Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AaBDCCL AOBOCCON AaBoCCDC HabDC I No Spaci... Heading 1 Heading 2 Normal Title Subtitle Subtle Em.. bex An Font Paragraph Styles 11.11.21:3!1.4.1.5 1.6 1.7 1.8

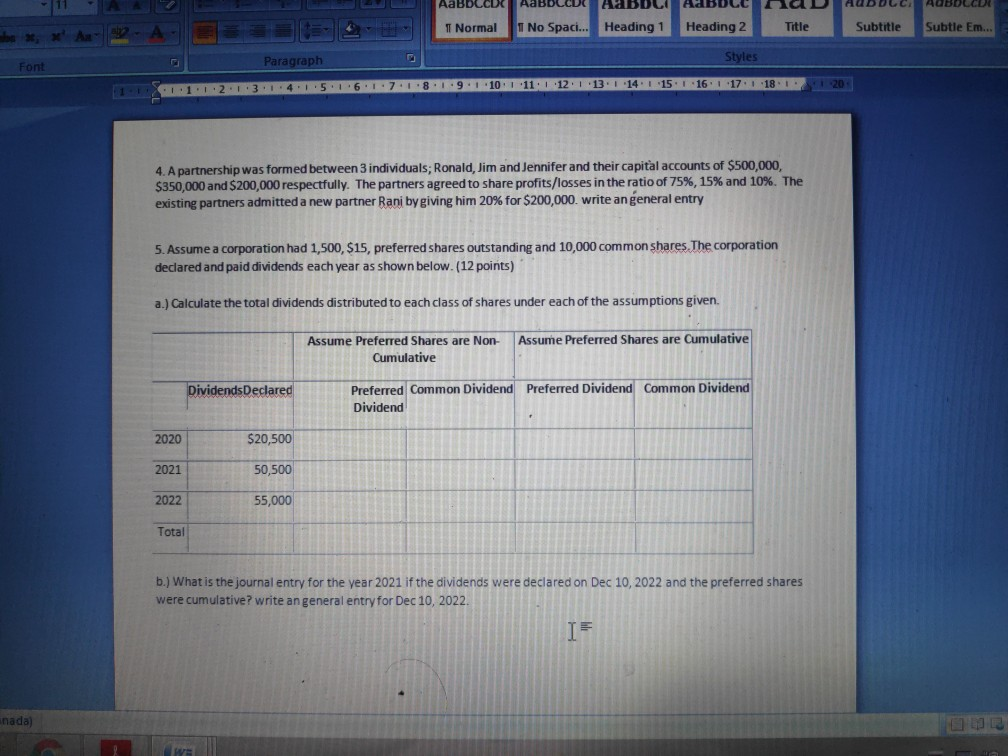

AaBDCCL AOBOCCON AaBoCCDC HabDC I No Spaci... Heading 1 Heading 2 Normal Title Subtitle Subtle Em.. bex An Font Paragraph Styles 11.11.21:3!1.4.1.5 1.6 1.7 1.8 1.91 101 111 112 113 114 115 116 117 118 120 4. A partnership was formed between 3 individuals; Ronald, Jim and Jennifer and their capital accounts of $500,000, $350,000 and $200,000 respectfully. The partners agreed to share profits/losses in the ratio of 75%, 15% and 10%. The existing partners admitted a new partner Rani by giving him 20% for $200,000. write an general entry 5. Assume a corporation had 1,500, $15, preferred shares outstanding and 10,000 common shares. The corporation declared and paid dividends each year as shown below. (12 points) a.) Calculate the total dividends distributed to each class of shares under each of the assumptions given. Assume Preferred Shares are Cumulative Assume Preferred Shares are Non- Cumulative Dividends Declared Preferred Common Dividend Preferred Dividend Common Dividend Dividend 2020 $20,500 2021 50,500 2022 55,000 Total b.) What is the journal entry for the year 2021 if the dividends were declared on Dec 10, 2022 and the preferred shares were cumulative? write an general entry for Dec 10, 2022 IF nada) AaBDCCL AOBOCCON AaBoCCDC HabDC I No Spaci... Heading 1 Heading 2 Normal Title Subtitle Subtle Em.. bex An Font Paragraph Styles 11.11.21:3!1.4.1.5 1.6 1.7 1.8 1.91 101 111 112 113 114 115 116 117 118 120 4. A partnership was formed between 3 individuals; Ronald, Jim and Jennifer and their capital accounts of $500,000, $350,000 and $200,000 respectfully. The partners agreed to share profits/losses in the ratio of 75%, 15% and 10%. The existing partners admitted a new partner Rani by giving him 20% for $200,000. write an general entry 5. Assume a corporation had 1,500, $15, preferred shares outstanding and 10,000 common shares. The corporation declared and paid dividends each year as shown below. (12 points) a.) Calculate the total dividends distributed to each class of shares under each of the assumptions given. Assume Preferred Shares are Cumulative Assume Preferred Shares are Non- Cumulative Dividends Declared Preferred Common Dividend Preferred Dividend Common Dividend Dividend 2020 $20,500 2021 50,500 2022 55,000 Total b.) What is the journal entry for the year 2021 if the dividends were declared on Dec 10, 2022 and the preferred shares were cumulative? write an general entry for Dec 10, 2022 IF nada)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started