Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Zambian manufacturing company is considering investing in a machinery worth K6.5million to produce a soft drink called 'KiKO' with a market life of

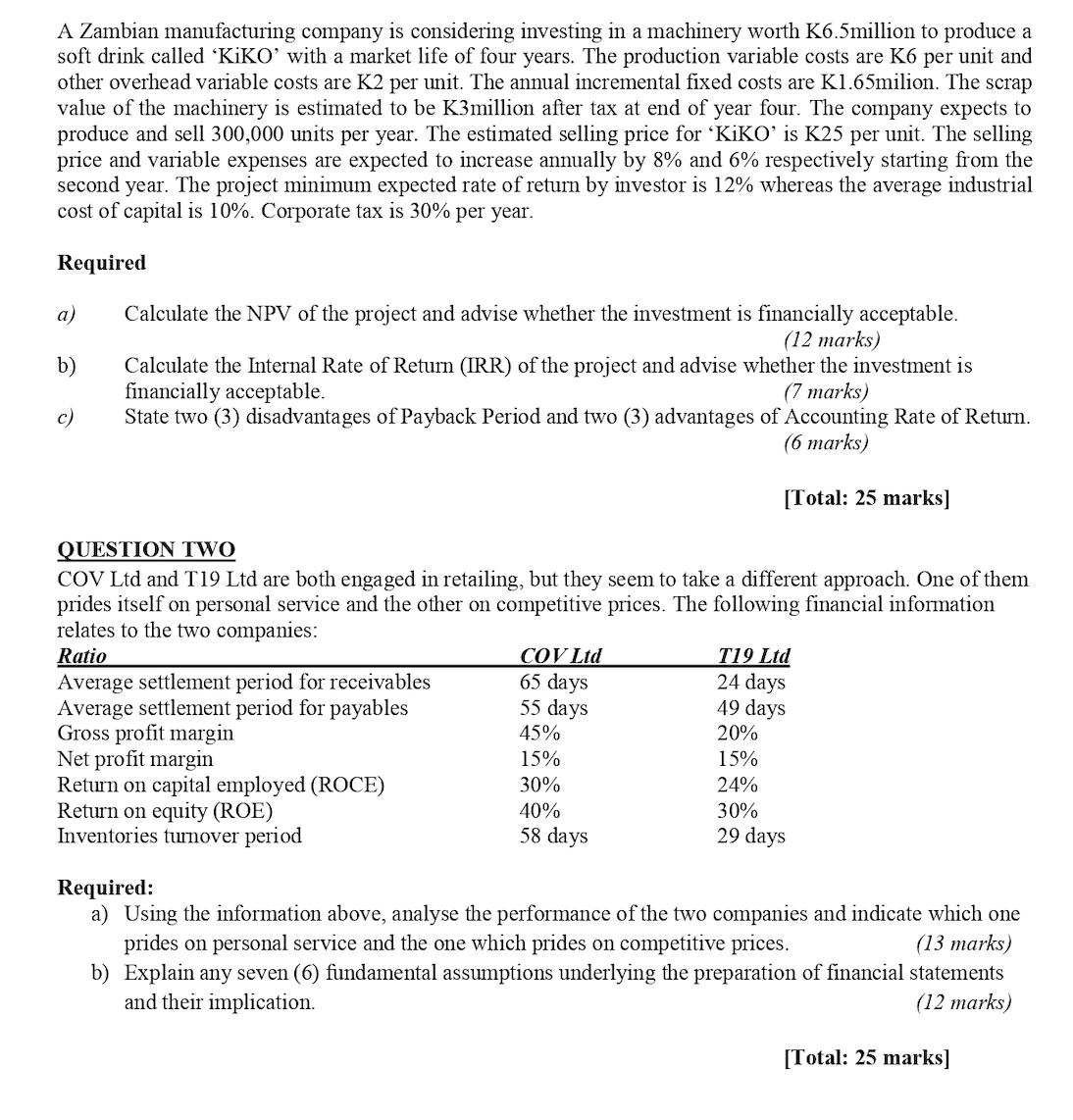

A Zambian manufacturing company is considering investing in a machinery worth K6.5million to produce a soft drink called 'KiKO' with a market life of four years. The production variable costs are K6 per unit and other overhead variable costs are K2 per unit. The annual incremental fixed costs are K1.65milion. The scrap value of the machinery is estimated to be K3million after tax at end of year four. The company expects to produce and sell 300,000 units per year. The estimated selling price for 'KiKO' is K25 per unit. The selling price and variable expenses are expected to increase annually by 8% and 6% respectively starting from the second year. The project minimum expected rate of return by investor is 12% whereas the average industrial cost of capital is 10%. Corporate tax is 30% per year. Required a) b) c) Calculate the NPV of the project and advise whether the investment is financially acceptable. (12 marks) Calculate the Internal Rate of Return (IRR) of the project and advise whether the investment is financially acceptable. (7 marks) State two (3) disadvantages of Payback Period and two (3) advantages of Accounting Rate of Return. (6 marks) [Total: 25 marks] QUESTION TWO COV Ltd and T19 Ltd are both engaged in retailing, but they seem to take a different approach. One of them prides itself on personal service and the other on competitive prices. The following financial information relates to the two companies: Ratio Average settlement period for receivables Average settlement period for payables COV Ltd 65 days 55 days Gross profit margin 45% Net profit margin 15% Return on capital employed (ROCE) 30% Return on equity (ROE) 40% Inventories turnover period 58 days Required: T19 Ltd 24 days 49 days 20% 15% 24% 30% 29 days a) Using the information above, analyse the performance of the two companies and indicate which one prides on personal service and the one which prides on competitive prices. (13 marks) b) Explain any seven (6) fundamental assumptions underlying the preparation of financial statements and their implication. (12 marks) [Total: 25 marks] Graduate School of Business Examinations SECTION B: CHOOSE ANY TWO QUESTIONS QUESTION THREE a) DMJ Industries Ltd makes baskets. The fixed costs of operating the workshop for a month total K8,000. Each basket requires materials that cost K75. Each basket takes one hour to make, and the business pays the basket makers K120 an hour. The basket makers are all on contracts such that if they do not work for any reason, they are not paid. The baskets are sold to a wholesaler for K300 each. Calculate the breakeven point for the business in units and revenue. (4 marks) Calculate the margin of safety (%) and comment. (4 marks) i) 11) iii) Discuss the usefulness to a manager of knowing the breakeven point. (7 marks) b) Assuming DMJ Industries has spare capacity in that its basket makers have some spare time. An