Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AB Builders, Incorporated, has 11year bonds outstanding with a par value of $2,000 and a quoted price of 93.852 . The bonds pay interest semiannually

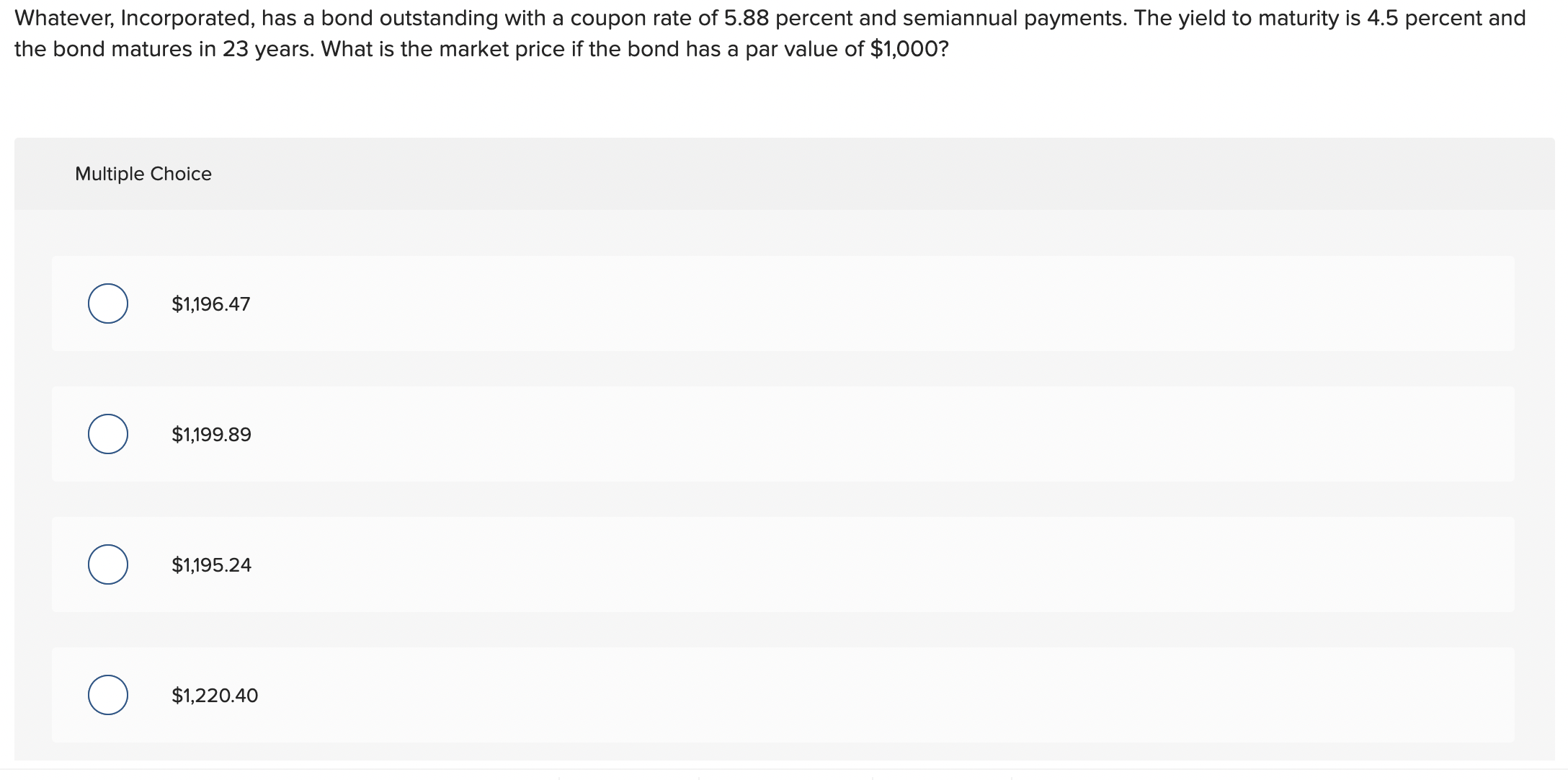

AB Builders, Incorporated, has 11year bonds outstanding with a par value of $2,000 and a quoted price of 93.852 . The bonds pay interest semiannually and have a yield to maturity of 6.41 percent. What is the coupon rate? Crossfade Corporation has a bond with a par value of $2,000 that sells for $1,902.14. The bond has a coupon rate of 6.48 percent and matures in 12 years. If the bond makes semiannual coupon payments, what is the YTM of the bond? There is a zero coupon bond that sells for $437.81 and has a par value of $1,000. If the bond has 12 years to maturity, what is the yield to maturity? Assume semiannual compounding. A stock is expected to maintain a constant dividend growth rate of 4.4 percent indefinitely. If the stock has a dividend yield of 5.7 percent, what is the required return on the stock? The Red Bud Company pays a constant dividend of $2.10 a share. The company announced today that it will continue to do this for another 2 years after which time they will discontinue paying dividends permanently. What is one share of this stock worth today if the required rate of return is 7.7 percent? New Gadgets, Incorporated, currently pays no dividend but is expected to pay its first annual dividend of $5.00 per share exactly 9 years from today. After that, the dividends are expected to grow at 3.7 percent forever. If the required return is 11.5 percent, what is the price of the stock today? Kindzi Company has preferred stock outstanding that is expected to pay an annual dividend of $4.88 every year in perpetuity. If the required return is 4.69 percent, what is the current stock price? Michael's, Incorporated, just paid $2.20 to its shareholders as the annual dividend. Simultaneously, the company announced that future dividends will be increasing by 4.8 percent. If you require a rate of return of 9 percent, how much are you willing to pay today to purchase one share of the company's stock? Kasey Corporation has a bond outstanding with a coupon rate of 5.75 percent and semiannual payments. The bond has a yield to maturity of 4.7 percent, a par value of $2,000, and matures in 22 years. What is the quoted price of the bond? Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a $14 per share dividend 10 years from today and will increase the dividend by 3.9 percent per year thereafter. If the required return on this stock is 12.5 percent, what is the current share price? A Japanese company has a bond outstanding that sells for 91.53 percent of its 100,000 par value. The bond has a coupon rate of 3.4 percent paid annually and matures in 16 years. What is the yield to maturity of this bond? Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. The bond market requires a return of 6.2 percent on the 15 -year bonds issued by Mingwei Manufacturing. The 6.2 percent is referred to as the: Footsteps Company has a bond outstanding with a coupon rate of 5.3 percent and annual payments. The bond currently sells for $1,008.47, matures in 17 years, and has a par value of $1,000. What is the YTM of the bond? Asonia Company will pay a dividend of $5.10,$9.20,$12.05, and $13.80 per share for each of the next four years, respectively. The company will then close its doors. If investors require a return of 9.4 percent on the company's stock, what is the stock price? Red Sun Rising just paid a dividend of $2.16 per share. The company said that it will increase the dividend by 30 percent and 25 percent over the next two years, respectively. After that, the company is expected to increase its annual dividend at 3.6 percent. If the required return is 10.6 percent, what is the stock price today? Whatever, Incorporated, has a bond outstanding with a coupon rate of 5.88 percent and semiannual payments. The yield to maturity is 4.5 percent and the bond matures in 23 years. What is the market price if the bond has a par value of $1,000 ? Multiple Choice $1,196.47 $1,199.89 $1,195.24 $1,220.40

