Answered step by step

Verified Expert Solution

Question

1 Approved Answer

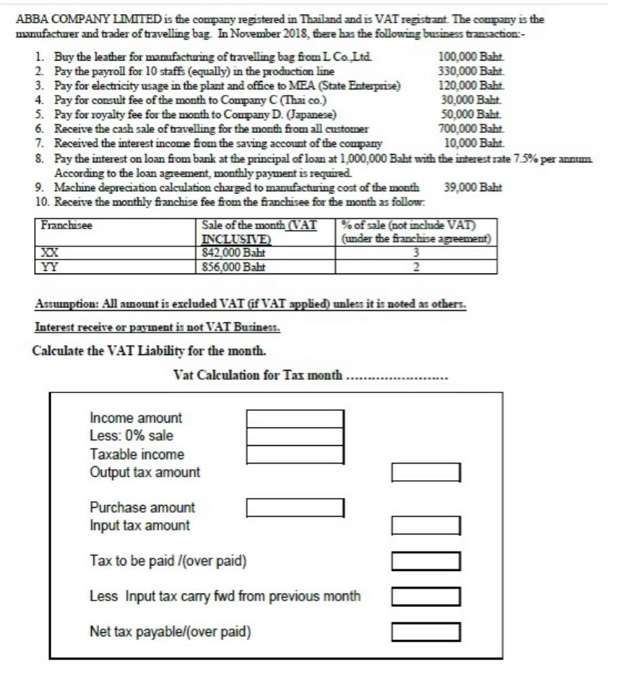

ABBA COMPANY LIMITED is the company registered in Thailand and is VAT registrant. The company is the manufacturer and trader of travelling bag. In

ABBA COMPANY LIMITED is the company registered in Thailand and is VAT registrant. The company is the manufacturer and trader of travelling bag. In November 2018, there has the following business transaction:- 1. Buy the leather for manufacturing of travelling bag from L Co.,Ltd. 2. Pay the payroll for 10 staffs (equally) in the production line 3. Pay for electricity usage in the plant and office to MEA (State Enterprise) 4. Pay for consult fee of the month to Company C (Thai co.) 5. Pay for royalty fee for the month to Company D. (Japanese) 6. Receive the cash sale of travelling for the month from all customer 7. Received the interest income from the saving account of the company 8. Pay the interest on loan from bank at the principal of loan at 1,000,000 Baht with According to the loan agreement, monthly payment is required. 9. Machine depreciation calculation charged to manufacturing cost of the month 10. Receive the monthly franchise fee from the franchisee for the month as follow. Franchisee XX YY Sale of the month (VAT INCLUSIVE) $42,000 Baht $56,000 Baht Vat Calculation for Tax month Income amount Less: 0% sale Taxable income Output tax amount 100,000 Baht. 330,000 Baht. ||| 120,000 Baht. 30,000 Baht. 50,000 Baht. % of sale (not include VAT) (under the franchise agreement) 2 Assumption: All amount is excluded VAT (if VAT applied) unless it is noted as others. Interest receive or payment is not VAT Business. Calculate the VAT Liability for the month. Purchase amount Input tax amount Tax to be paid /(over paid) Less Input tax carry fwd from previous month Net tax payable/(over paid) 700,000 Baht. 10,000 Baht. the interest rate 7.5% per annum 39,000 Baht 0000

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

VAT Calculation for the month of November 2018 Particulars Baht Baht Income Amount 2286916 Less 0 Sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started