Answered step by step

Verified Expert Solution

Question

1 Approved Answer

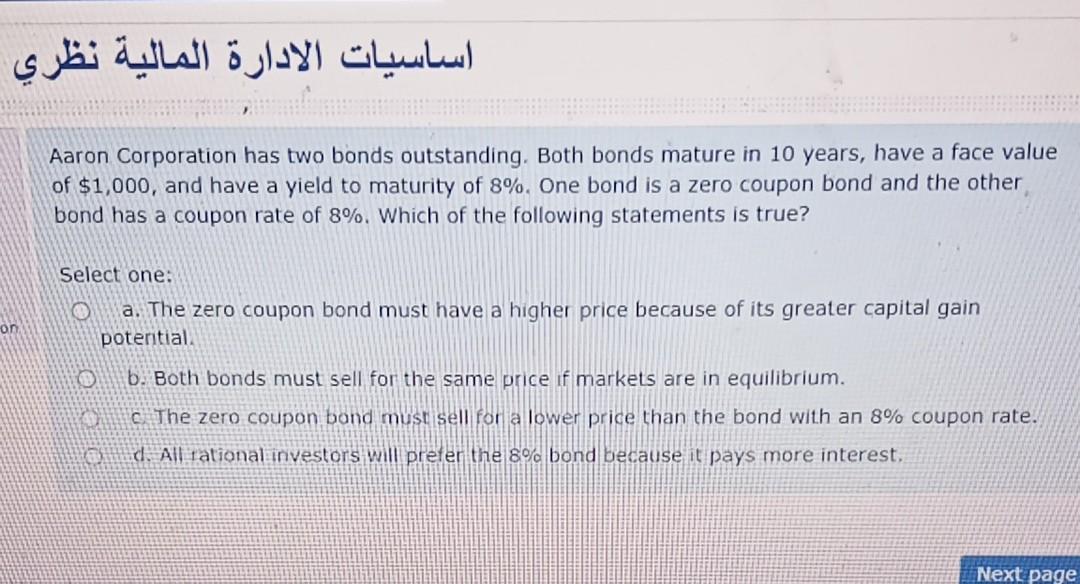

) ) Aaron Corporation has two bonds outstanding. Both bonds mature in 10 years, have a face value of $1,000, and have a yield to

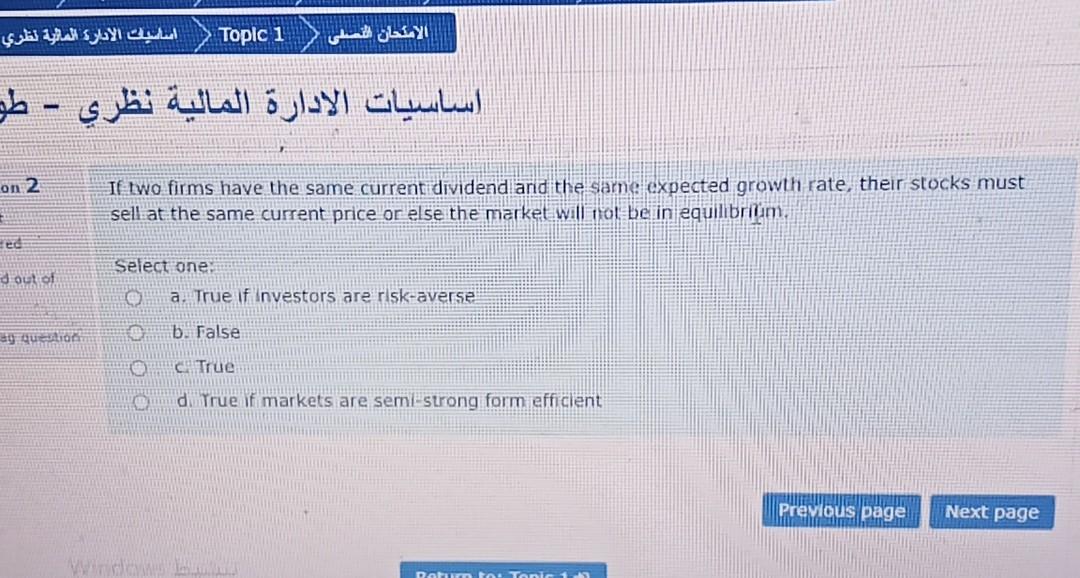

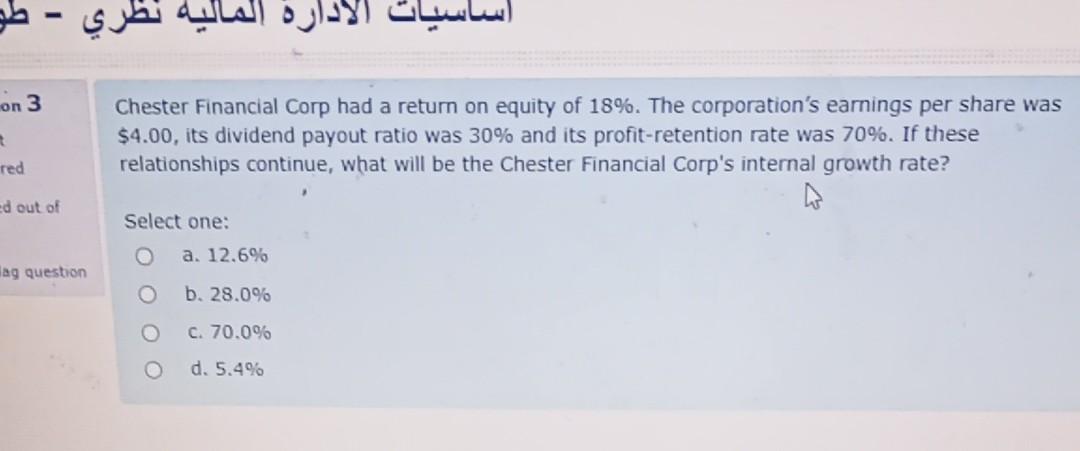

) ) Aaron Corporation has two bonds outstanding. Both bonds mature in 10 years, have a face value of $1,000, and have a yield to maturity of 8%. One bond is a zero coupon bond and the other bond has a coupon rate of 8%. Which of the following statements is true? Select one: on a. The zero coupon bond must have a higher price because of its greater capital gain poteritial. b. Both bonds must sell for the same price if markets are in equilibrium. c. The zero coupon bond must sell for a lower price than the bond with an 8% coupon rate. d. All rational investors will prefer the 8% bond because it pays more interest, Next page Topic 1 - on 2 If two firms have the same current dividend and the same expected growth rate, their stocks must sell at the same current price or else the market will not be in equilibrium. ed out of Select one a. True if Investors are risk-averse 1 b. False True di True if markets are semi-strong form efficient Previous page Next page Dato Tante - on 3 Chester Financial Corp had a return on equity of 18%. The corporation's earnings per share was $4.00, its dividend payout ratio was 30% and its profit-retention rate was 70%. If these relationships continue, what will be the Chester Financial Corp's internal growth rate? red ed out of Select one: a 12.69 lag question O b. 28.09 C 70.05 O d, 5.4 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started