AB Builders, Incorporated, has 11year bonds outstanding with a par value of $2,000 and a quoted price of 93.852 . The bonds pay interest semiannually and have a yield to maturity of 6.41 percent. What is the coupon rate? Crossfade Corporation has a bond with a par value of $2,000 that sells for $1,902.14. The bond has a coupon rate of 6.48 percent and matures in 12 years. If the bond makes semiannual coupon payments, what is the YTM of the bond? There is a zero coupon bond that sells for $437.81 and has a par value of $1,000. If the bond has 12 years to maturity, what is the yield to maturity? Assume semiannual compounding. A stock is expected to maintain a constant dividend growth rate of 4.4 percent indefinitely. If the stock has a dividend yield of 5.7 percent, what is the required return on the stock? The Red Bud Company pays a constant dividend of $2.10 a share. The company announced today that it will continue to do this for another 2 years after which time they will discontinue paying dividends permanently. What is one share of this stock worth today if the required rate of return is 7.7 percent? New Gadgets, Incorporated, currently pays no dividend but is expected to pay its first annual dividend of $5.00 per share exactly 9 years from today. After that, the dividends are expected to grow at 3.7 percent forever. If the required return is 11.5 percent, what is the price of the stock today? Kindzi Company has preferred stock outstanding that is expected to pay an annual dividend of $4.88 every year in perpetuity. If the required return is 4.69 percent, what is the current stock price? Michael's, Incorporated, just paid $2.20 to its shareholders as the annual dividend. Simultaneously, the company announced that future dividends will be increasing by 4.8 percent. If you require a rate of return of 9 percent, how much are you willing to pay today to purchase one share of the company's stock? Kasey Corporation has a bond outstanding with a coupon rate of 5.75 percent and semiannual payments. The bond has a yield to maturity of 4.7 percent, a par value of $2,000, and matures in 22 years. What is the quoted price of the bond? Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a $14 per share dividend 10 years from today and will increase the dividend by 3.9 percent per year thereafter. If the required return on this stock is 12.5 percent, what is the current share price? A Japanese company has a bond outstanding that sells for 91.53 percent of its 100,000 par value. The bond has a coupon rate of 3.4 percent paid annually and matures in 16 years. What is the yield to maturity of this bond? Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. The bond market requires a return of 6.2 percent on the 15 -year bonds issued by Mingwei Manufacturing. The 6.2 percent is referred to as the: Footsteps Company has a bond outstanding with a coupon rate of 5.3 percent and annual payments. The bond currently sells for $1,008.47, matures in 17 years, and has a par value of $1,000. What is the YTM of the bond? Asonia Company will pay a dividend of $5.10,$9.20,$12.05, and $13.80 per share for each of the next four years, respectively. The company will then close its doors. If investors require a return of 9.4 percent on the company's stock, what is the stock price? Red Sun Rising just paid a dividend of $2.16 per share. The company said that it will increase the dividend by 30 percent and 25 percent over the next two years, respectively. After that, the company is expected to increase its annual dividend at 3.6 percent. If the required return is 10.6 percent, what is the stock price today? Whatever, Incorporated, has a bond outstanding with a coupon rate of 5.88 percent and semiannual payments. The yield to maturity is 4.5 percent and the bond matures in 23 years. What is the market price if the bond has a par value of $1,000 ? Multiple Choice $1,196.47 $1,199.89 $1,195.24 $1,220.40 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started