overseas retail chain has offered the business an order for 500,000 baskets at a price of K210 each. i) Without considering any wider issues, should the business accept the order? (Assume that the business does not rent the machine). (3 marks) ii) Discuss other factors that should be taken into account before the offer from the overseas is accepted. (7 marks) [Total: 25 marks] QUESTION FOUR SUN Plc is considering a project requiring investment of K250, 000 in an equipment with a life of five years and a residual value of K40, 000. Annual net cash flows will be K105, 000, K98, 000, K65,000, K51, 000 and K20, 000 for the five years respectively. According to the company policy, a project with the payback period of 2.5 years or less is acceptable. The company has a target accounting rate of return (ARR) of 10%. Required Calculate the ARR based on average investment and advise whether the investment is financially acceptable. (12 marks) i) ii) Calculate the payback period and advise whether the investment is financially acceptable. (7 marks) iii) Explain the concept of time value of money. (6 marks) [Total: 25 marks] QUESTION FIVE DoDG holding Plc sales three (3) products in three (3) different market sectors in Zambia. In a recent meeting, the Chief Financial Officer and Chief Marketing Officer discussed the pricing aspect of these products. Product A: The market for this product is highly competitive and the product is ordinary. The major competitors add a profit margin of 15% on the production costs to determine the selling price. The average production costs are K250 per unit which is considered to be very high. Product B: DODG Plc controls over 98% of the market share for this product and its competitors are very small. The production costs are K350 per unit and the Chief Financial Officer has advised that a make-up of 30% on full cost should be added. Product C: The market research recently conducted for this product indicated that most customers are interested in the quality and taste of the product. The average production costs are K250 per unit. Some customers are will to be charged 35% margin of the production costs and others 40% make-up on full cost. 3 Page Graduate School of Business Examinations Required a) Recommend with reasons the appropriate pricing approach that DoDG Plc can adopt for pricing each of the three (3) products. b) Determine the selling price of each of the three (3) products. c) Discuss whether management accounting information is more with financial accounting information. (12 marks) (6 marks) important to an organisation compared (7 marks) [Total: 25marks] QUESTION SIX a) Explain the bird in the hand theory and signalling theory in relation to the dividend policy. (6 marks) b) Explain four types of dividend policies that a listed company can adopt. (8 marks) c) Explain any two (2) ways in which a company may protect itself against foreign currency risk. (4 marks) d) Explain the benefits of budgeting to you as a manager of an organisation. (7 marks) 4 Page END OF PAPER IRR L%+NPVL (H% -L%) NPVL-NPVH [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started