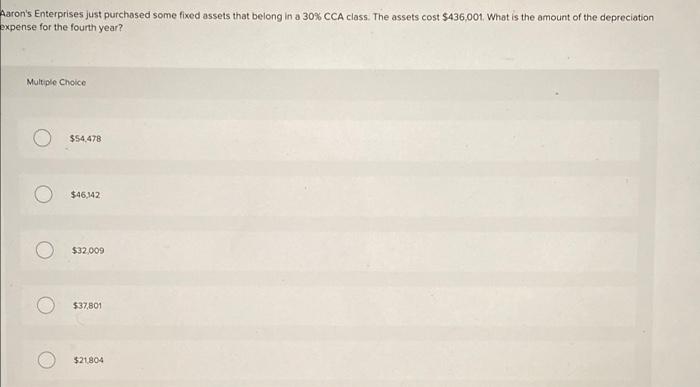

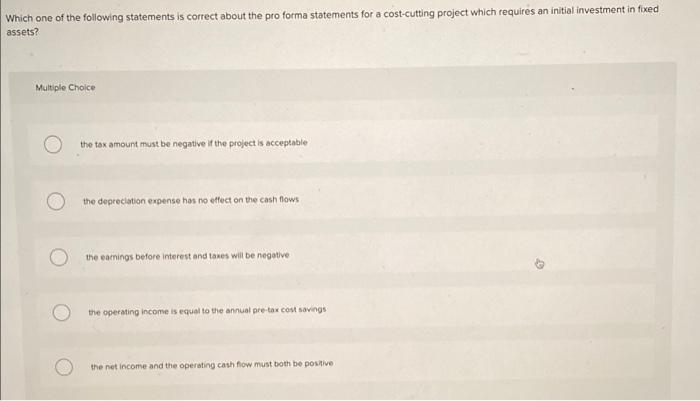

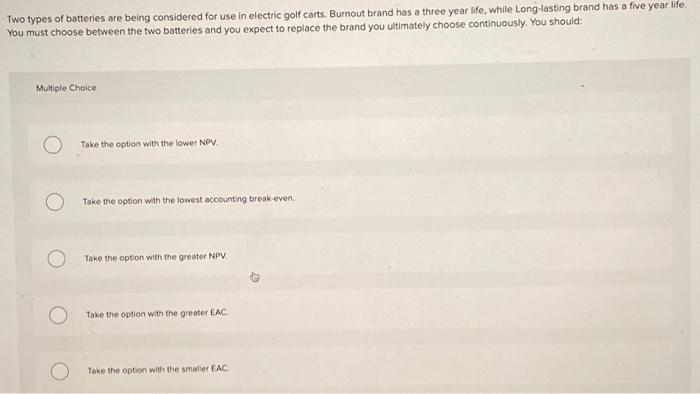

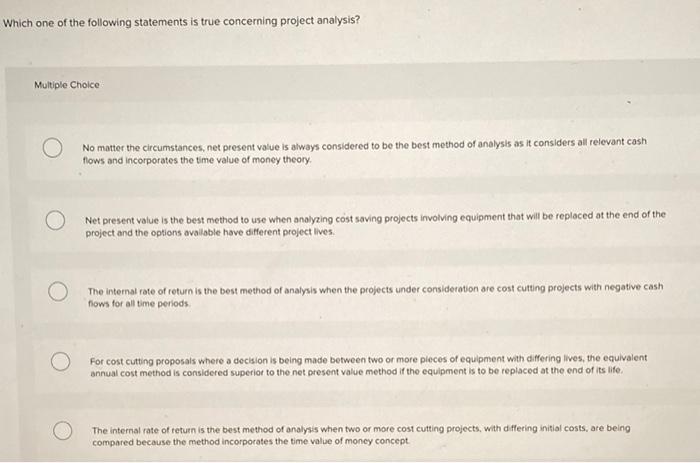

Aaron's Enterprises just purchased some fixed assets that belong in a 30% CCA class. The assets cost $436,001 What is the amount of the depreciation expense for the fourth year? Multiple Choice $54.478 $46.142 o $32.009 $37,801 $21804 Which one of the following statements is correct about the pro forma statements for a cost-cutting project which requires an initial investment in fixed assets? Multiple Choice the tax amount must be negative if the project is acceptable the depreciation expense has no effect on the cash flows the earnings before interest and taxes will be negative the operating income is equal to the annual pre-tax cost savings the net income and the operating cash flow must both be positive Two types of batteries are being considered for use in electric golf carts. Burnout brand has a three year life, while Long-lasting brand has a five year life You must choose between the two batteries and you expect to replace the brand you ultimately choose continuously. You should Multiple Choice Take the option with the lower NPV. Take the option with the lowest accounting break-even. Take the option with the greater NPV. Take the option with the greater EAC o Take the option with the smaller EAC Which one of the following statements is true concerning project analysis? Multiple Choice No matter the circumstances, net present value is always considered to be the best method of analysis as it considers all relevant cash flows and incorporates the time value of money theory Net present value is the best method to use when analyzing cost saving projects involving equipment that will be replaced ot the end of the project and the options available have different project lives. The internal rate of return is the best method of analysis when the projects under consideration are cost cutting projects with negative cash flows for all time periods a For cost cutting proposals where a decision is being made between two or more pleces of equipment with differing lives, the equivalent annual cost method is considered superior to the net present value method if the equipment is to be replaced at the end of its life The internal rate of return is the best method of analysis when two or more cost cutting projects, with differing initial costs, are being compared because the method incorporates the time value of money concept