Answered step by step

Verified Expert Solution

Question

1 Approved Answer

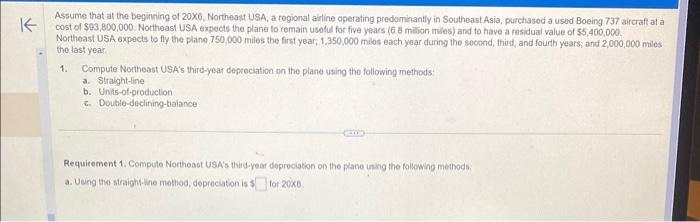

abc all part please Assume that at the beginning of 20X6, Northeast USA, a regional airline operating predominantly in Southeast Asia, purchased a used Boeing

abc all part please

Assume that at the beginning of 20X6, Northeast USA, a regional airline operating predominantly in Southeast Asia, purchased a used Boeing 737 aircraft at a cost of $93,800,000. Nottheast USA expects the plane to remain usoful for five years (6.8 milition mises) and to have a residual value of $5,400,000. Northoast USA expects to fly the plane 750,000 miles the first year, 1,350,000 milos each year during the s00ond, third, and fourth years; and 2,000,000 milos the last year. 1. Compute Northeast USA's third-year depreciation on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining-balance Requitement 1. Compute Northoaot USA's third.year depreciation on the plane uning the following methods. a. Uning the straight the mathod, depreciation is 1 for 200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started