Question: AaBbcc AaBb AaBbt AaBbc AaBbcc AaBbC T Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 abc X X Anya- Font Paragraph Styles

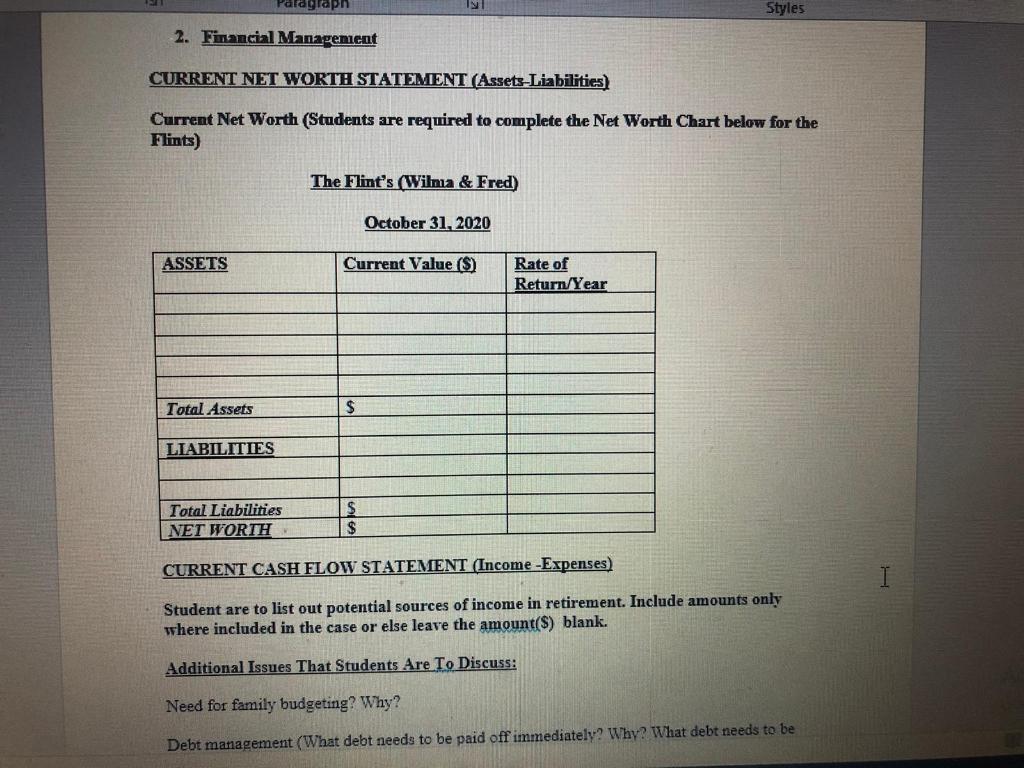

AaBbcc AaBb AaBbt AaBbc AaBbcc AaBbC T Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 abc X X Anya- Font Paragraph Styles Read the case and answer the questions at the end. Background I It's Monday moming, November 16, 2020 and you are an experienced financial planner, specializing in retirement planning. This aftemoon you are going to meet with your new clients, Fred & Wilma Flint. Prior to today you have only talked to the Flint's on the phone and you are looking forward to preparing a comprehensive retirement plan for them over the next few weeks Before the meeting today you decide to go through your notes from the telephone conversation that you had with the Flints' last week. Below are your rough notes from the conversation: Background Notes Fred is now 67 years old and Wilma is 56 years old. Both Wilma and Fred are healthy and both are still working full time. Wilma works for a marketing firm and expects to earn a salary of $135,000 in 2020 Wilma contributes to her Employer Pension Plan, as required by her employment agreement At age 67, Fred still works (in the education field) and he expects to earn a gross salary of $85,000 in 2020. Fred works on contract and is not a member of an employer pension plan. Fred receives no benefits from his employer. In 2017 the Flints' got involved in sailing and now rent a large sailboat twice a year for a trip down the east coast of United States. These trips have added a large cost to the Flint's already very expensive lifestyle. The Flint's expect their total expenses for 2020 to be $255,000. Both Fred and Wilma want to retire in 2 years (at the end of 2022). In retirement, the Flint's estimate that they will require at least $160,000 in gross income 2 T AaBbcc AaBb AaBbt AaBBC AaBbcc AaBbc I Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 ab Font Paragraph Styles employer's pension plan. Under her employer's early retirement package, Wilma expects to eam pension income from her defined contribution pension plan when she retires. Wilma was recently informed by her employer that her pension income amount was guaranteed at 60% of her ending salary when she retires. Wilma asks you to aplain this guaranteed pension amount to her as that was not her understanding of how her employers DC pension plan worked. Fred hopes that this level of income in retirement will be equal to their expenses in retirement. However, the Flint's are not very good at managing their money and have never prepared a budget to monitor their spending. One of their key goals is to ensure that they do not run out of money in retirement. Their other financial goal is to ensure that all of their debt is paid off by the time they retire. The Flint's lease both of their cars. The Flints intend to live an active life in retirement (travel/sail, dine out, etc.) for as long as they stay healthy (say, after 10 years in retirement). For financial planning purposes, you assume that the Flints will live until the age of 90. On October 31, 2020, the Flint's assets included: . . Their principle residence, which is currently valued at $1 million purchased 12 years ago for $700,000); The Flint's have a joint bank account totalling $2,000 in cash. Wilma's RRSP, which is currently valued at $225,000. Wilma's has a Locked-in RRSP account. This account was opened by Wilma in 2005 when she transferred over the money from her pension plan at her former employer. Fred has a GIC for $145,000 in his non-registered account. This GIC is very safe and pays interest of 0.5% per year. This GIC matures in 3 months. Fred expects the interest rate to start to increase on a regular basis over the next 4 years. Last month Fred's great uncle passed away. Fred uncle left him this Corporate bond (pays 3% interest per year). Interest is paid semi-annually. After doing some research. Fred determined that his uncle bought the bond at its face value of $25,000. Today, the bond is valued $28,500. The current interest rate in the economy is 2.25%. The Flint's are considering selling the bond and using the money to pay off some of their line of credit (debt). The Flint's would like you to tell them: Help Tell me what you want