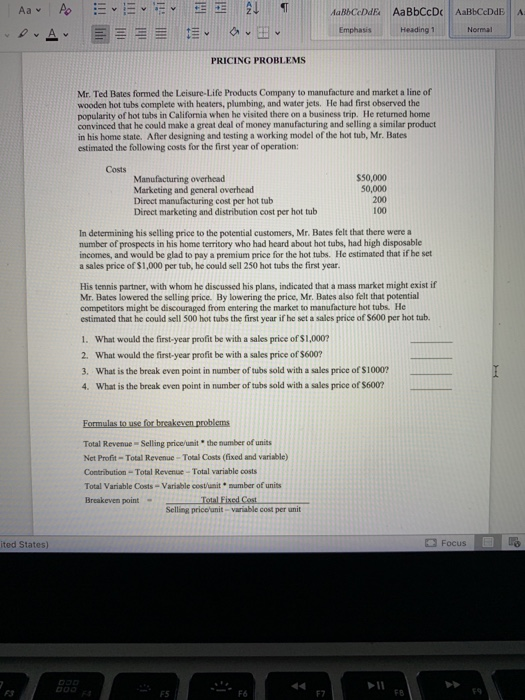

Aa v EEEE ST AaBb Ced AaBbCcDc AaBbCeDdE E 21 19 av Emphasis Heading 1 Normal PRICING PROBLEMS Mr. Ted Bates formed the Leisure Life Products Company to manufacture and market a line of wooden hot tubs complete with heaters, plumbing, and water jets. He had first observed the popularity of hot tubs in California when he visited there on a business trip. He returned home convinced that he could make a great deal of money manufacturing and selling a similar product in his home state. After designing and testing a working model of the hot tub, Mr. Bates estimated the following costs for the first year of operation: 200 Costs Manufacturing overhead $50,000 Marketing and general overhead 50,000 Direct manufacturing cost per hot tub Direct marketing and distribution cost per hot tub 100 In determining his selling price to the potential customers, Mr. Bates felt that there were a number of prospects in his home territory who had heard about hot tubs, had high disposable incomes, and would be glad to pay a premium price for the hot tubs. He estimated that if he set a sales price of $1,000 per tub, he could sell 250 hot tubs the first year. His tennis partner, with whom he discussed his plans, indicated that a mass market might exist if Mr. Bates lowered the selling price. By lowering the price, Mr. Bates also felt that potential competitors might be discouraged from entering the market to manufacture hot tubs. He estimated that he could sell 500 hot tubs the first year if he set a sales price of S600 per hot tub. 1. What would the first-year profit be with a sales price of $1,000? 2. What would the first-year profit be with a sales price of $600? 3. What is the break even point in number of tubs sold with a sales price of $1000? 4. What is the break even point in number of tubs sold with a sales price of $6007 Formulas to use for breakeven problems Total Revenue Selling price/unit the number of units Net Profit-Total Revenue - Total Costs (fixed and variable) Contribution - Total Revenue - Total variable costs Total Variable Costs - Variable costit number of units Breakeven point Total Fixed Cost Selling price/unit-variable cost per unit ited States) Focus 11