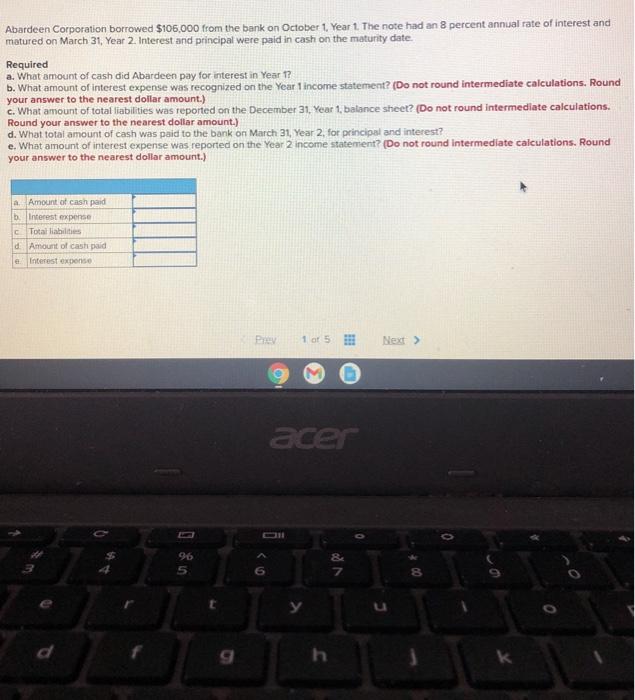

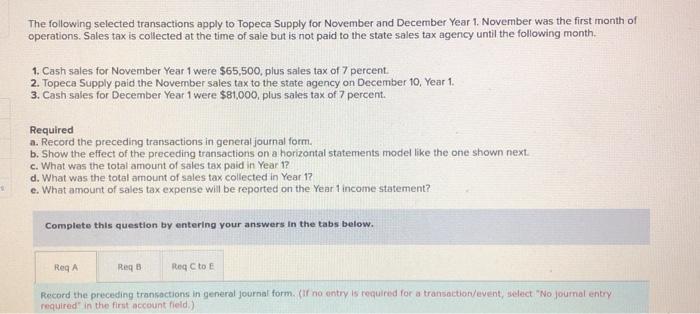

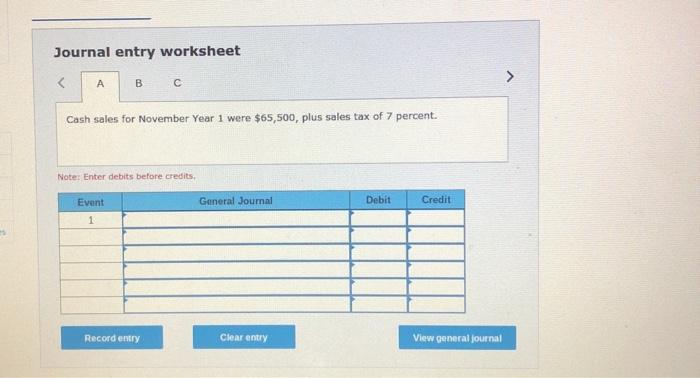

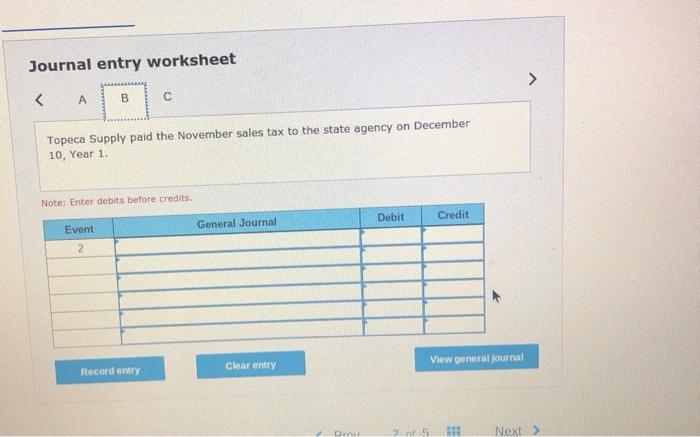

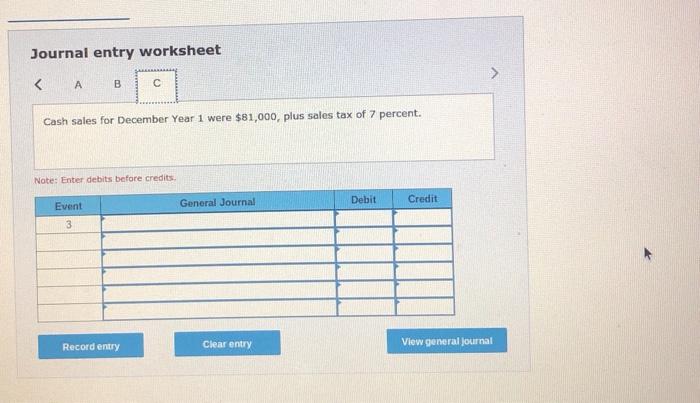

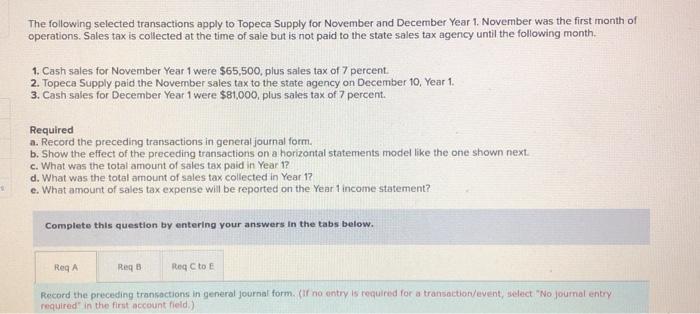

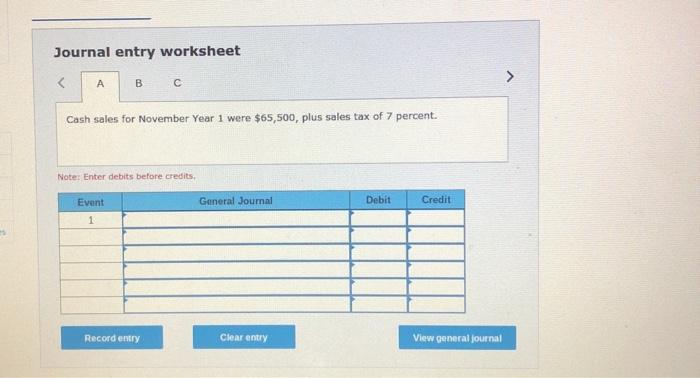

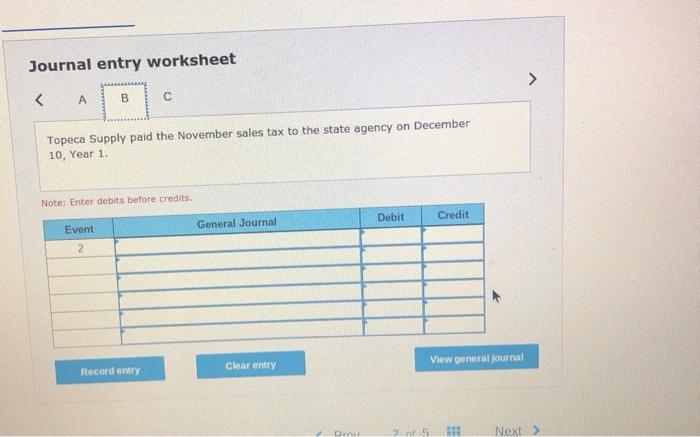

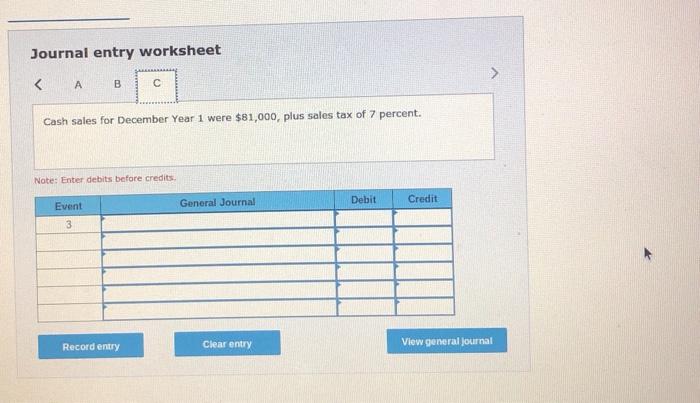

Abardeen Corporation borrowed $106.000 from the bank on October 1, Year 1. The note had an 8 percent annual rate of interest and matured on March 31, Year 2. Interest and principal were paid in cash on the maturity date. Required a. What amount of cash did Abardeen pay for interest in Year ? b. What amount of interest expense was recognized on the Year 1 income statement? (Do not round intermediate calculations, Round c. What amount of total liabilities was reported on the December 31, Year 1, balance sheet? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) d. What total amount of cash was paid to the bank on March 31, Year 2, for principal and interest? e. What amount of interest expense was reported on the Year 2 income statement? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) a Amount of cash paid b. Interest expense Total liabilities d Amount of cast paid e Interest expense PV 1 of 5 Next > acer 96 5 7 o The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,500, plus sales tax of 7 percent 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $81.000, plus sales tax of 7 percent. Required a. Record the preceding transactions in general journal form. b. Show the effect of the preceding transactions on a horizontal statements model like the one shown next. c. What was the total amount of sales tax paid in Year 1? d. What was the total amount of sales tax collected in Year 17 e. What amount of sales tax expense will be reported on the Year 1 income statement? Complete this question by entering your answers in the tabs below. Reg Reg B Recto Record the preceding transactions in general Journal form. (ir no entry is required for a transaction/event, select "No journal entry required in the first account field) Journal entry worksheet B Cash sales for November Year 1 were $65,500, plus sales tax of 7 percent. Note: Enter debits before credits Event General Journal Debit Credit 1 Record entry Clear entry View general journal Journal entry worksheet