Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aaron formed Laff Company and Associates, a consulting firm, in 1983. During the 80's, he admitted Beth, Connie, Diane and Eva as partners (via

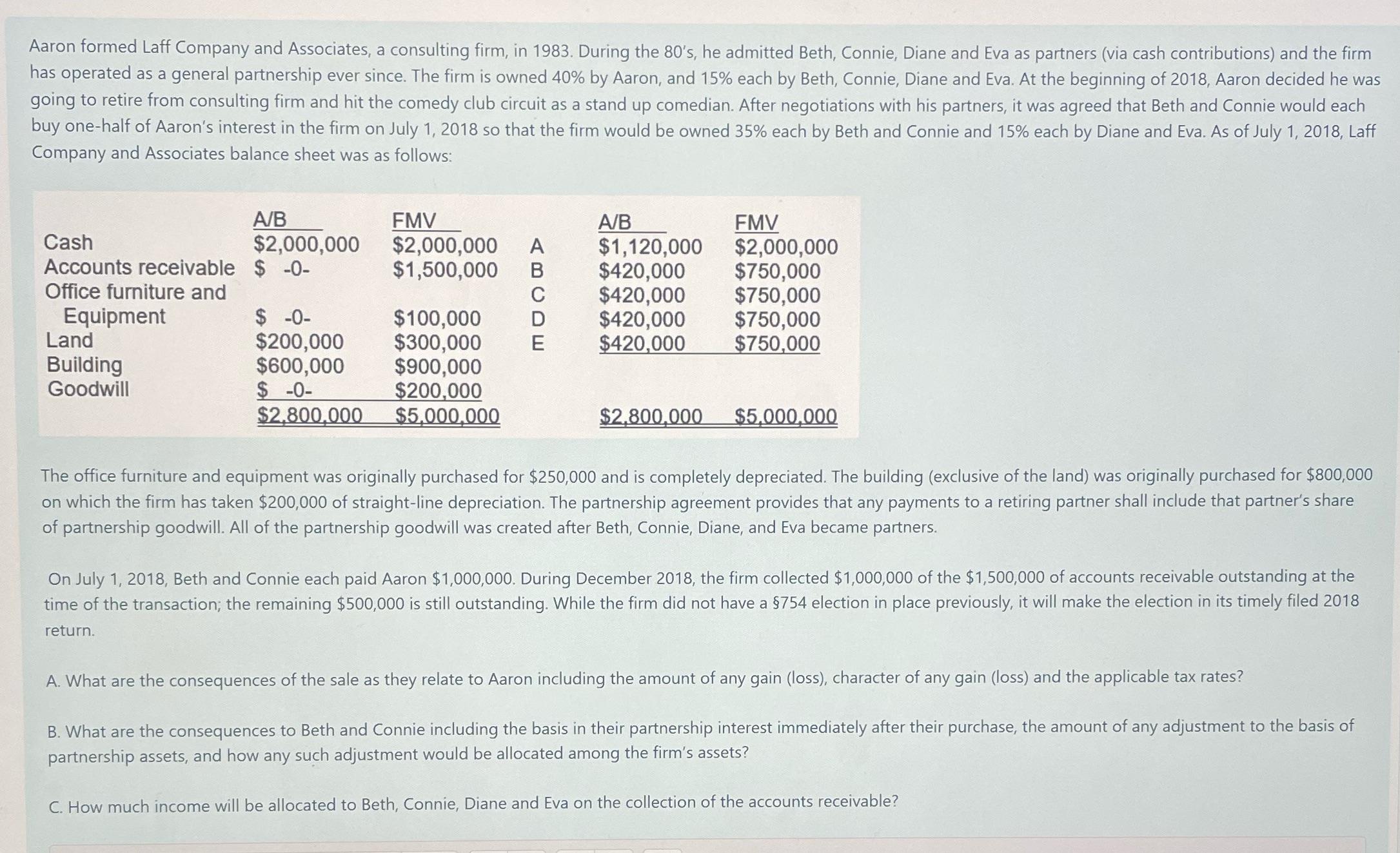

Aaron formed Laff Company and Associates, a consulting firm, in 1983. During the 80's, he admitted Beth, Connie, Diane and Eva as partners (via cash contributions) and the firm has operated as a general partnership ever since. The firm is owned 40% by Aaron, and 15% each by Beth, Connie, Diane and Eva. At the beginning of 2018, Aaron decided he was going to retire from consulting firm and hit the comedy club circuit as a stand up comedian. After negotiations with his partners, it was agreed that Beth and Connie would each buy one-half of Aaron's interest in the firm on July 1, 2018 so that the firm would be owned 35% each by Beth and Connie and 15% each by Diane and Eva. As of July 1, 2018, Laff Company and Associates balance sheet was as follows: Cash Accounts receivable Office furniture and Equipment Land Building Goodwill A/B $2,000,000 $ -0- $ -0- $200,000 $600,000 $-0- $2,800,000 FMV $2,000,000 A $1,500,000 B C $100,000 $300,000 $900,000 $200,000 $5,000,000 A/B $1,120,000 $420,000 $420,000 $420,000 E $420,000 $2,800,000 FMV $2,000,000 $750,000 $750,000 $750,000 $750,000 $5,000,000 The office furniture and equipment was originally purchased for $250,000 and is completely depreciated. The building (exclusive of the land) was originally purchased for $800,000 on which the firm has taken $200,000 of straight-line depreciation. The partnership agreement provides that any payments to a retiring partner shall include that partner's share of partnership goodwill. All of the partnership goodwill was created after Beth, Connie, Diane, and Eva became partners. On July 1, 2018, Beth and Connie each paid Aaron $1,000,000. During December 2018, the firm collected $1,000,000 of the $1,500,000 of accounts receivable outstanding at the time of the transaction; the remaining $500,000 is still outstanding. While the firm did not have a 754 election in place previously, it will make the election in its timely filed 2018 return. A. What are the consequences of the sale as they relate to Aaron including the amount of any gain (loss), character of any gain (loss) and the applicable tax rates? B. What are the consequences to Beth and Connie including the basis in their partnership interest immediately after their purchase, the amount of any adjustment to the basis of partnership assets, and how any such adjustment would be allocated among the firm's assets? C. How much income will be allocated to Beth, Connie, Diane and Eva on the collection of the accounts receivable?

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

A Consequences to Aaron 1 Amount of Gain The gain on the sale of Aarons partnership interest is the difference between the amount received and Aarons ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started