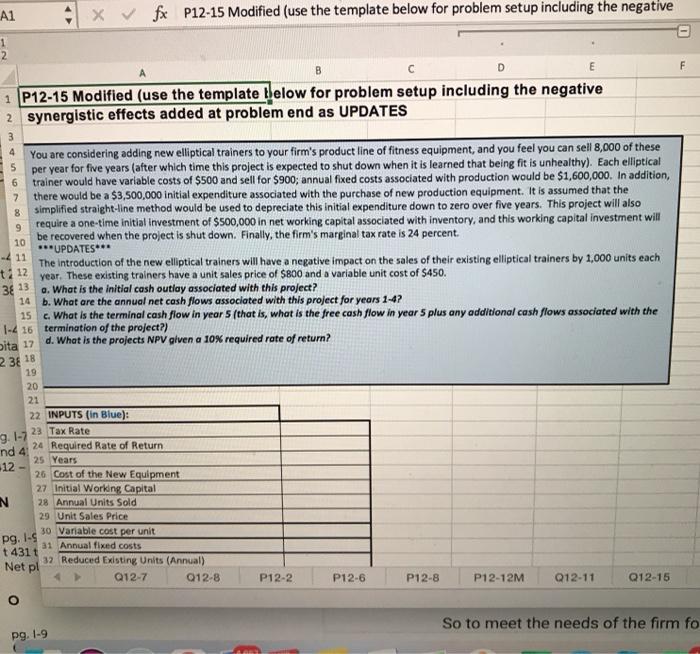

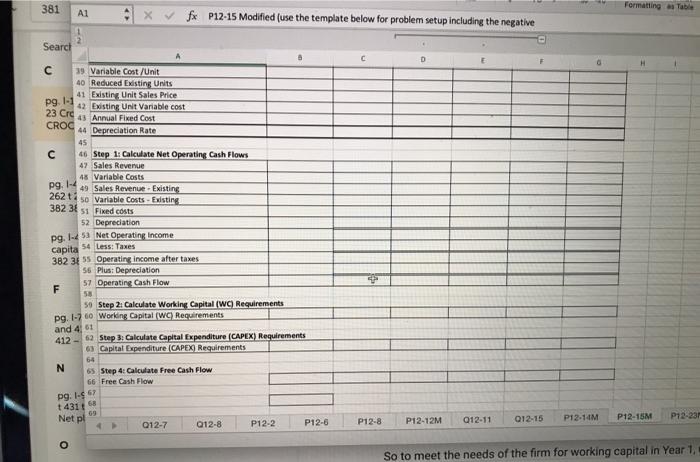

A1 1 x fx P12-15 Modified (use the template below for problem setup including the negative 1 2 B D E F 1 P12-15 Modified (use the template below for problem setup including the negative 2 synergistic effects added at problem end as UPDATES 7 You are considering adding new elliptical trainers to your firm's product line of fitness equipment, and you feel you can sell 8,000 of these per year for five years (after which time this project is expected to shut down when it is learned that being fit is unhealthy). Each elliptical 6 trainer would have variable costs of $500 and sell for $900; annual fixed costs associated with production would be $1,600,000. In addition, there would be a $3,500,000 initial expenditure associated with the purchase of new production equipment. It is assumed that the simplified straight-line method would be used to depreciate this initial expenditure down to zero over five years. This project will also require a one-time initial investment of $500,000 in net working capital associated with inventory, and this working capital investment will be recovered when the project is shut down. Finally, the firm's marginal tax rate is 24 percent ***UPDATES*** The introduction of the new elliptical trainers will have a negative impact on the sales of their existing elliptical trainers by 1,000 units each t2 12 year. These existing trainers have a unit sales price of $800 and a variable unit cost of $450. 3 13 a. What is the initial cash outlay associated with this project? 14 b. What are the annual net cash flows associated with this project for years 1-4? . What is the terminal cash flow in year 5 (that is, what is the free cash flow in year 5 plus any additional cash flows associated with the 1-2 16 termination of the project?) Dita 17 d. What is the projects NPV given a 10% required rate of retur? 9 10 -2 11 15 2 3 18 19 20 21 22 INPUTS (in Blue): 9. 1-7 23 Tax Rate 24 Required Rate of Return nd 4 25 Years 12 - 26 Cost of the New Equipment 27 Initial Working Capital N 28 Annual Units Sold 29 Unit Sales Price 30 Variable cost per unit 31 Annual fixed costs t 431t Net pl 32 Reduced Existing Units (Annual) Q12-7 012-8 pg. I-5 P12-2 P12-6 P12-8 P12-12M Q12-11 Q12-15 o So to meet the needs of the firm fo pg. 1-9 381 Formatting as Table 1 Xfx P12-15 Modified (use the template below for problem setup including the negative Search D F H pg. 1 39 Variable Cost/Unit 40 Reduced Existing Units 41 Existing Unit Sales Price pg 1-1 42 Existing Unit Variable cost 23 Cre 43 Annual Fixed Cost CROC 44 Depreciation Rate 45 46 Step 1: Calculate Net Operating Cash Flows 47 Sales Revenue 48 Variable costs 49 Sales Revenue - Existing 2621 50 Variable Costs - Existing 382 34 51 Fixed costs 52 Depreciation pg. 1-253 Net Operating Income capita 54 Less: Taxes 382 34 55 Operating income after taxes 55 Plus: Depreciation F 57 Operating Cash Flow 58 59 Step 2: Calculate Working Capital (WC) Requirements pg. 1-760 Working Capital (WC) Requirements and 461 412 - 62 Step 3: Calculate Capital Expenditure (CAPEX) Requirements 6 Capital Expenditure (CAPEX) Requirements 64 N 65 Step 4: Calculate Free Cash Flow 66 Free Cash Flow pg. 1-6 67 t 431 Net pl P12-15M P12-23 012-15 012-7 P12-6 Q12-11 P12.14M Q12-8 P12-2 P12-8 P12-12M o So to meet the needs of the firm for working capital in Year 1