to do wRo-14 -A A 21 abe x x - aly. A c| 1 Normal Heading 1 Heading 2 Heading 3 Heading 4 Headin- Font Paragraph Background on the Other Flint Family Members Styles Dino Flint Dino Flint, age 29, not working as he was disabled in a car accident last year. The Flint's are very concerned about their son Dino. According to the doctors, Dino will never be able to work full time and will therefore be limited in his capacity to earn a good living Dino receives $3,500 per month from the insurance company as a result of the accident, to pay for his medical care. These payments will continue until Dino reaches the age of 60 and then they will stop- Dino was a student when the accident happened and has never paid into CPP. The Flint's ask you to help them put a plan together so that Dino will be able to manage financially when Fred & Wilma are deceased. Pebbles Flint Pebbles Flint, age 25, is a full time student and is married to Slate Stone. Pebbles and Slate are expecting their first child next month. Fred would like to surprise Pebbles with a special gift for her baby: 4 years of free college tuition when his granddaughter reaches the age of 18. Fred estimates that this will cost him $2,000 per year, for 18 year. Fred would like to the details (advantages) of any tax planning ideas for saving money for his grandchild's college tuition. Specifically Fred would like to know: i i when can Fred start saving for his grandchild's education what is the maximum amount that he can contribute, and does he receive a tax deduction when the contribution is made. Additional Information Wilma has a few questions for you, as her financial planner, to discuss in your meeting: Wom REVIEW VIEW Tell me what you want to do Aa- EESTAL I AaBbcc AaBb AaBbt AaBBC AaBb IT Normal Heading 1 Heading 2 Heading 3 Heading A Paragraph Styles Wilma has a few questions for you, as her financial planner, to discuss in your meeting- 1. Wilma was told by her hairdresser that she will have to start withdrawing money from her RRSP when she retires in 2 years. Wilma would like to wait until later into her retirement before she has to withdraw her RRSP money and pay tax on it. Please let Wilma know if her hairdresser is correct. 3 2. Wilma read in the newspaper that opening a Spousal RRSPs is a good way to reduce the overall family income tax burden. Wilma asks you to explain if her and Fred could benefit from setting up and contributing to a Spousal RRSP. I 14 A A - P AaBbcc AaBb AaBbi AaBbc AaBbcc AaBbcc 1 Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 A - aby - A Font Paragraph Styles Tax Planning Last week Wilma was watching a business news program where they discussed the "clawback" of Old Age Security (OAS) payments. Wilma is now concerned that the clawback may affect her and Fred and she asks you to explain if this OAS will impact her and Fred. Wilma wants to know if she should make her RRSP contribution to her regular RRSP or to her Lock-in RRSP. Please provide Wilma with an answer. REQUIRED: Prepare a retirement plan for the Flints. In your plan answer all of the Flint's questions that were raised in the above notes. Use the following headings to organize your plan: 1. Client Background Fred Wilma Pebbles I Dino Client Goals & Assumptions Short-term Goals: Long-Term Goals: Your analysis and calculations are based in part, on the following assumptions: 1. Ignore inflation 2. Rate of retum is 5% (before tax) on the non-registered investment account. 3. Clients will live until age 90. Paragraph Styles 2. Financial Management CURRENT NET WORTH STATEMENT (Assets-Liabilities Current Net Worth (Students are required to complete the Net Worth Chart below for the Flints) The Flint's (Wilma & Fred) October 31, 2020 ASSETS Current Value (S) Rate of Return/Year Total Assets $ LIABILITIES Total Liabilities NET WORTH CURRENT CASH FLOW STATEMENT (Income -Expenses) Student are to list out potential sources of income in retirement. Include amounts only where included in the case or else leave the amount($) blank. Additional Issues That Students Are To Discuss: Need for family budgeting? Why? Debt management (What debt needs to be paid off immediately? Why? What debt needs to be References Layout Mailings Review View Help Tell me what you want to do 14 w Ro -A A EEEE 21 AaBbcc AaBb AaBbt AaBBC AaBbCc AaBbcc 1 Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 abe x, X A-ay-A- Styles Font Paragraph Additional Issues That Students Are To Discuss: Need for family budgeting? Why? Debt management (What debt needs to be paid off immediately? Why? What debt needs to be paid off by retirement date? Fred's Corporate Bond (keep or sell, based on the yield to maturity) 3. Asset Management This section entails a review of the client's investments. Students are to answer the following investment-related questions: 5 I Are the Flints' investments earning acceptable rates of return? Students to provide comments Remember, the expected rates of return should be a minimum of 5%. Provide the Flints with a financial strategy for dealing with Dino's future financial dilemma. 4. Tax Planning Students to answer questions raised by the Flints: What is the estimated tax amount on sale of principal residence? 14 A A - E 21 AaBbcc AaBb AaBbt AaBbc AaBbCc AaBbc I Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 X, X A-ay-A- Font Paragraph Styles 4. Tax Planning Students to answer questions raised by the Flints: What is the estimated tax amount on sale of principal residence? Discuss options for saving for post-secondary school for Fred & Wilma's grandchild. Are Spousal RRSPs a good idea for the Flints? Explain pros & cons of spousal RRSPs, as it relates to the Flint's situation Should Wilma make her retirement account contributions to her regular RRSP or to her Lock-in RRSP? Are there any other investment accounts that the Flints should open that would provide a tax advantage. If so, how much can each of them contribute to their own account? (Explain the advantages of both Fred and Wilma opening up TFSAs. How much can they each contribute if they open up the accounts in 2020.) 5. Retirement Planning Based on the estimated income and expenditures provided by the Flint's, will Wilma and Fred have a positive cash flow in their first year of retirement? Students to address retirement planning questions raised by Wilma: I Discuss Wilma's DC Pension Plan-is the amount to be paid out on retirement guaranteed? Impact of the OAS "slawback" on the Flints in retirement, if any? Are there any benefits of spousal RRSPs for the Flint's? Explain why and be specific? AaBbcc AaBb AaBbt AaBbc AaBbcc AaBbC T Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 abc X X Anya- Font Paragraph Styles Read the case and answer the questions at the end. Background I It's Monday moming, November 16, 2020 and you are an experienced financial planner, specializing in retirement planning. This aftemoon you are going to meet with your new clients, Fred & Wilma Flint. Prior to today you have only talked to the Flint's on the phone and you are looking forward to preparing a comprehensive retirement plan for them over the next few weeks Before the meeting today you decide to go through your notes from the telephone conversation that you had with the Flints' last week. Below are your rough notes from the conversation: Background Notes Fred is now 67 years old and Wilma is 56 years old. Both Wilma and Fred are healthy and both are still working full time. Wilma works for a marketing firm and expects to earn a salary of $135,000 in 2020 Wilma contributes to her Employer Pension Plan, as required by her employment agreement At age 67, Fred still works (in the education field) and he expects to earn a gross salary of $85,000 in 2020. Fred works on contract and is not a member of an employer pension plan. Fred receives no benefits from his employer. In 2017 the Flints' got involved in sailing and now rent a large sailboat twice a year for a trip down the east coast of United States. These trips have added a large cost to the Flint's already very expensive lifestyle. The Flint's expect their total expenses for 2020 to be $255,000. Both Fred and Wilma want to retire in 2 years (at the end of 2022). In retirement, the Flint's estimate that they will require at least $160,000 in gross income 2 T AaBbcc AaBb AaBbt AaBBC AaBbcc AaBbc I Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 ab Font Paragraph Styles employer's pension plan. Under her employer's early retirement package, Wilma expects to eam pension income from her defined contribution pension plan when she retires. Wilma was recently informed by her employer that her pension income amount was guaranteed at 60% of her