Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A1 A Xfx Accessibility tab summary: Students please use the B C D E 2 The price of Chive Corp. stock will be either

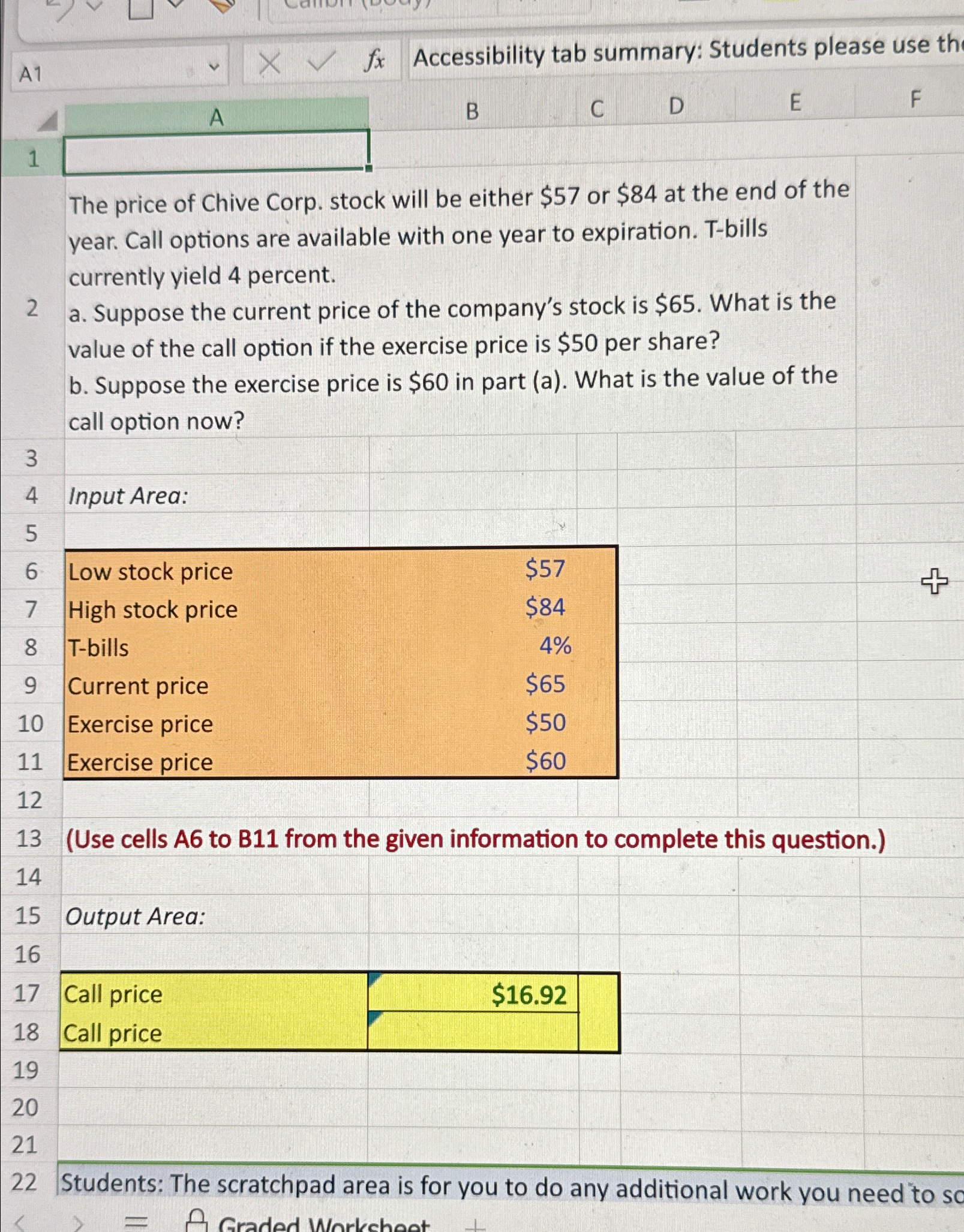

A1 A Xfx Accessibility tab summary: Students please use the B C D E 2 The price of Chive Corp. stock will be either $57 or $84 at the end of the year. Call options are available with one year to expiration. T-bills currently yield 4 percent. a. Suppose the current price of the company's stock is $65. What is the value of the call option if the exercise price is $50 per share? b. Suppose the exercise price is $60 in part (a). What is the value of the call option now? F 3 4 Input Area: 5 6 Low stock price $57 + 7 High stock price $84 8 T-bills 4% 9 Current price $65 10 Exercise price $50 11 Exercise price $60 12 13 (Use cells A6 to B11 from the given information to complete this question.) 14 15 Output Area: 16 17 Call price 18 Call price 19 20 21 $16.92 22 Students: The scratchpad area is for you to do any additional work you need to so Graded Worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started