AAA has an issue regarding Alice, one of the members (of the LLC) that they would like us to research. As you may recall

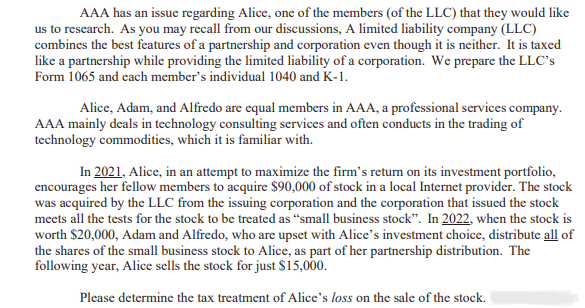

AAA has an issue regarding Alice, one of the members (of the LLC) that they would like us to research. As you may recall from our discussions, A limited liability company (LLC) combines the best features of a partnership and corporation even though it is neither. It is taxed like a partnership while providing the limited liability of a corporation. We prepare the LLC's Form 1065 and each member's individual 1040 and K-1. Alice, Adam, and Alfredo are equal members in AAA, a professional services company. AAA mainly deals in technology consulting services and often conducts in the trading of technology commodities, which it is familiar with. In 2021, Alice, in an attempt to maximize the firm's return on its investment portfolio, encourages her fellow members to acquire $90,000 of stock in a local Internet provider. The stock was acquired by the LLC from the issuing corporation and the corporation that issued the stock meets all the tests for the stock to be treated as "small business stock". In 2022, when the stock is worth $20,000, Adam and Alfredo, who are upset with Alice's investment choice, distribute all of the shares of the small business stock to Alice, as part of her partnership distribution. The following year, Alice sells the stock for just $15,000. Please determine the tax treatment of Alice's loss on the sale of the stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started