ending salary when she retires. Wilma asks you to aplain this guaranteed pension amount to her as that was not her understanding of how her employers DC pension plan worked. Fred hopes that this level of income in retirement will be equal to their expenses in retirement. However, the Flint's are not very good at managing their money and have never prepared a budget to monitor their spending. One of their key goals is to ensure that they do not run out of money in retirement. Their other financial goal is to ensure that all of their debt is paid off by the time they retire. The Flint's lease both of their cars. The Flints intend to live an active life in retirement (travel/sail, dine out, etc.) for as long as they stay healthy (say, after 10 years in retirement). For financial planning purposes, you assume that the Flints will live until the age of 90. On October 31, 2020, the Flint's assets included: . . Their principle residence, which is currently valued at $1 million purchased 12 years ago for $700,000); The Flint's have a joint bank account totalling $2,000 in cash. Wilma's RRSP, which is currently valued at $225,000. Wilma's has a Locked-in RRSP account. This account was opened by Wilma in 2005 when she transferred over the money from her pension plan at her former employer. Fred has a GIC for $145,000 in his non-registered account. This GIC is very safe and pays interest of 0.5% per year. This GIC matures in 3 months. Fred expects the interest rate to start to increase on a regular basis over the next 4 years. Last month Fred's great uncle passed away. Fred uncle left him this Corporate bond (pays 3% interest per year). Interest is paid semi-annually. After doing some research. Fred determined that his uncle bought the bond at its face value of $25,000. Today, the bond is valued $28,500. The current interest rate in the economy is 2.25%. The Flint's are considering selling the bond and using the money to pay off some of their line of credit (debt). The Flint's would like you to tell them: Help Tell me what you want to do wRo-14 -A A 21 abe x x - aly. A c| 1 Normal Heading 1 Heading 2 Heading 3 Heading 4 Headin- Font Paragraph Background on the Other Flint Family Members Styles Dino Flint Dino Flint, age 29, not working as he was disabled in a car accident last year. The Flint's are very concerned about their son Dino. According to the doctors, Dino will never be able to work full time and will therefore be limited in his capacity to earn a good living Dino receives $3,500 per month from the insurance company as a result of the accident, to pay for his medical care. These payments will continue until Dino reaches the age of 60 and then they will stop- Dino was a student when the accident happened and has never paid into CPP. The Flint's ask you to help them put a plan together so that Dino will be able to manage financially when Fred & Wilma are deceased. Pebbles Flint Pebbles Flint, age 25, is a full time student and is married to Slate Stone. Pebbles and Slate are expecting their first child next month. Fred would like to surprise Pebbles with a special gift for her baby: 4 years of free college tuition when his granddaughter reaches the age of 18. Fred estimates that this will cost him $2,000 per year, for 18 year. Fred would like to the details (advantages) of any tax planning ideas for saving money for his grandchild's college tuition. Specifically Fred would like to know: i i when can Fred start saving for his grandchild's education what is the maximum amount that he can contribute, and does he receive a tax deduction when the contribution is made. Additional Information Wilma has a few questions for you, as her financial planner, to discuss in your meeting: Wom REVIEW VIEW Tell me what you want to do Aa- EESTAL I AaBbcc AaBb AaBbt AaBBC AaBb IT Normal Heading 1 Heading 2 Heading 3 Heading A Paragraph Styles Wilma has a few questions for you, as her financial planner, to discuss in your meeting- 1. Wilma was told by her hairdresser that she will have to start withdrawing money from her RRSP when she retires in 2 years. Wilma would like to wait until later into her retirement before she has to withdraw her RRSP money and pay tax on it. Please let Wilma know if her hairdresser is correct. 