Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AA 3-2 Compartive Analysis LO A1,A2 Saved AA 3-2 Comparative Analysis LO A1, A2 Key figures for the recent two years of both Apple and

AA 3-2 Compartive Analysis LO A1,A2

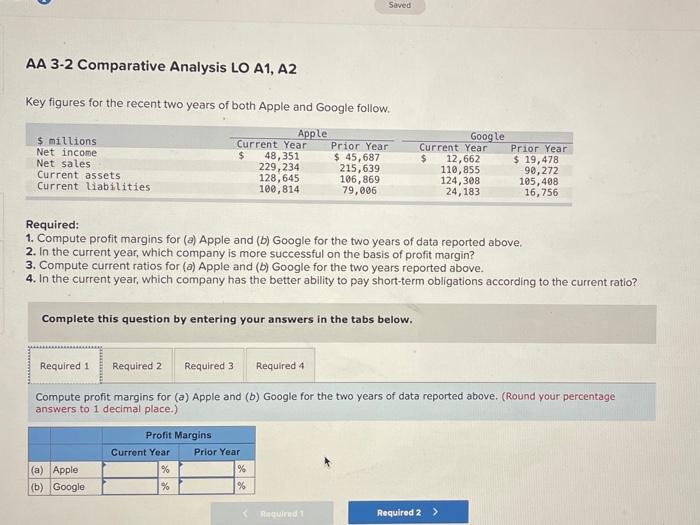

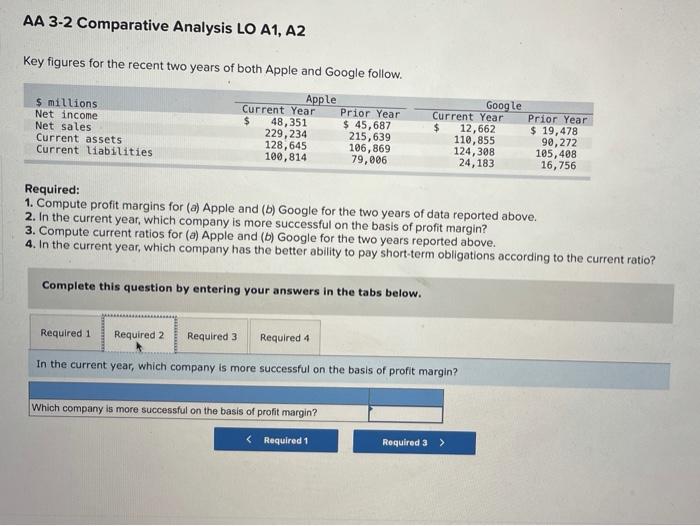

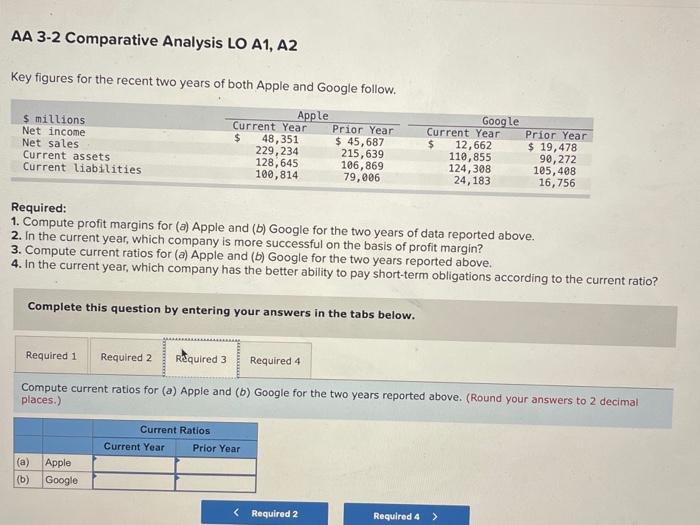

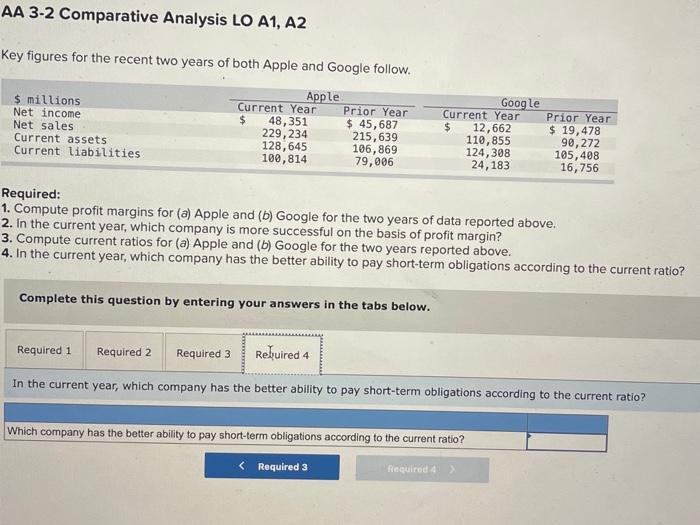

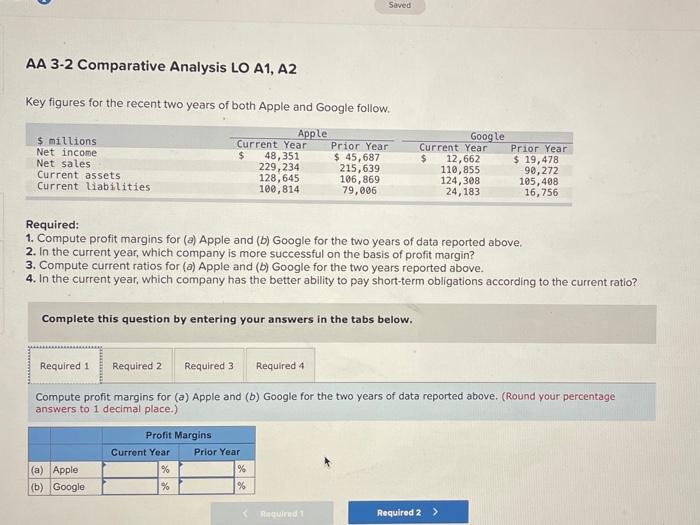

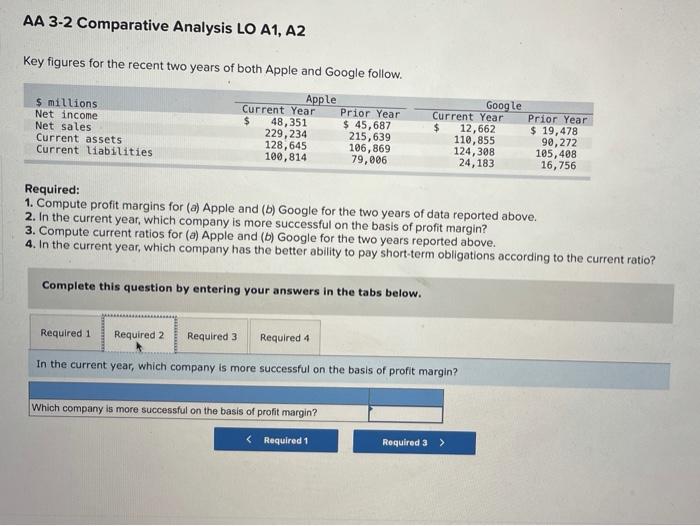

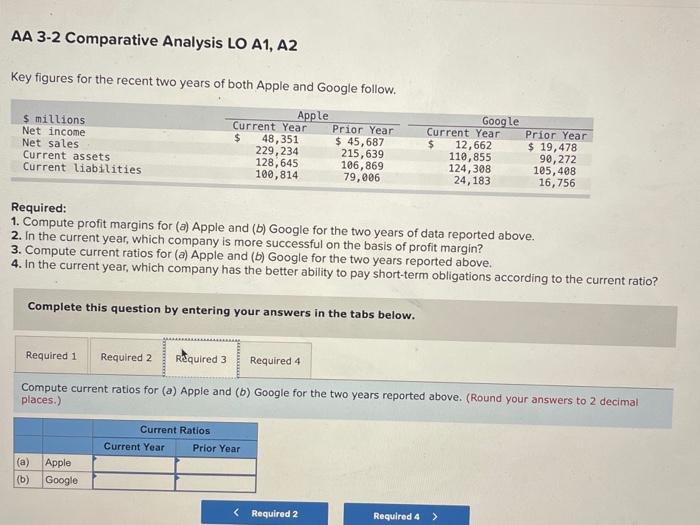

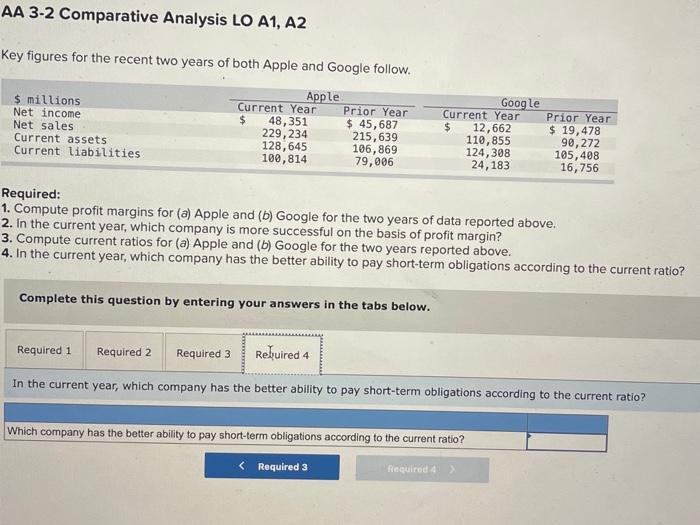

Saved AA 3-2 Comparative Analysis LO A1, A2 Key figures for the recent two years of both Apple and Google follow. Apple $ millions Current Year Prior Year Net income $ 48,351 $ 45,687 Net sales 229, 234 215,639 Current assets 128, 645 106,869 Current liabilities 100,814 79,006 Google Current Year $ 12,662 110,855 124,308 24,183 Prior Year $ 19,478 90,272 105,408 16,756 Required: 1. Compute profit margins for (a) Apple and (b) Google for the two years of data reported above. 2. In the current year, which company is more successful on the basis of profit margin? 3. Compute current ratios for (a) Apple and (b) Google for the two years reported above. 4. In the current year, which company has the better ability to pay short-term obligations according to the current ratio? