Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABA RYM BGP HLG portfolio analysis NZX website and YAHOO Finance website is helpful to this question. www.nzx.com https://finance.yahoo.com/quote/%5ENZ50/history?p=%5ENZ50 QUESTION 3 PORTFOLIO ANALYSIS Suppose you

ABA RYM BGP HLG portfolio analysis

NZX website and YAHOO Finance website is helpful to this question.

www.nzx.com

https://finance.yahoo.com/quote/%5ENZ50/history?p=%5ENZ50

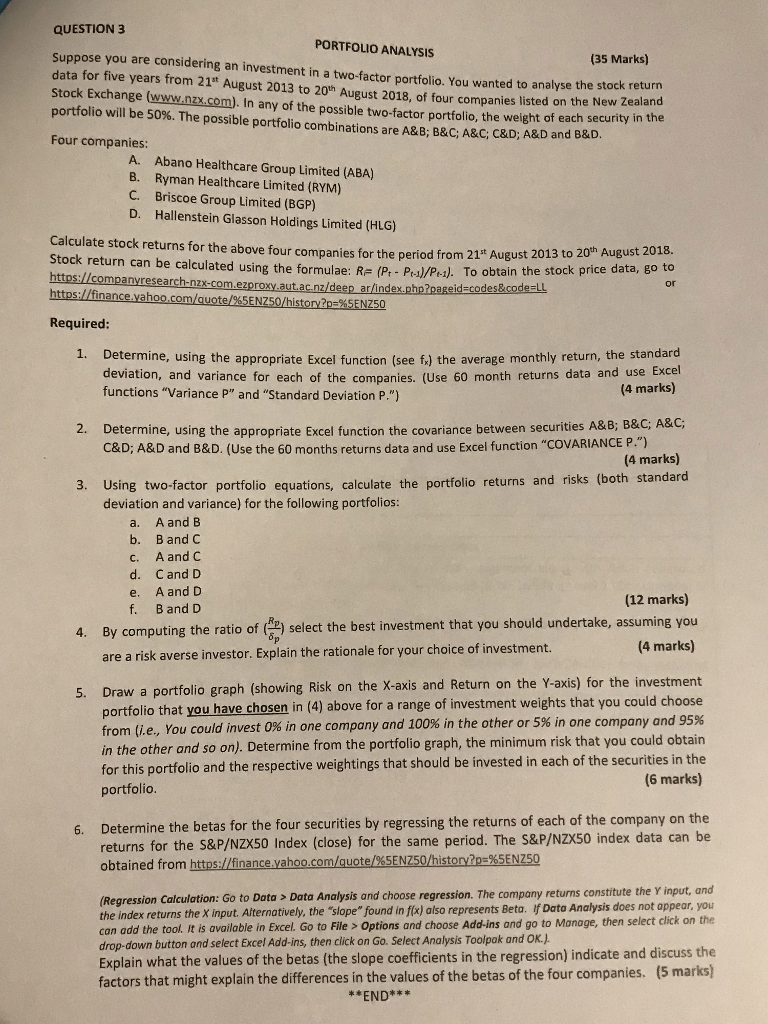

QUESTION 3 PORTFOLIO ANALYSIS Suppose you are considering an investment in a two-factor portfolio. You wanted to analyse the stock return data for five years from 21t August 2013 to 20th August 2018, of four companies listed on the New Zealand Stock Exchange (www.nzx.com). In any of the possible two-factor portfolio, the weight of each security in the portfolio will be 50%. The possible portfolio combinations are A&B, B&CA&C, C&D; A&D and B&D, Four companies: (35 Marks) A. Abano Healthcare Group Limited (ABA) B. Ryman Healthcare Limited (RYM) C. Briscoe Group Limited (BGP) D. Hallenstein Glasson Holdings Limited (HLG) Calculate stock ret Stock return can be calculated using the formulae: R (P- Pa)/Pe). urns for the above four companies for the period from 21 August 2013 to 20th August 2018. To obtain the stock price data, go to or Required 1. Determine, using the appropriate Excel function (see f,) the average monthly return, the standar Excel deviation, and variance for each of the companies. (Use 60 month returns data and use functions "Variance P" and "Standard Deviation P.") (4 marks) C; A&C 4 marks Determine, using the appropriate Excel function the covariance between securities A&B; B& C&D; A&D and B&D. (Use the 60 months returns data and use Excel function "COVARIANCE P.") 2. 3. Using two-factor portfolio equations, calculate the portfolio returns and risks (both standard deviation and variance) for the following portfolios C. d. Cand D (12 marks) ratio of (2) select the best investment that you should undertake, assuming you 4 marks) 4. By computing the are a risk averse investor. Explain the rationale for your choice of investment. a portfolio graph (showing Risk on the X-axis and Return on the Y-axis) for the investment You could invest 0% in one company and 100% in the other or 5% in one company and 95% be invested in each of the securities in the 5. Draw portfolio that you have chosen in (4) above for a range of investment weights that you could choose from (i.e., in the other and so on). Determine from the portfolio graph, the minimum risk that you could obtain for this portfolio and the respective weightings that should portfolio (6 marks) etermine the betas for the four securities by regressing the returns of each of the company on the returns for the S&P/NZX50 Index (close) for the same period. The S&P/NZX50 index data can be obtained from https://finance.yahoo.com/guote/%5ENZ50/history?p2%5ENZ50 ssion Calculation: Go to Data > Data Analysis and choose regression. The company returns constitute the Y input, and Regres the index returns the X input. Alternatively, the "slope" found in fix) also represents Beta. if Dato Analysis does not appear can add the toof. It is available in Excel. Go to File > Options and choose Add-ins and go to Manage, then select click on the drop-down button and select Excel Add-ins, then click on Go. Select Analysis Toolpak and OK.J Explain what the values of the betas (the slope coefficients in the regression) indicate and discuss the factors that might explain the differences in the values of the betas of the four companies. (5 mark **END***Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started