Answered step by step

Verified Expert Solution

Question

1 Approved Answer

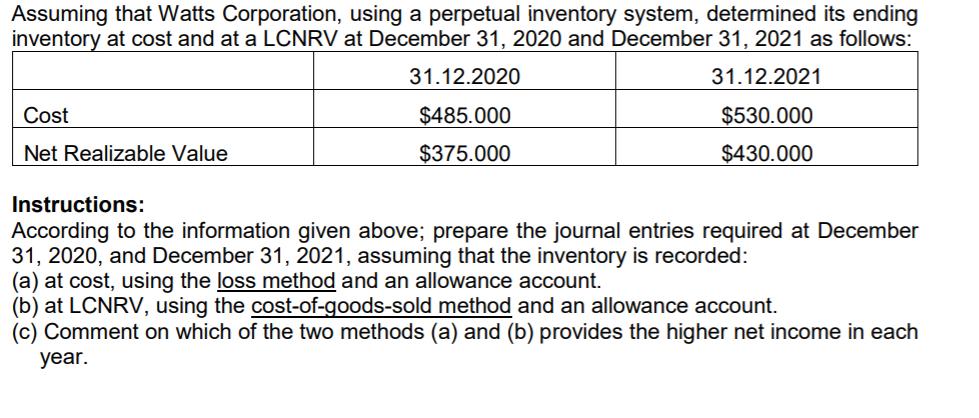

Assuming that Watts Corporation, using a perpetual inventory system, determined its ending inventory at cost and at a LCNRV at December 31, 2020 and

Assuming that Watts Corporation, using a perpetual inventory system, determined its ending inventory at cost and at a LCNRV at December 31, 2020 and December 31, 2021 as follows: 31.12.2021 $530.000 $430.000 Cost Net Realizable Value 31.12.2020 $485.000 $375.000 Instructions: According to the information given above; prepare the journal entries required at December 31, 2020, and December 31, 2021, assuming that the inventory is recorded: (a) at cost, using the loss method and an allowance account. (b) at LCNRV, using the cost-of-goods-sold method and an allowance account. (c) Comment on which of the two methods (a) and (b) provides the higher net income in each year.

Step by Step Solution

★★★★★

3.26 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 2 3 4 5 100032239959982 11 14 16 17 Solution a Loss method prepetual i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started