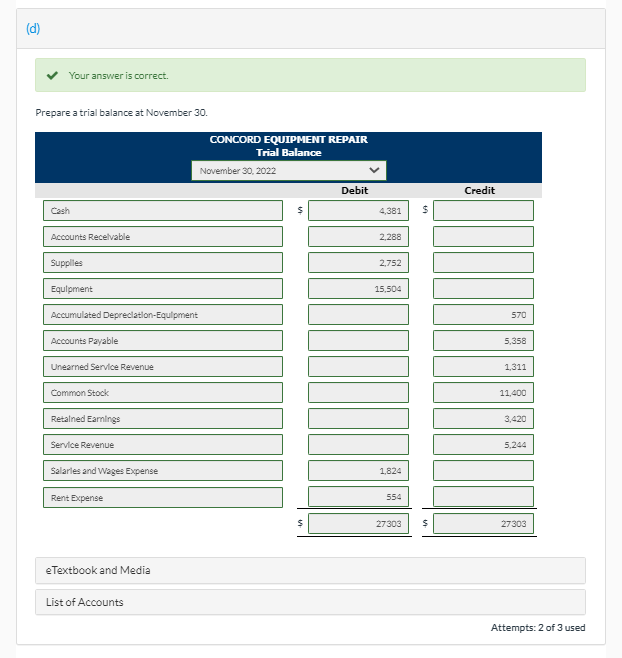

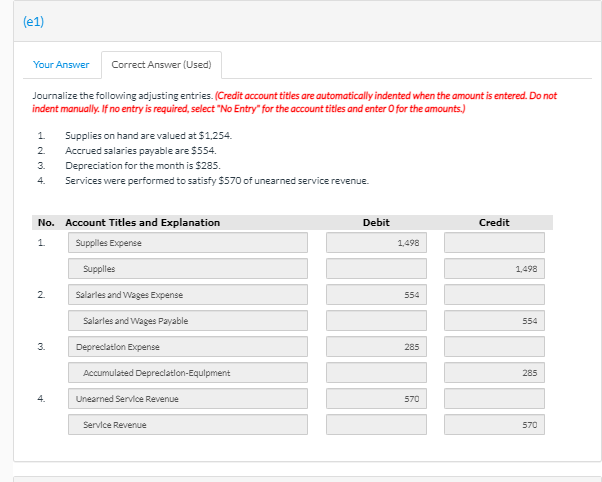

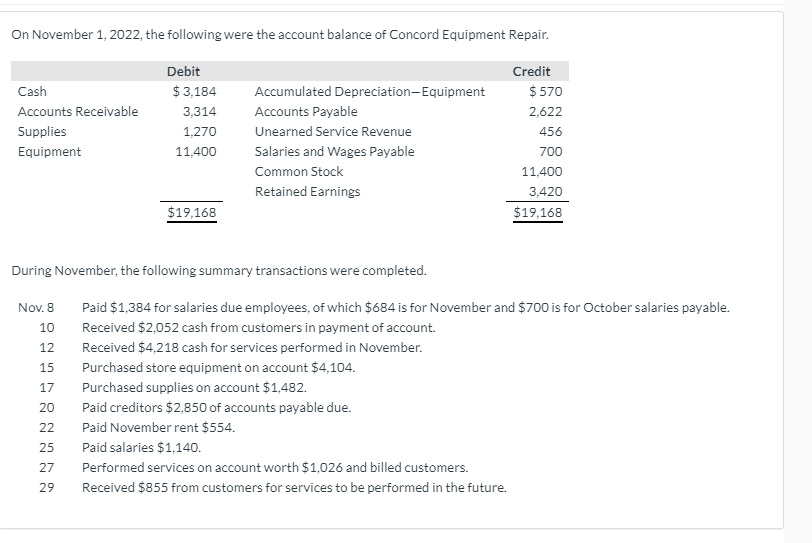

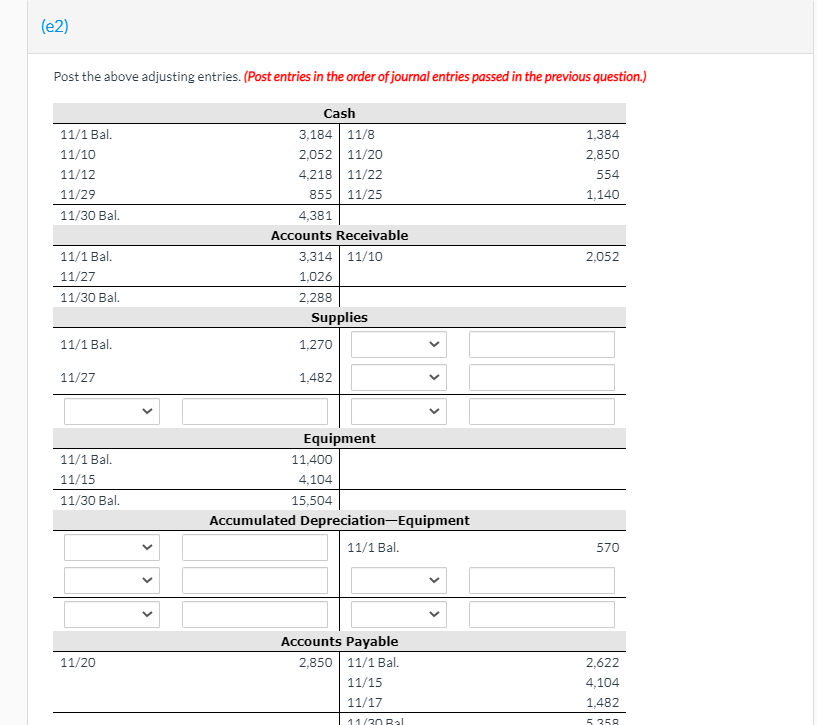

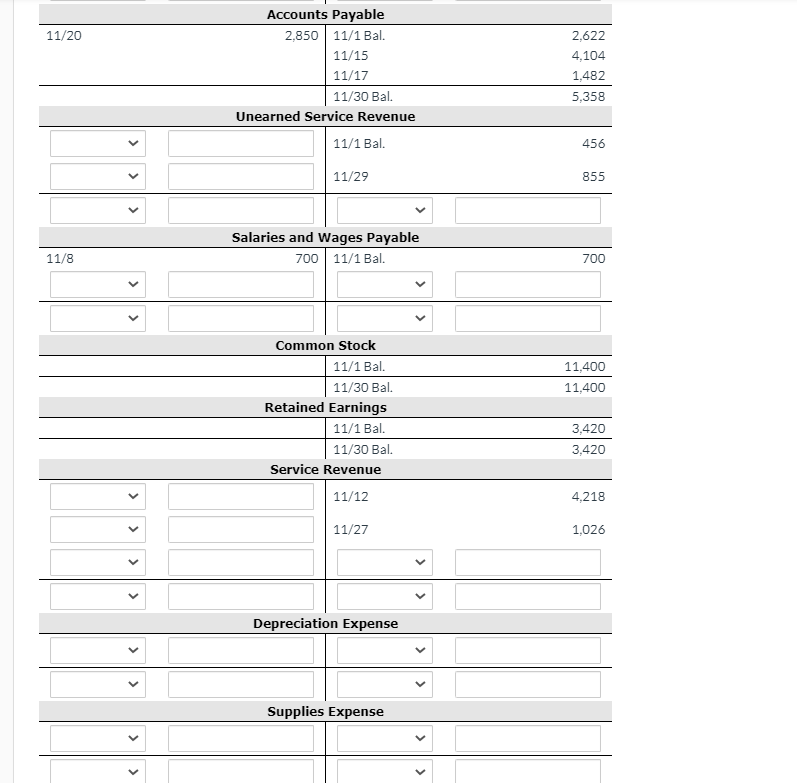

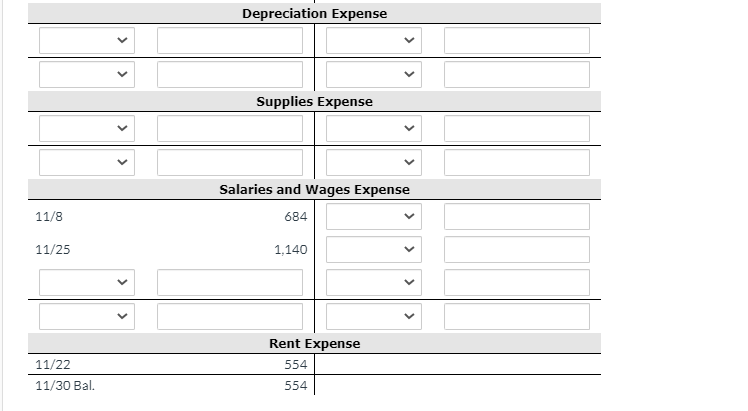

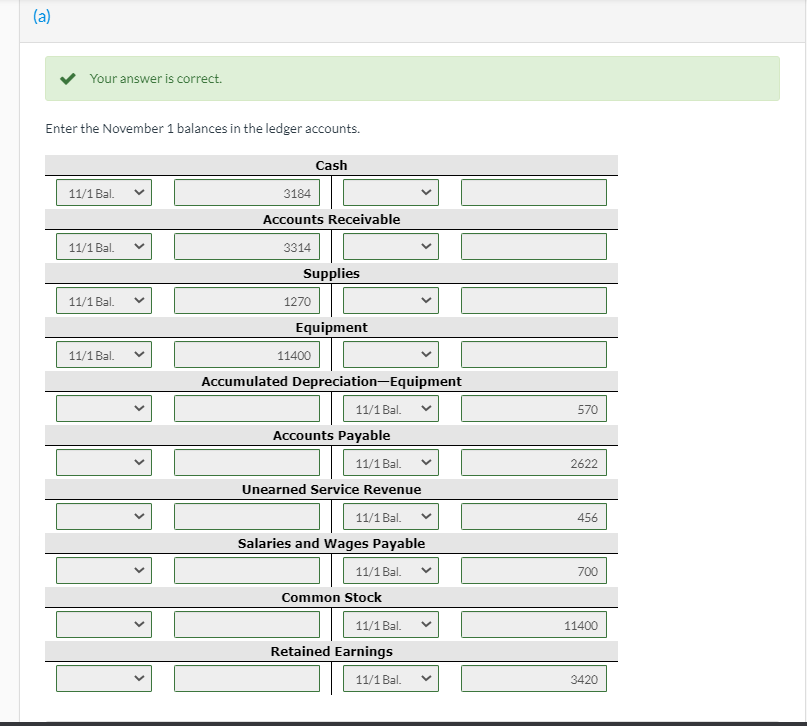

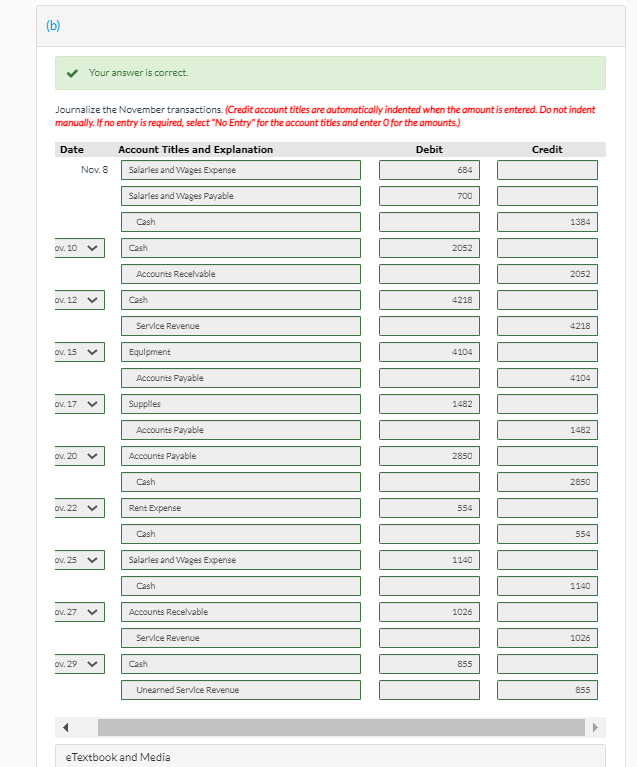

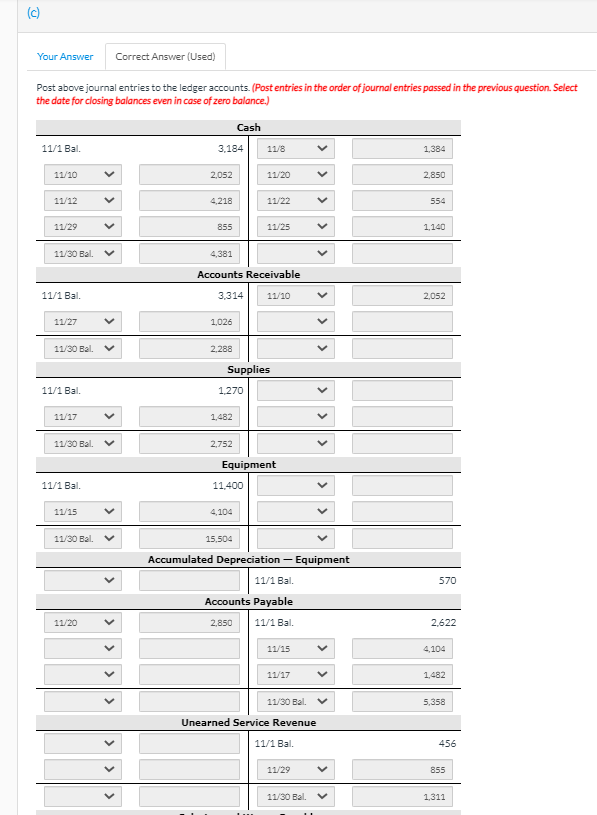

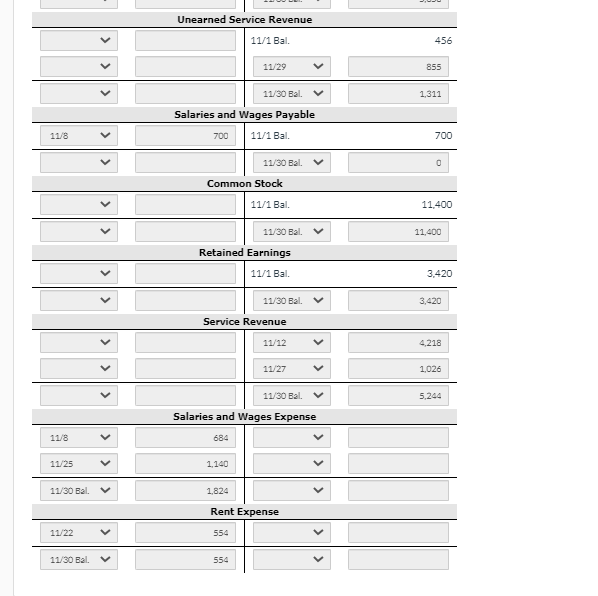

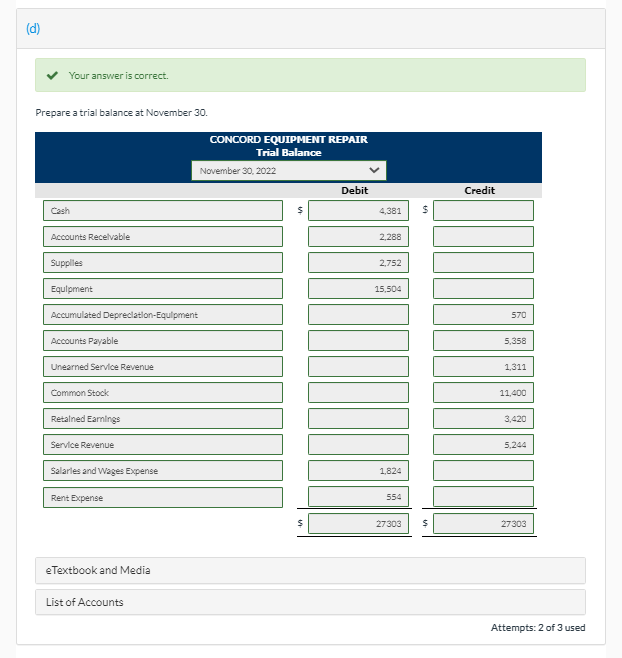

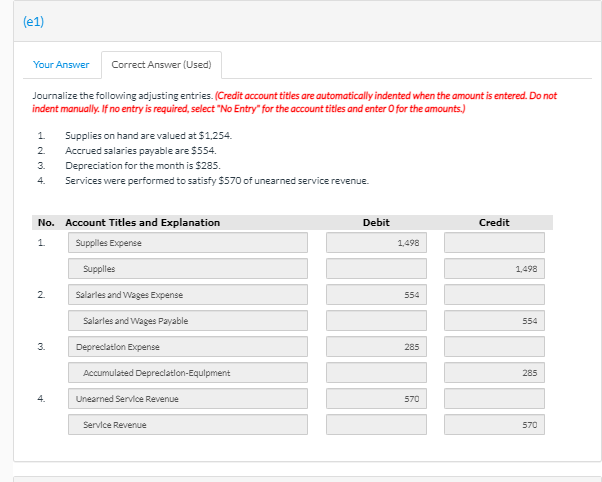

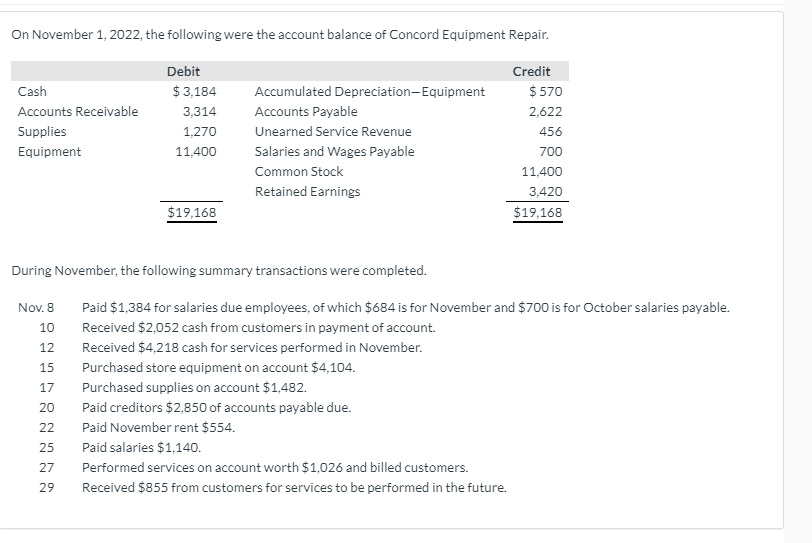

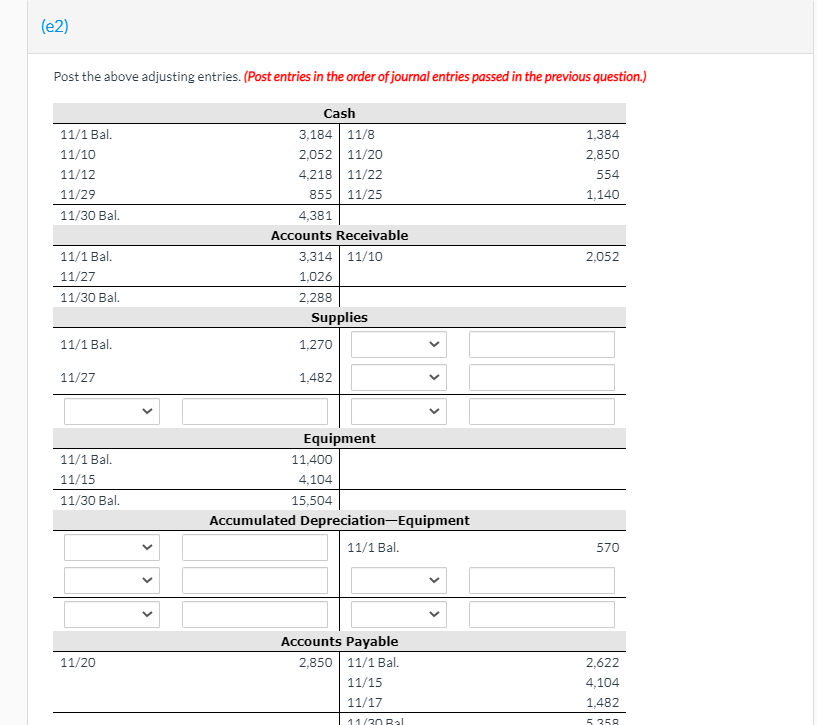

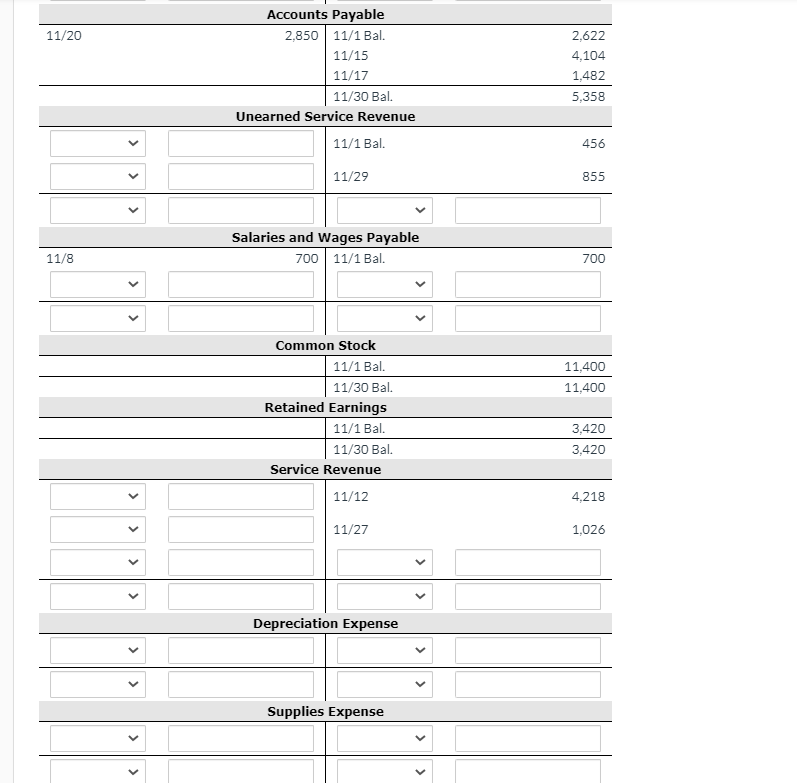

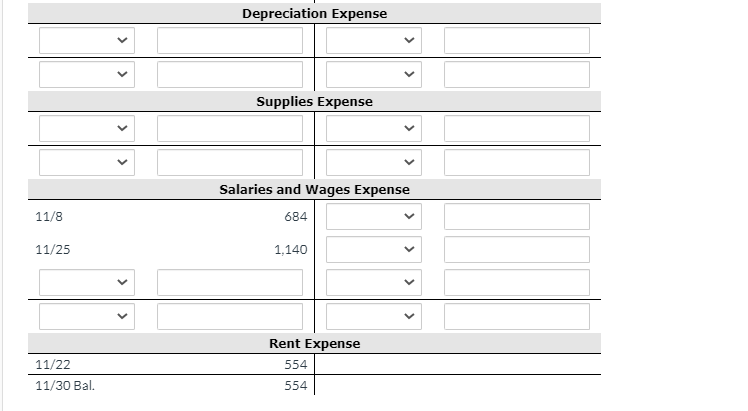

