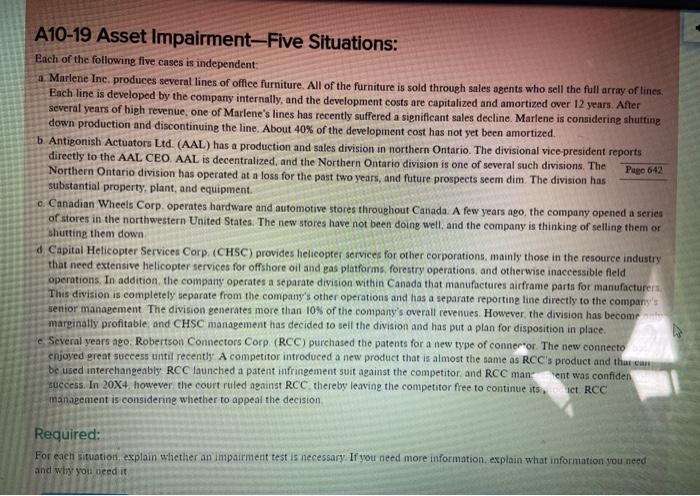

A10-19 Asset Impairment-Five Situations: Each of the following five cases is independent a Marlene Inc. produces several lines of office furniture. All of the furniture is sold through sales agents who sell the full array of lines. Each line is developed by the company internally, and the development costs are capitalized and amortized over 12 years. After several years of high revenue, one of Marlene's lines has recently suffered a significant sales decline. Marlene is considering shutting down production and discontinuing the line. About 40% of the development cost has not yet been amortized. b Antigonish Actuators Ltd. (AAL) has a production and sales division in northern Ontario. The divisional vice president reports directly to the AAL CEO. AAL is decentralized, and the Northern Ontario division is one of several such divisions. The Page 642 Northern Ontario division has operated at a loss for the past two years, and future prospects seem dim. The division has substantial property, plant, and equipment. c. Canadian Wheels Corp. operates hardware and automotive stores throughout Canada. A few years ago, the company opened a series of stores in the northwestern United States. The new stores have not been doing well, and the company is thinking of selling them or shutting them down Capital Helicopter Services Corp. (CHSC) provides helicopter services for other corporations, mainly those in the resource industry that need extensive helicopter services for offshore oil and gas platforms. forestry operations, and otherwise inaccessible field operations. In addition the company operates a separate division within Canada that manufactures airframe parts for manufacturers This division is completely separate from the company's other operations and has a separate reporting line directly to the company's senior management The division generates more than 10% of the company's overall revenues. However, the division has become marginally profitable and CHSC management has decided to sell the division and has put a plan for disposition in place. e Several years ago. Robertson Connectors Corp (RCC) purchased the patents for a new type of connerror. The new connecto enjoyed great success until recently A competitor introduced a new product that is almost the same as RCC's product and that can be used interchangeably RCC launched a patent infringement suit against the competitor and RCC man ent was confiden success. In 20X4, however the court ruled against RCC thereby leaving the competitor free to continue its et RCC management is considering whether to appeal the decision Required: For each situation explain whether an impairment test is necessary. If you need more information, explain what information you need and why you need it