Answered step by step

Verified Expert Solution

Question

1 Approved Answer

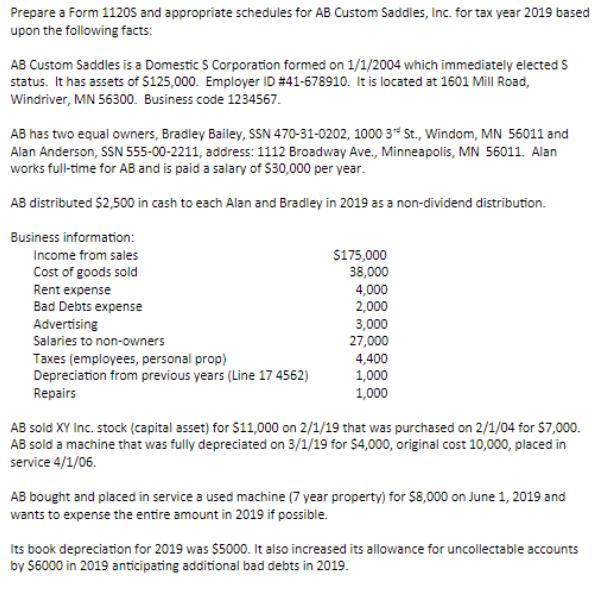

Prepare a Form 1120S and appropriate schedules for AB Custom Saddles, Inc. for tax year 2019 based upon the following facts: AB Custom Saddles

Prepare a Form 1120S and appropriate schedules for AB Custom Saddles, Inc. for tax year 2019 based upon the following facts: AB Custom Saddles is a Domestic S Corporation formed on 1/1/2004 which immediately elected S status. It has assets of $125,000. Employer ID # 41-678910. It is located at 1601 Mill Road, Windriver, MN 56300. Business code 1234567. AB has two equal owners, Bradley Bailey, SSN 470-31-0202, 1000 3* St., Windom, MN 56011 and Alan Anderson, SSN 555-00-2211, address: 1112 Broadway Ave., Minneapolis, MN 56011. Alan works full-time for AB and is paid a salary of 530,000 per year. AB distributed $2,500 in cash to each Alan and Bradley in 2019 as a non-dividend distribution. Business information: $175,000 38,000 4,000 2,000 3,000 27,000 4,400 1,000 1,000 Income from sales Cost of goods sold Rent expense Bad Debts expense Advertising Salaries to non-owners Taxes (employees, personal prop) Depreciation from previous years (Line 17 4562) Repairs AB sold XY Inc. stock (capital asset) for S11,000 on 2/1/19 that was purchased on 2/1/04 for $7,000. AB sold a machine that was fully depreciated on 3/1/19 for $4,000, original cost 10,000, placed in service 4/1/06. AB bought and placed in service a used machine (7 year property) for $8,000 on June 1, 2019 and wants to expense the entire amount in 2019 if possible. Its book depreciation for 2019 was $5000. It also increased its allowance for uncollectable accounts by $6000 in 2019 anticipating additional bad debts in 2019.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution given data prepare a fprm 1120 S and appropriale ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started