Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jackets Ltd is considering expanding its highly successful denim jackets business. The initial investment costs and net annual cash flows for two projects considered

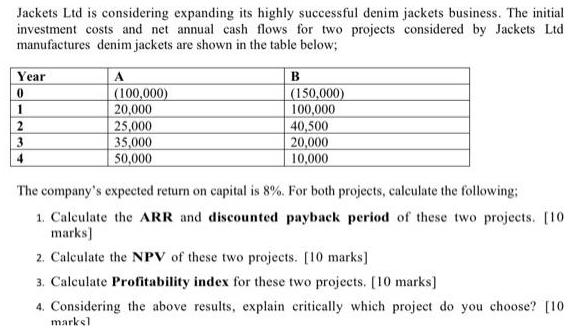

Jackets Ltd is considering expanding its highly successful denim jackets business. The initial investment costs and net annual cash flows for two projects considered by Jackets Ltd manufactures denim jackets are shown in the table below; Year 0 1 2 3 4 A (100,000) 20,000 25,000 35,000 50,000 B (150,000) 100,000 40,500 20,000 10,000 The company's expected return on capital is 8%. For both projects, calculate the following: 1. Calculate the ARR and discounted payback period of these two projects. [10 marks] 2. Calculate the NPV of these two projects. [10 marks] 3. Calculate Profitability index for these two projects. [10 marks] 4. Considering the above results, explain critically which project do you choose? [10 markel

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER The bonds will have a float ation cost of 66 percent of the market value which is 1 145 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started