Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ab ck 5) You are a speculator and believe the price of jet fuel will fall. You would most likely buy: a) A cash settled

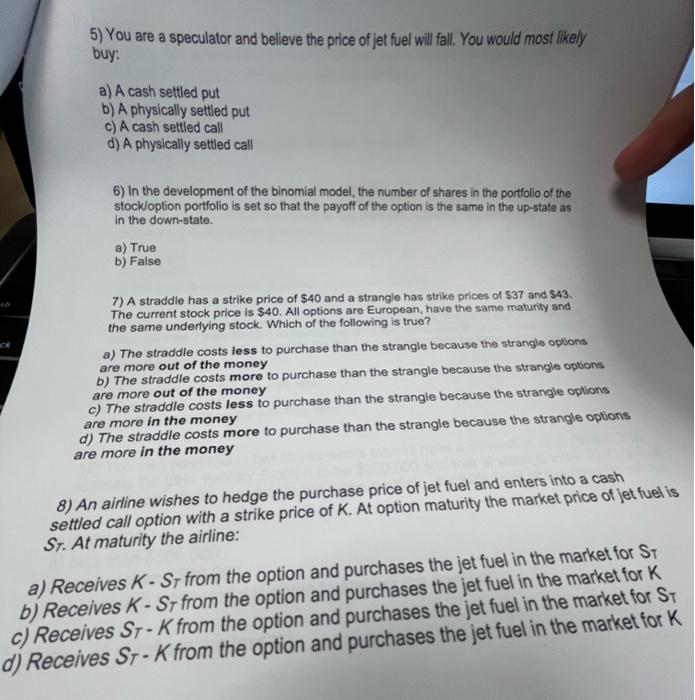

ab ck 5) You are a speculator and believe the price of jet fuel will fall. You would most likely buy: a) A cash settled put b) A physically settled put c) A cash settled call d) A physically settled call

6) In the development of the binomial model, the number of shares in the portfolio of the stock/option portfolio is set so that the payoff of the option is the same in the up-state as in the down-state. a) True b) False

7) A straddle has a strike price of $40 and a strangle has strike prices of $37 and $43. The current stock price is $40. All options are European, have the same maturity and the same underlying stock. Which of the following is true? a) The straddle costs less to purchase than the strangle because the strangle options are more out of the money b) The straddle costs more to purchase than the strangle because the strangle options are more out of the money c) The straddle costs less to purchase than the strangle because the strangle options are more in the money d) The straddle costs more to purchase than the strangle because the strangle options are more in the money

8) An airline wishes to hedge the purchase price of jet fuel and enters into a cash settled call option with a strike price of K. At option maturity the market price of jet fuel is ST. At maturity the airline: a) Receives K-ST from the option and purchases the jet fuel in the market for ST b) Receives K-ST from the option and purchases the jet fuel in the market for K c) Receives ST-K from the option and purchases the jet fuel in the market for ST d) Receives ST-K from the option and purchases the jet fuel in the market for K

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started