Question: A1A Ltd. provided Su with a motor vehicle for the entire year, and the company also paid for all operating costs for the vehicle,

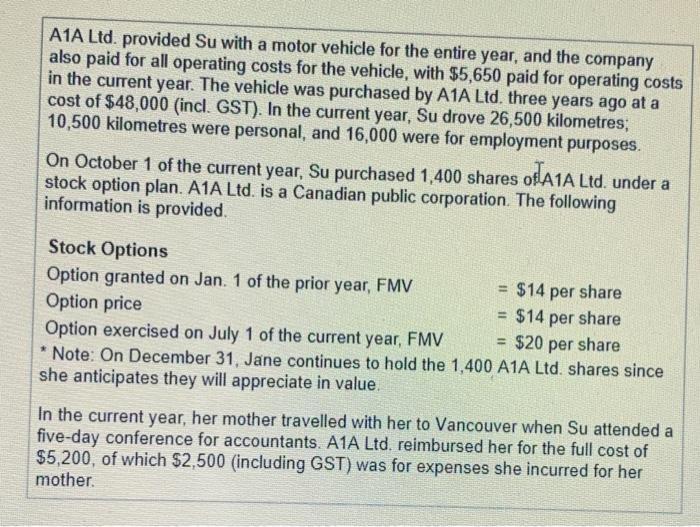

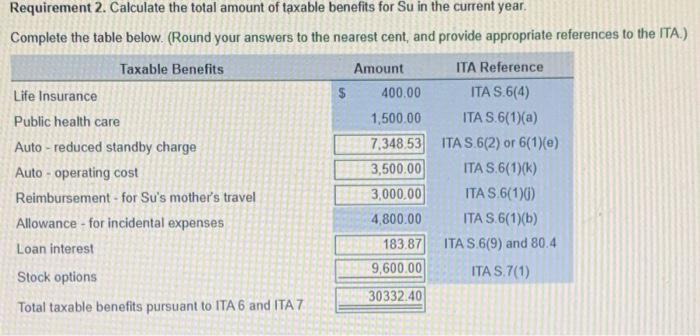

A1A Ltd. provided Su with a motor vehicle for the entire year, and the company also paid for all operating costs for the vehicle, with $5,650 paid for operating costs in the current year. The vehicle was purchased by A1A Ltd. three years ago at a cost of $48,000 (incl. GST). In the current year, Su drove 26,500 kilometres; 10,500 kilometres were personal, and 16,000 were for employment purposes. On October 1 of the current year, Su purchased 1,400 shares of A1A Ltd. under a stock option plan. A1A Ltd. is a Canadian public corporation. The following information is provided. Stock Options Option granted on Jan. 1 of the prior year, FMV Option price = $14 per share = $14 per share Option exercised on July 1 of the current year, FMV = $20 per share *Note: On December 31, Jane continues to hold the 1,400 A1A Ltd. shares since she anticipates they will appreciate in value. In the current year, her mother travelled with her to Vancouver when Su attended a five-day conference for accountants. A1A Ltd. reimbursed her for the full cost of $5,200, of which $2,500 (including GST) was for expenses she incurred for her mother. Requirement 2. Calculate the total amount of taxable benefits for Su in the current year. Complete the table below. (Round your answers to the nearest cent, and provide appropriate references to the ITA.) Taxable Benefits Life Insurance Public health care Auto-reduced standby charge Auto-operating cost Reimbursement - for Su's mother's travel Allowance - for incidental expenses Loan interest Stock options Total taxable benefits pursuant to ITA 6 and ITA 7 $ Amount 400.00 1,500.00 7,348.53 3,500.00 3,000,00 4,800.00 183.87 9,600.00 30332.40 ITA Reference ITA S.6(4) ITA S.6(1)(a) ITA S.6(2) or 6(1)(e) ITA S.6(1)(K) ITA S.6(1)(j) ITA S.6(1)(b) ITA S.6(9) and 80.4 ITA S.7(1)

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Life insurance 400000 x 020 80000 Public health care 1500 x 015 225 Auto reduced standby ... View full answer

Get step-by-step solutions from verified subject matter experts