Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Your company is aiming to increase its cash reserve for future development. Given the interest rate of compound interest in a unit trust

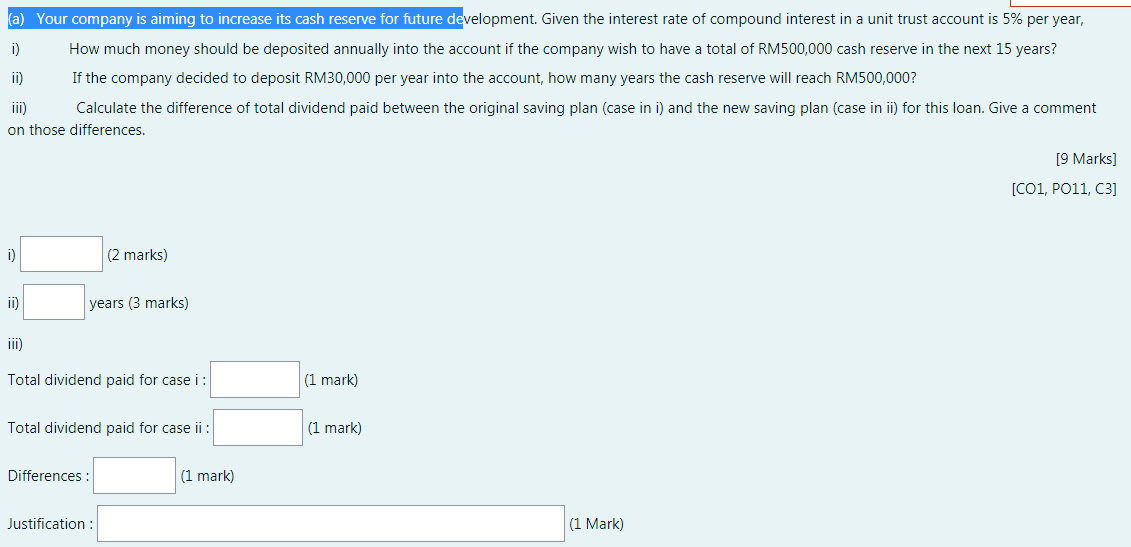

(a) Your company is aiming to increase its cash reserve for future development. Given the interest rate of compound interest in a unit trust account is 5% per year, i) How much money should be deposited annually into the account if the company wish to have a total of RM500,000 cash reserve in the next 15 years? i) If the company decided to deposit RM30,000 per year into the account, how many years the cash reserve will reach RM500,000? ii) Calculate the difference of total dividend paid between the original saving plan (case in i) and the new saving plan (case in ii) for this loan. Give a comment on those differences. [9 Marks] [C01, PO11, 3] i) (2 marks) ii) years (3 marks) iii) Total dividend paid for case i: (1 mark) Total dividend paid for case ii : (1 mark) Differences : (1 mark) Justification : (1 Mark)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Solution Assumption It is assumed that amount is deposited at the beginning of every year i Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started