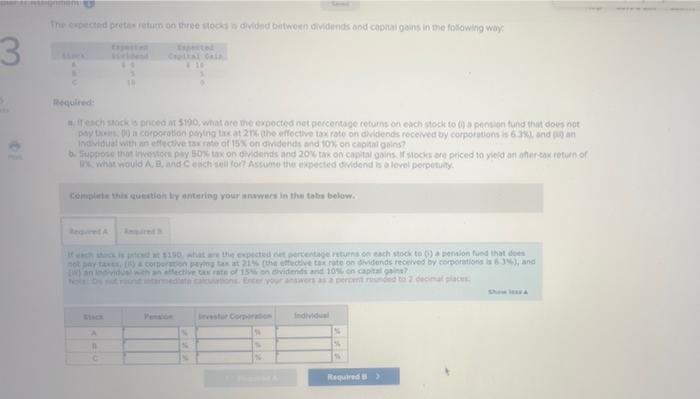

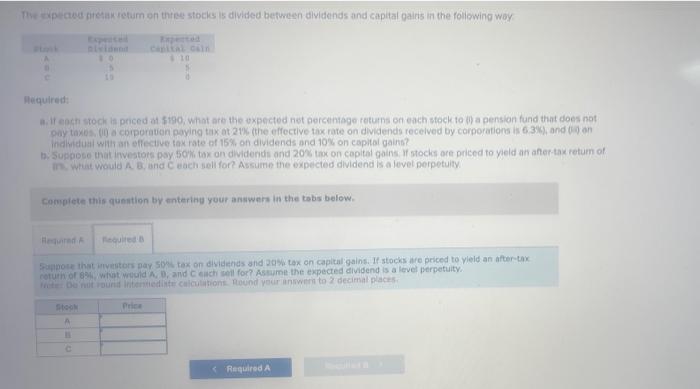

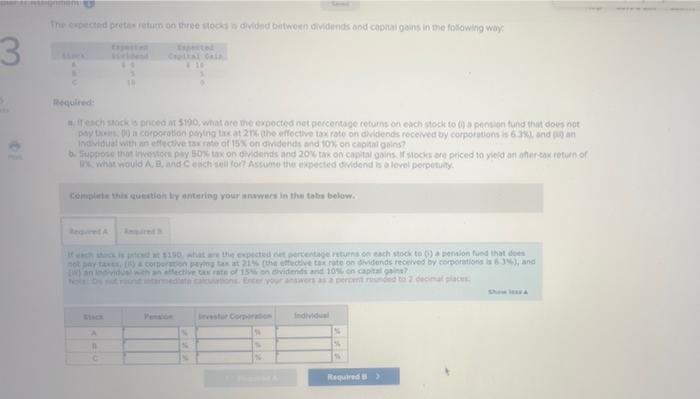

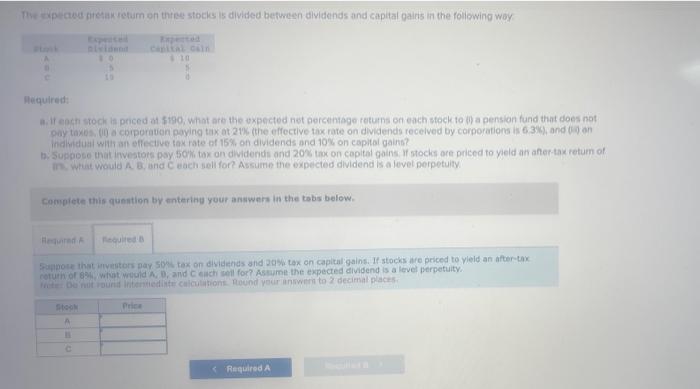

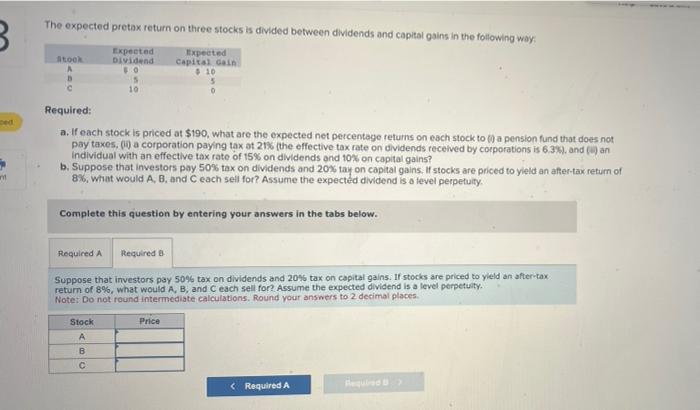

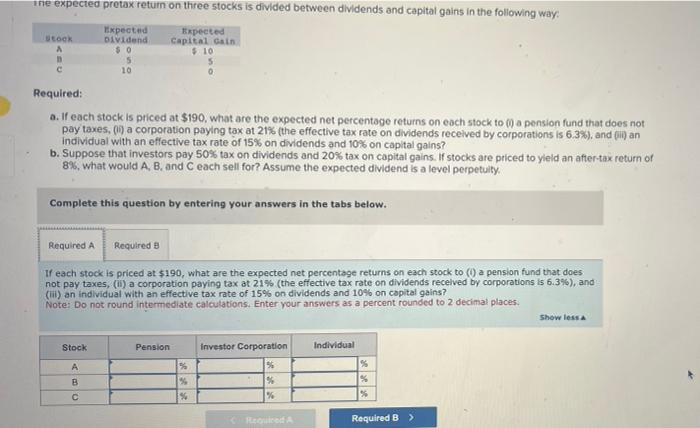

3 The expected pretas return on three stocks is divided between dividends and capital gains in the following way Expected Capital Gain 44 3 18 9 Required: If each stock is priced at $190, what are the expected net percentage returns on each stock to () a pension fund that does not pay taxis ) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and i an individual with an effective tax rate of 15% on dividends and 10% on capital gains? b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of Dx, what would A, B. and C each sell for? Assume the expected dividend is a level perpetuity. Complete this question by entering your answers in the tabs below. Required A If each stock is priced at $190, what are the expected net percentage returns on each stock to () a pension fund that does not pay taxes, [)a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and [R) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? Not: Os tround intermediate calouations. Enter your answers as a percent rounded to 2 decimal places Individual 56 B N % C Required > *** IN The expected pretax return on three stocks is divided between dividends and capital gains in the following way pividend capital cain $10 A 5 Required: a. If each stock is priced at $190, what are the expected net percentage returns on each stock to () a pension fund that does not pay taxes, (l) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (i) an Individual with an effective tax rate of 15% on dividends and 10% on capital gains? b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax retum of in what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity Complete this question by entering your answers in the tabs below. Required B Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity.. Note: Do not round Intermediate calculations. Round your answers to 2 decimal places. Price Stook A B Show less A