3 2. Wilma read in the newspaper that opening a Spousal RRSPs is a good way to reduce the overall family income tax burden. Wilma asks you to explain if her and Fred could benefit from setting up and contributing to a Spousal RRSP. I 14 A A - P AaBbcc AaBb AaBbi AaBbc AaBbcc AaBbcc 1 Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 A - aby - A Font Paragraph Styles Tax Planning Last week Wilma was watching a business news program where they discussed the "clawback" of Old Age Security (OAS) payments. Wilma is now concerned that the clawback may affect her and Fred and she asks you to explain if this OAS will impact her and Fred. Wilma wants to know if she should make her RRSP contribution to her regular RRSP or to her Lock-in RRSP. Please provide Wilma with an answer. REQUIRED: Prepare a retirement plan for the Flints. In your plan answer all of the Flint's questions that were raised in the above notes. Use the following headings to organize your plan: 1. Client Background Fred Wilma Pebbles I Dino Client Goals & Assumptions Short-term Goals: Long-Term Goals: Your analysis and calculations are based in part, on the following assumptions: 1. Ignore inflation 2. Rate of retum is 5% (before tax) on the non-registered investment account. 3. Clients will live until age 90. Paragraph Styles 2. Financial Management CURRENT NET WORTH STATEMENT (Assets-Liabilities Current Net Worth (Students are required to complete the Net Worth Chart below for the Flints) The Flint's (Wilma & Fred) October 31, 2020 ASSETS Current Value (S) Rate of Return/Year Total Assets $ LIABILITIES Total Liabilities NET WORTH CURRENT CASH FLOW STATEMENT (Income -Expenses) Student are to list out potential sources of income in retirement. Include amounts only where included in the case or else leave the amount($) blank. Additional Issues That Students Are To Discuss: Need for family budgeting? Why? Debt management (What debt needs to be paid off immediately? Why? What debt needs to be References Layout Mailings Review View Help Tell me what you want to do 14 w Ro -A A EEEE 21 AaBbcc AaBb AaBbt AaBBC AaBbCc AaBbcc 1 Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 abe x, X A-ay-A- Styles Font Paragraph Additional Issues That Students Are To Discuss: Need for family budgeting? Why? Debt management (What debt needs to be paid off immediately? Why? What debt needs to be paid off by retirement date? Fred's Corporate Bond (keep or sell, based on the yield to maturity) 3. Asset Management This section entails a review of the client's investments. Students are to answer the following investment-related questions: 5 I Are the Flints' investments earning acceptable rates of return? Students to provide comments Remember, the expected rates of return should be a minimum of 5%. Provide the Flints with a financial strategy for dealing with Dino's future financial dilemma. 4. Tax Planning Students to answer questions raised by the Flints: What is the estimated tax amount on sale of principal residence? 14 A A - E 21 AaBbcc AaBb AaBbt AaBbc AaBbCc AaBbc I Normal Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 X, X A-ay-A- Font Paragraph Styles 4. Tax Planning Students to answer questions raised by the Flints: What is the estimated tax amount on sale of principal residence? Discuss options for saving for post-secondary school for Fred & Wilma's grandchild. Are Spousal RRSPs a good idea for the Flints? Explain pros & cons of spousal RRSPs, as it relates to the Flint's situation Should Wilma make her retirement account contributions to her regular RRSP or to her Lock-in RRSP? Are there any other investment accounts that the Flints should open that would provide a tax advantage. If so, how much can each of them contribute to their own account? (Explain the advantages of both Fred and Wilma opening up TFSAs. How much can they each contribute if they open up the accounts in 2020.) 5. Retirement Planning Based on the estimated income and expenditures provided by the Flint's, will Wilma and Fred have a positive cash flow in their first year of retirement? Students to address retirement planning questions raised by Wilma: I Discuss Wilma's DC Pension Plan-is the amount to be paid out on retirement guaranteed? Impact of the OAS "slawback" on the Flints in retirement, if any? Are there any benefits of spousal RRSPs for the Flint's? Explain why and be specific

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts