Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AAM3781 2021 Assignments Question 1 (30 marks) Construction Namibia (CN) is a company in the civil engineering industry with headquarters in Windhoek. It undertakes contracts

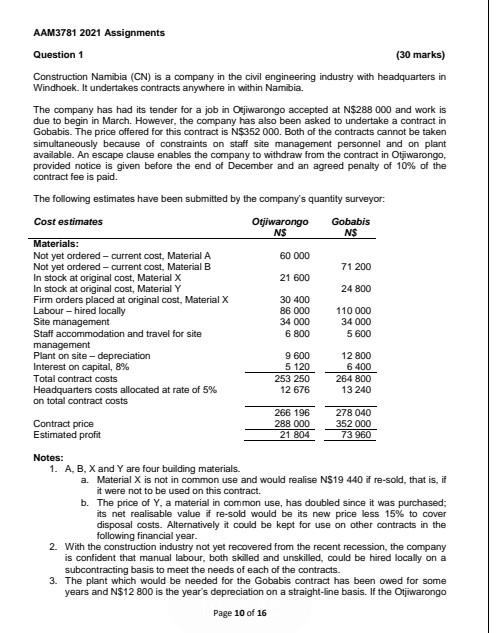

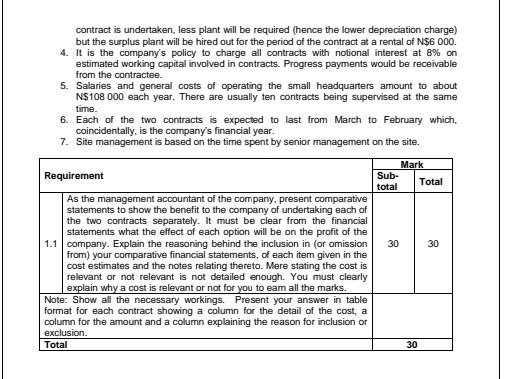

AAM3781 2021 Assignments Question 1 (30 marks) Construction Namibia (CN) is a company in the civil engineering industry with headquarters in Windhoek. It undertakes contracts anywhere in within Namibia. The company has had its tender for a job in Otjiwarongo accepted at N$288 000 and work is due to begin in March. However, the company has also been asked to undertake a contract in Gobabis. The price offered for this contract is N$352 000. Both of the contracts cannot be taken simultaneously because of constraints on staff site management personnel and on plant available. An escape clause enables the company to withdraw from the contract in Otjiwarongo, provided notice is given before the end of December and an agreed penalty of 10% of the contract fee is paid. The following estimates have been submitted by the company's quantity Surveyor. Cost estimates Otjiwarongo Gobabis NS NS Materials: Not yet ordered - current cost, Material A 60 000 Not yet ordered - current cost, Material B 71 200 In stock at original cost, Material X 21 600 In stock at original cost, Material Y 24 800 Firm orders placed at original cost, Material X 30 400 Labour-hired locally 86 000 110 000 Site management 34 000 34 000 Staff accommodation and travel for site 6 800 5 600 management Plant on site-depreciation 9 600 12 800 Interest on capital, 8% 5 120 6400 Total contract costs 253 250 264 800 Headquarters costs allocated at rate of 5% 12 676 13 240 on total contract costs 266 196 278 040 Contract price 288 000 352 000 Estimated profit 21 804 73 960 Notes: 1. A, B, X and Y are four building materials. a. Material X is not in common use and would realise N$19 440 if re-sold, that is, if it were not to be used on this contract. b. The price of Y, a material in common use, has doubled since it was purchased; its net realisable value if re-sold would be its new price less 15% to cover disposal costs. Alternatively it could be kept for use on other contracts in the following financial year. 2. With the construction industry not yet recovered from the recent recession, the company is confident that manual labour, both skilled and unskilled, could be hired locally on a subcontracting basis to meet the needs of each of the contracts. 3. The plant which would be needed for the Gobabis contract has been owed for some years and N$12 800 is the year's depreciation on a straight-line basis. If the Otjiwarongo Page 10 of 16 contract is undertaken, less plant will be required (hence the lower depreciation charge) but the surplus plant will be hired out for the period of the contract at a rental of N$6 000. 4. It is the company's policy to charge all contracts with notional interest at 8% on estimated working capital involved in contracts. Progress payments would be receivable from the contractee. 5. Salaries and general costs of operating the small headquarters amount to about N$108 000 each year. There are usually ten contracts being supervised at the same time. 6. Each of the two contracts is expected to last from March to February which, coincidentally, is the company's financial year. 7. Site management is based on the time spent by senior management on the site. Requirement Mark Sub- total Total 30 30 As the management accountant of the company, present comparative statements to show the benefit to the company of undertaking each of the two contracts separately. It must be clear from the financial statements what the effect of each option will be on the profit of the 1.1 company. Explain the reasoning behind the inclusion in (or omission from) your comparative financial statements, of each item given in the cost estimates and the notes relating thereto. Mere stating the cost is relevant or not relevant is not detailed enough. You must clearly explain why a cost is relevant or not for you to eam all the marks. Note: Show all the necessary workings. Present your answer in table format for each contract showing a