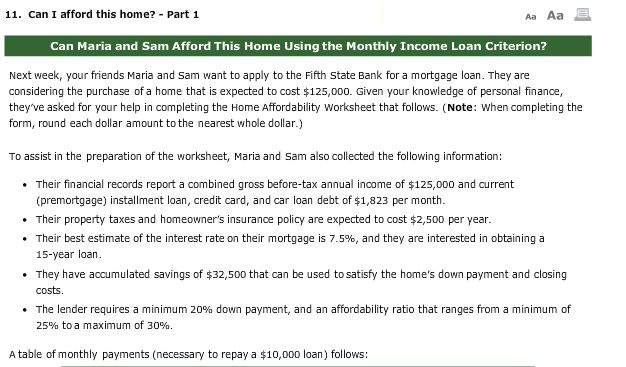

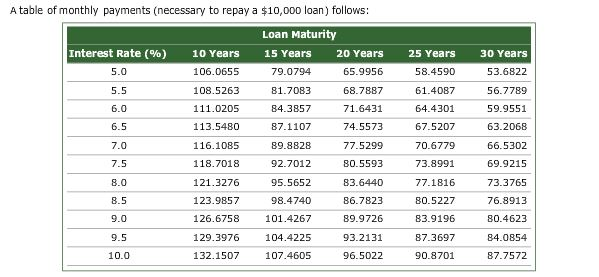

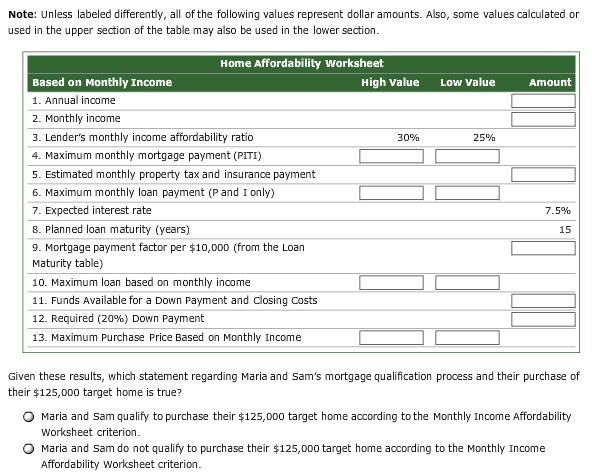

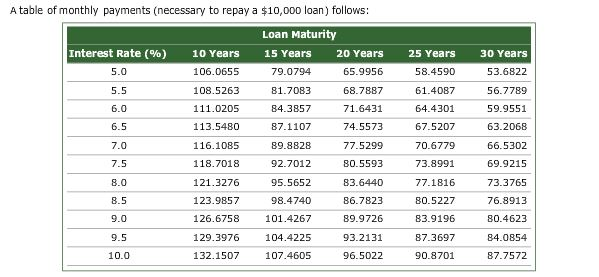

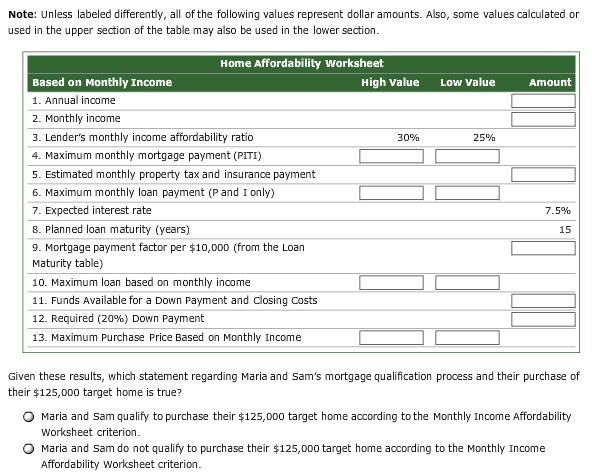

Aa Aa 11. Can I afford this home? Part 1 Can Maria and Sam Afford This Home Using the Monthly Income Loan Criterion? Next week, your friends Maria and Sam want to apply to the Fifth State Bank for a mortgage loan. They are considering the purchase of a home that is expected to cost $125,000- Given your knowledge of personal finance, they've asked for your help in completing the Home Affordability worksheet that follows. (Note: when completing the form, round each dollar amount to the nearest whole dollar. To assist in the preparation of the worksheet, Maria and Sam also collected the following information: Their financial records report a combined gross before-tax annual income of $125,000 and current (premortgage) installment loan, credit card, and car loan debt of $1,823 per month. Their property taxes and homeowner's insurance policy are expected to cost $2,500 per year. Their best estimate of the interest rate on their mortgage is 7.5%, and they are interested in obtaining a 15-year loan. They have accumulated savings of $32,500 that can be used to satisfy the home's down payment and closing costs. The lender requires a minimum 20% down payment, and an affordability ratio that ranges from a minimum of 25% to a maximum of 30% A table of monthly payments (necessany to repay a $10,000 loan) follows: Aa Aa 11. Can I afford this home? Part 1 Can Maria and Sam Afford This Home Using the Monthly Income Loan Criterion? Next week, your friends Maria and Sam want to apply to the Fifth State Bank for a mortgage loan. They are considering the purchase of a home that is expected to cost $125,000- Given your knowledge of personal finance, they've asked for your help in completing the Home Affordability worksheet that follows. (Note: when completing the form, round each dollar amount to the nearest whole dollar. To assist in the preparation of the worksheet, Maria and Sam also collected the following information: Their financial records report a combined gross before-tax annual income of $125,000 and current (premortgage) installment loan, credit card, and car loan debt of $1,823 per month. Their property taxes and homeowner's insurance policy are expected to cost $2,500 per year. Their best estimate of the interest rate on their mortgage is 7.5%, and they are interested in obtaining a 15-year loan. They have accumulated savings of $32,500 that can be used to satisfy the home's down payment and closing costs. The lender requires a minimum 20% down payment, and an affordability ratio that ranges from a minimum of 25% to a maximum of 30% A table of monthly payments (necessany to repay a $10,000 loan) follows