Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A,B,C and D please You manage a multi-stage VC fund conducting due diligence on an pharmaceutical start-up. The required rate of return is 33%. You

A,B,C and D please

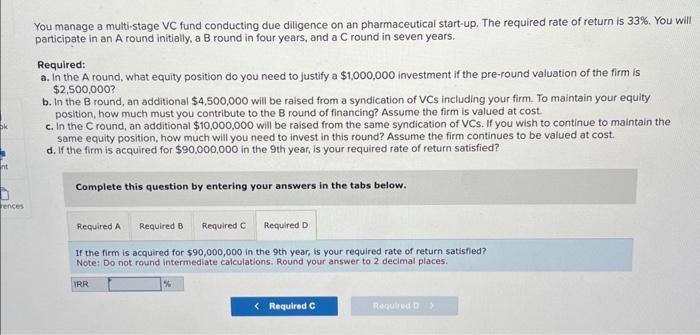

You manage a multi-stage VC fund conducting due diligence on an pharmaceutical start-up. The required rate of return is 33%. You will participate in an A round initially, a B round in four years, and a C round in seven years. Required: a. In the A round, what equity position do you need to justify a $1,000,000 investment if the pre-round valuation of the firm is $2,500,000 ? b. In the B round, an additional $4,500,000 will be raised from a syndication of VCs including your firm. To maintain your equity position, how much must you contribute to the B round of financing? Assume the firm is valued at cost. c. In the C round, an additional $10,000,000 will be raised from the same syndication of VCs. If you wish to continue to maintain the same equity position, how much will you need to invest in this round? Assume the firm continues to be valued at cost. d. If the firm is acquired for $90,000,000 in the 9 th year, is your required rate of return satisfied? Complete this question by entering your answers in the tabs below. If the firm is acquired for $90,000,000 in the 9 th year, is your required rate of return satisfied? Note; Do not round intermediate calculations. Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started