Answered step by step

Verified Expert Solution

Question

1 Approved Answer

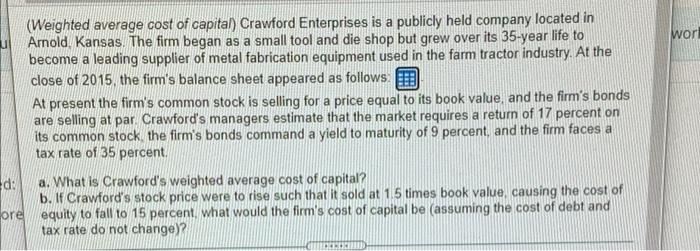

a+b pls wor (Weighted average cost of capital) Crawford Enterprises is a publicly held company located in Arnold Kansas. The firm began as a small

a+b pls

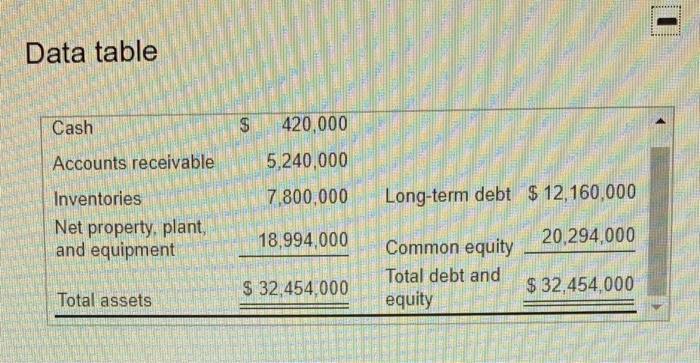

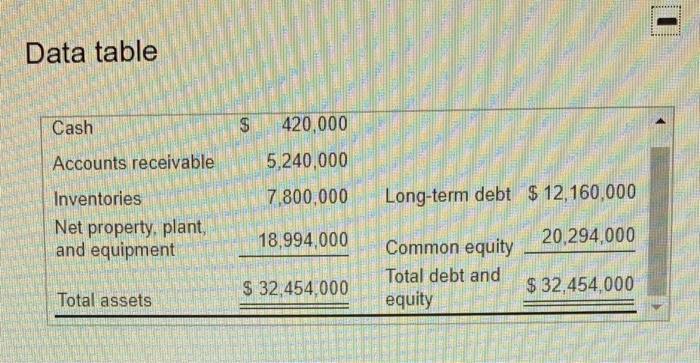

wor (Weighted average cost of capital) Crawford Enterprises is a publicly held company located in Arnold Kansas. The firm began as a small tool and die shop but grew over its 35-year life to become a leading supplier of metal fabrication equipment used in the farm tractor industry. At the close of 2015, the firm's balance sheet appeared as follows: At present the firm's common stock is selling for a price equal to its book value, and the firm's bonds are selling at par Crawford's managers estimate that the market requires a return of 17 percent on its common stock the firm's bonds command a yield to maturity of 9 percent and the firm faces a tax rate of 35 percent. d: a. What is Crawford's weighted average cost of capital? b. If Crawford's stock price were to rise such that it sold at 1.5 times book value, causing the cost of ore equity to fall to 15 percent what would the firm's cost of capital be (assuming the cost of debt and tax rate do not change)? DRO Data table Cash $ 420,000 Accounts receivable 5,240,000 7.800.000 Long-term debt $ 12,160,000 Inventories Net property, plant, and equipment 18,994,000 20,294,000 Common equity Total debt and equity $ 32,454,000 $ 32,454,000 Total assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started