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute profit margins for (a) Apple and (b) Google for the two years of data reported above. (Round your percentage answers to 1 decimal place.) Profit Margins Current Year Prior Year (a) Apple % (b) Google % % % BITED Required 2 > AA 3-2 Comparative Analysis LO A1, A2 Key figures for the recent two years of both Apple and Google follow. $ millions Net income Net sales Current assets Current liabilities Apple Current Year Prior Year $ 48,351 $ 45,687 229, 234 215, 639 128,645 106,869 100,814 79,006 Google Current Year Prior Year $ 12,662 $ 19,478 110,855 90,272 124,308 105,408 24,183 16,756 Required: 1. Compute profit margins for (a) Apple and (b) Google for the two years of data reported above. 2. In the current year, which company is more successful on the basis of profit margin? 3. Compute current ratios for (a) Apple and (b) Google for the two years reported above. 4. In the current year, which company has the better ability to pay short-term obligations according to the current ratio? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 In the current year, which company is more successful on the basis of profit margin? Which company is more successful on the basis of profit margin? AA 3-2 Comparative Analysis LO A1, A2 Key figures for the recent two years of both Apple and Google follow. $ millions Net income Net sales Current assets Current liabilities Apple Current Year Prior Year $ 48,351 $ 45,687 229, 234 215,639 128,645 106,869 100,814 79,006 Google Current Year Prior Year $ 12,662 $ 19,478 110,855 90,272 124,308 105,408 24,183 16,756 Required: 1. Compute profit margins for (a) Apple and (b) Google for the two years of data reported above. 2. In the current year, which company is more successful on the basis of profit margin? 3. Compute current ratios for (a) Apple and (5) Google for the two years reported above. 4. In the current year, which company has the better ability to pay short-term obligations according to the current ratio? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute current ratios for (a) Apple and (b) Google for the two years reported above. (Round your answers to 2 decimal places.) Current Ratios Current Year Prior Year (a) (b) Apple Google AA 3-2 Comparative Analysis LO A1, A2 Key figures for the recent two years of both Apple and Google follow. $ millions Net income Net sales Current assets Current liabilities Apple Current Year Prior Year 48,351 $ 45,687 229, 234 215,639 128,645 106,869 100,814 79,006 Google Current Year Prior Year $ 12,662 $ 19,478 110,855 90,272 124,308 105,408 24,183 16,756 Required: 1. Compute profit margins for (a) Apple and (b) Google for the two years of data reported above. 2. In the current year, which company is more successful on the basis of profit margin? 3. Compute current ratios for (a) Apple and (b) Google for the two years reported above. 4. In the current year, which company has the better ability to pay short-term obligations according to the current ratio? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Rebuired 4 In the current year, which company has the better ability to pay short-term obligations according to the current ratio? Which company has the better ability to pay short-term obligations according to the current ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started