Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Search Case 3: Overstated depreciation for long-term assets In 2009 Lufthansa, the German national airline, reported that it depreciated its aircraft over 12 years

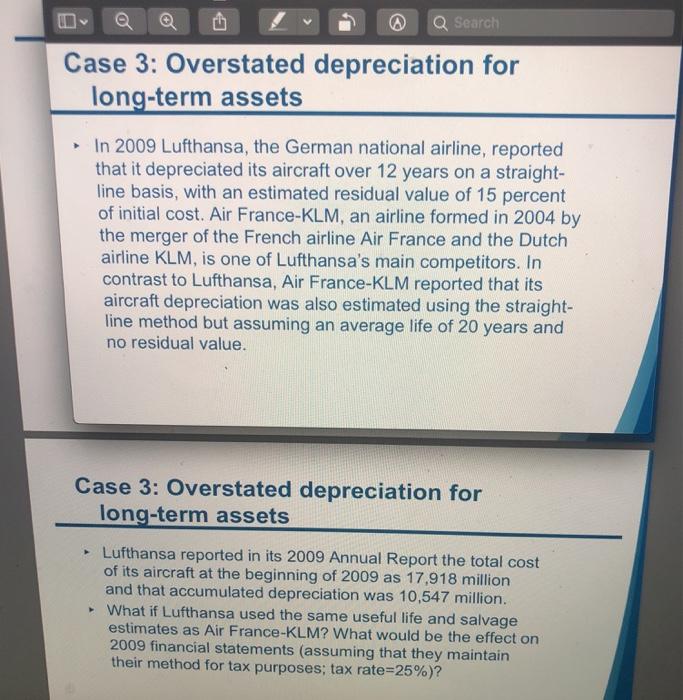

Search Case 3: Overstated depreciation for long-term assets In 2009 Lufthansa, the German national airline, reported that it depreciated its aircraft over 12 years on a straight- line basis, with an estimated residual value of 15 percent of initial cost. Air France-KLM, an airline formed in 2004 by the merger of the French airline Air France and the Dutch airline KLM, is one of Lufthansa's main competitors. In contrast to Lufthansa, Air France-KLM reported that its aircraft depreciation was also estimated using the straight- line method but assuming an average life of 20 years and no residual value. Case 3: Overstated depreciation for long-term assets Lufthansa reported in its 2009 Annual Report the total cost of its aircraft at the beginning of 2009 as 17,918 million and that accumulated depreciation was 10,547 million. What if Lufthansa used the same useful life and salvage estimates as Air France-KLM? What would be the effect on 2009 financial statements (assuming that they maintain their method for tax purposes; tax rate=25%)?

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

For buy thank Yer 2009 Highl Life of the Airsaft 12 yeare Method of Depreciation gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started