(a) Your answer is correct. Enter the November 1 balances in the ledger accounts. Cash 11/1 Bal. 3184 Accounts Receivable > 11/1 Bal. 3314 Supplies 11/1 Bal. 1270 11 11/1 Bal. Equipment 11400 Accumulated Depreciation-Equipment 11/1 Bal. Accounts Payable 570 11/1 Bal. 2622 456 Unearned Service Revenue 11/1 Bal. Salaries and Wages Payable 11/1 Bal. Common Stock 11/1 Bal. Retained Earnings 700 11400 11/1 Bal. 3420 (b) Your answer is correct. Journalize the November transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"for the account titles and enter for the amounts.) Date Account Titles and Explanation Credit Nov. 8 Salaries and Wages Expense Salaries and Wages Payable 700 Debit 684 Cash 1384 ov. 10 Cash 2052 Accounts Recevable 2052 ov. 12 V Cash 4218 Service Revenue 4218 ov. 15 Equipment 4104 Accounts Payable 4104 OV. 17 Supplies 1482 Accounts Payable 1482 OV. 20 Accounts Payable 2850 Cash 2850 OV. 22 Rent Expense 554 Cash 554 ov. 25 Salaries and Wages Expense 1140 Cash 1140 ov. 27 Accounts Receivable 1026 Service Revenue 1026 ov. 29 V Cash 855 Unearned Service Revenue 855 e Textbook and Media (c) Your Answer Correct Answer (Used) Post above journal entries to the ledger accounts. (Post entries in the order of journal entries passed in the previous question. Select the date for closing balances even in case of zero balance.) Cash 11/1 