Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A1 Property Dividend (Equity Investments) On December 1, 2020, S Corporation declared property dividend in the form of equity investments held by S Corporation

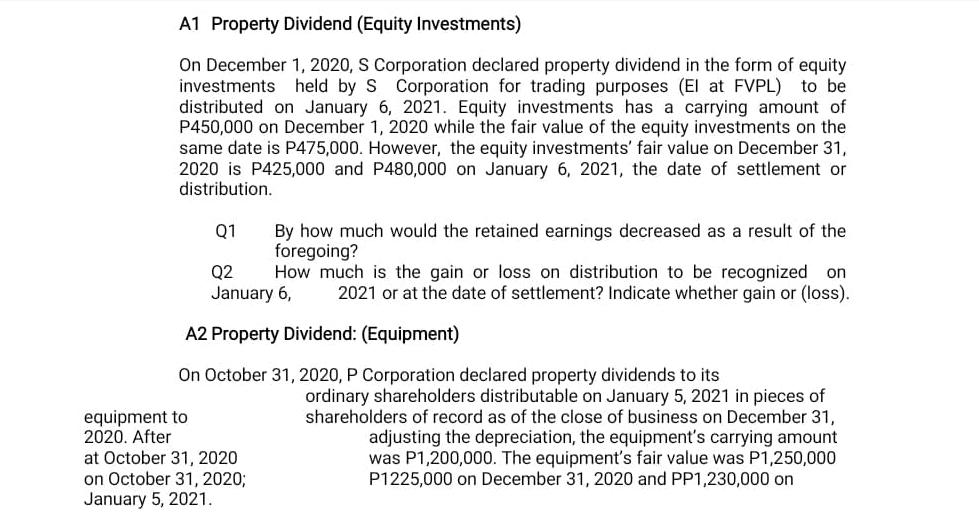

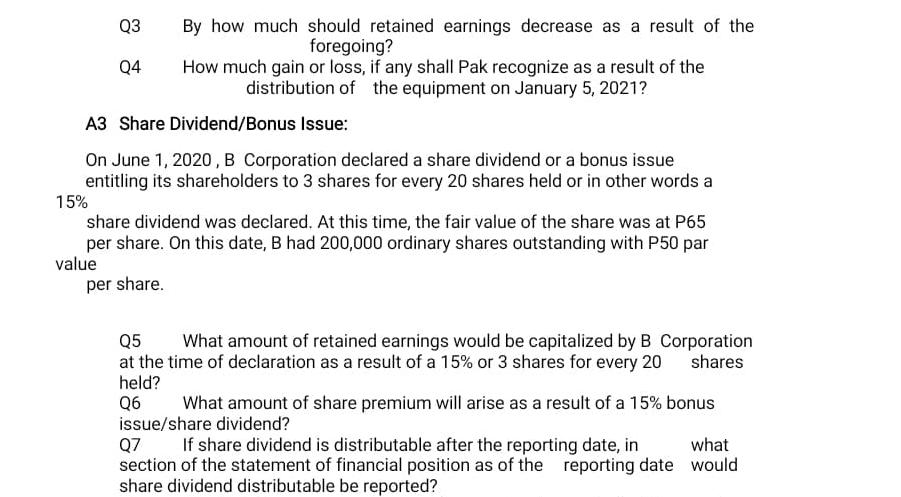

A1 Property Dividend (Equity Investments) On December 1, 2020, S Corporation declared property dividend in the form of equity investments held by S Corporation for trading purposes (El at FVPL) to be distributed on January 6, 2021. Equity investments has a carrying amount of P450,000 on December 1, 2020 while the fair value of the equity investments on the same date is P475,000. However, the equity investments' fair value on December 31, 2020 is P425,000 and P480,000 on January 6, 2021, the date of settlement or distribution. Q1 Q2 By how much would the retained earnings decreased as a result of the foregoing? How much is the gain or loss on distribution to be recognized on January 6, 2021 or at the date of settlement? Indicate whether gain or (loss). A2 Property Dividend: (Equipment) On October 31, 2020, P Corporation declared property dividends to its equipment to 2020. After at October 31, 2020 on October 31, 2020; January 5, 2021. ordinary shareholders distributable on January 5, 2021 in pieces of shareholders of record as of the close of business on December 31, adjusting the depreciation, the equipment's carrying amount was P1,200,000. The equipment's fair value was P1,250,000 P1225,000 on December 31, 2020 and PP1,230,000 on 15% Q3 Q4 By how much should retained earnings decrease as a result of the foregoing? How much gain or loss, if any shall Pak recognize as a result of the distribution of the equipment on January 5, 2021? A3 Share Dividend/Bonus Issue: On June 1, 2020, B Corporation declared a share dividend or a bonus issue entitling its shareholders to 3 shares for every 20 shares held or in other words a share dividend was declared. At this time, the fair value of the share was at P65 per share. On this date, B had 200,000 ordinary shares outstanding with P50 par value per share. Q5 What amount of retained earnings would be capitalized by B Corporation at the time of declaration as a result of a 15% or 3 shares for every 20 shares held? Q6 What amount of share premium will arise as a result of a 15% bonus issue/share dividend? Q7 what If share dividend is distributable after the reporting date, in section of the statement of financial position as of the reporting date would share dividend distributable be reported? 7 Q9 60 By how much would retained earnings decrease as a result of cash dividend declaration on preference share? Q10 By how much would retained earnings be charged as a result of cash dividend declaration on ordinary shares? scrip Q11 What if in the above problem, the corporation declared a 6% dividend on preference share on October 1 payable on November 1 to shareholder of record on October 15 with 10% interest, by how much would retained earnings decrease as a result of a 6% scrip dividend? Q12 In relation to Q11, by how much would total assets decrease after the payment of the 6% scrip dividend including the 10% interest month? for 1 L L

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started