Question

ABC Acquisition Company (ABC Co.) is looking to acquire LHC Group Inc. (ticker symbol LHCG and will be referred to as LHC). It plans to

ABC Acquisition Company ("ABC Co.") is looking to acquire LHC Group Inc. (ticker symbol LHCG and will be referred to as "LHC"). It plans to take advantage of LHC's existing post-acute and non-acute healthcare provider network and expand into markets it does not yet serve such as inner-city neighborhoods and other unserved and underserved markets. Through its other affiliate health care companies, ABC Co. believes it can take advantage of potential synergies which will translate to cost savings of 20% to 30% over the next two years. By the company's estimate, this can translate to higher returns and can increase the standard deviation of the stock price to two times its current level.

ABC Co. intends to purchase LHC group through a combination of equity and debt in a leveraged buyout transaction. ABC Co. has set a maximum threshold on the resulting company's debt levels which can potentially see an increase in LHC's debt to 15 times its current level. ABC Co. prefers to finance as much of the acquisition as possible through debt subject to the maximum threshold it has set above. The rest will be financed through raising equity. The company has hired you to value the firm and to help it in determining a fair purchase price for the company. In your anlaysis, use a time-frame of three years

Using LHC's financial results for the end of 2016, how much is the company currently worth?(kindly find the financial results for the end of 2016 for LHC Group to compute this ) ( you need to find the risk valuation of firm) )

Assume that all of the company's debt (including revolving credit facility and current portion of long-term debt) is zero-coupon debt with a term of three years, what is the market value of the debt? What is the firms current equity?

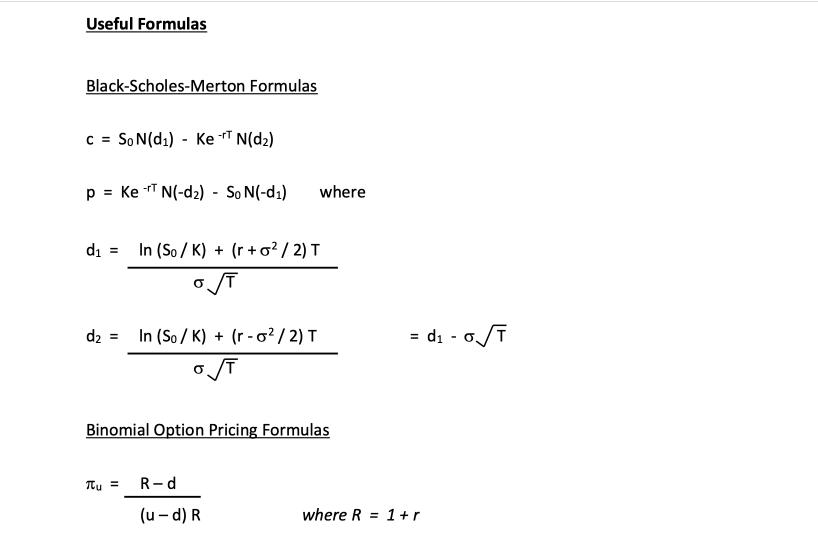

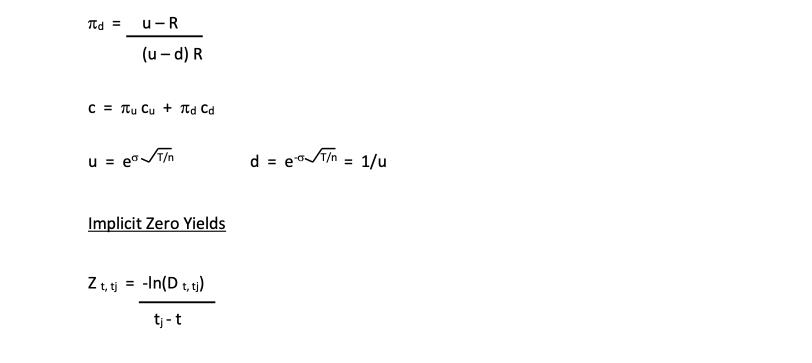

Useful Formulas Black-Scholes-Merton Formulas C = So N (d) KeT N(d) p = Ke N(-d) - So N(-d) -rT d = In (So/K) + (r +o/2) T o T d2 In (So/K) + (r-o/2) T = T where Binomial Option Pricing Formulas u = R-d (u - d) R =d - oT where R = 1+r

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I understand that the URL you provided httpsbardgooglecomutmsource...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started