Bal. 3,184 11/8 554 (d) Your answer is correct. Prepare a trial balance at November 30. CONCORD EQUIPMENT REPAIR Trial Balance November 30, 2022 Debit Credit Cash $ 4,381 $ Accounts Receivable 2.288 Supplies 2.752 Equipment 15,504 Accumulated Depreciation-Equipment 570 Accounts Payable 5.358 Unearned Service Revenue 1.311 Common Stock 11,400 Retained Earnings 3,420 Service Revenue 5.244 Salaries and Wages Expense 1.824 Rent Expense 554 27303 S 27303 eTextbook and Media List of Accounts Attempts: 2 of 3 used (e1) Your Answer Correct Answer (Used) Journalize the following adjusting entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Supplies on hand are valued at $1,254. Accrued salaries payable are $554. Depreciation for the month is $285. Services were performed to satisfy $570 of unearned service revenue. 1 2 3. 4. Debit Credit No. Account Titles and Explanation Supplies Expense 1. 1,498 Supplies 1,498 2 Salaries and Wages Expense 554 Salaries and Wages Payable 554 3. Depreciation Expense 285 Accumulated Depreciation Equipment 285 Unearned Service Revenue 570 Service Revenue 570 On November 1, 2022, the following were the account balance of Concord Equipment Repair. Cash Accounts Receivable Supplies Equipment Debit $3,184 3,314 1,270 11,400 Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Common Stock Retained Earnings Credit $570 2.622 456 700 11,400 3,420 $19,168 $19,168 During November, the following summary transactions were completed. Nov. 8 10 12 15 17 Paid $1,384 for salaries due employees, of which $684 is for November and $700 is for October salaries payable. Received $2,052 cash from customers in payment of account. Received $4,218 cash for services performed in November Purchased store equipment on account $4,104. Purchased supplies on account $1,482. Paid creditors $2,850 of accounts payable due. Paid November rent $554. Paid salaries $1,140. Performed services on account worth $1,026 and billed customers. Received $855 from customers for services to be performed in the future. 20 22 25 27 29 (e2) Post the above adjusting entries. (Post entries in the order of journal entries passed in the previous question.) 11/1 Bal. 11/10 11/12 11/29 11/30 Bal. 1,384 2,850 554 1,140 Cash 3,184 11/8 2,052 11/20 4,218 | 11/22 855 11/25 4,381 Accounts Receivable 3,314 11/10 1,026 2.288 Supplies 2.052 11/1 Bal. 11/27 11/30 Bal. 11/1 Bal. 1,270 11/27 1,482 11/1 Bal. 11/15 11/30 Bal. Equipment 11,400 4,104 15,504 Accumulated Depreciation Equipment 11/1 Bal. 456 11/29 855 Salaries and Wages Payable 700 11/1 Bal. 11/8 700 11,400 11,400 Common Stock 11/1 Bal. 11/30 Bal. Retained Earnings 11/1 Bal. 11/30 Bal. Service Revenue 3,420 3,420 > 11/12 4,218 > 11/27 1,026