column for the detail of the cost, a column for the amount and a column explaining the reason for inclusion or exclusion. Total 30 AAM3781 2021 Assignments Question 1 (30 marks) Construction Namibia (CN) is a company in the civil engineering industry with headquarters in Windhoek. It undertakes contracts anywhere in within Namibia. The company has had its tender for a job in Otjiwarongo accepted at N$288 000 and work is due to begin in March. However, the company has also been asked to undertake a contract in Gobabis. The price offered for this contract is N$352 000. Both of the contracts cannot be taken simultaneously because of constraints on staff site management personnel and on plant available. An escape clause enables the company to withdraw from the contract in Otjiwarongo, provided notice is given before the end of December and an agreed penalty of 10% of the contract fee is paid. The following estimates have been submitted by the company's quantity Surveyor. Cost estimates Otjiwarongo Gobabis NS NS Materials: Not yet ordered - current cost, Material A 60 000 Not yet ordered - current cost, Material B 71 200 In stock at original cost, Material X 21 600 In stock at original cost, Material Y 24 800 Firm orders placed at original cost, Material X 30 400 Labour-hired locally 86 000 110 000 Site management 34 000 34 000 Staff accommodation and travel for site 6 800 5 600 management Plant on site-depreciation 9 600 12 800 Interest on capital, 8% 5 120 6400 Total contract costs 253 250 264 800 Headquarters costs allocated at rate of 5% 12 676 13 240 on total contract costs 266 196 278 040 Contract price 288 000 352 000 Estimated profit 21 804 73 960 Notes: 1. A, B, X and Y are four building materials. a. Material X is not in common use and would realise N$19 440 if re-sold, that is, if it were not to be used on this contract. b. The price of Y, a material in common use, has doubled since it was purchased; its net realisable value if re-sold would be its new price less 15% to cover disposal costs. Alternatively it could be kept for use on other contracts in the following financial year. 2. With the construction industry not yet recovered from the recent recession, the company is confident that manual labour, both skilled and unskilled, could be hired locally on a subcontracting basis to meet the needs of each of the contracts. 3. The plant which would be needed for the Gobabis contract has been owed for some years and N$12 800 is the year's depreciation on a straight-line basis. If the Otjiwarongo Page 10 of 16 contract is undertaken, less plant will be required (hence the lower depreciation charge) but the surplus plant will be hired out for the period of the contract at a rental of N$6 000. 4. It is the company's policy to charge all contracts with notional interest at 8% on estimated working capital involved in contracts. Progress payments would be receivable from the contractee. 5. Salaries and general costs of operating the small headquarters amount to about N$108 000 each year. There are usually ten contracts being supervised at the same time. 6. Each of the two contracts is expected to last from March to February which, coincidentally, is the company's financial year. 7. Site management is based on the time spent by senior management on the site. Requirement Mark Sub- total Total 30 30 As the management accountant of the company, present comparative statements to show the benefit to the company of undertaking each of the two contracts separately. It must be clear from the financial statements what the effect of each option will be on the profit of the 1.1 company. Explain the reasoning behind the inclusion in (or omission from) your comparative financial statements, of each item given in the cost estimates and the notes relating thereto. Mere stating the cost is relevant or not relevant is not detailed enough. You must clearly explain why a cost is relevant or not for you to eam all the marks. Note: Show all the necessary workings. Present your answer in table format for each contract showing a column for the detail of the cost, a column for the amount and a column explaining the reason for inclusion or exclusion. Total 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started