Question

ABC Bank has committed to lend to a firm $30 million in 90 days. The loan will mature 60 days after its initiation. The

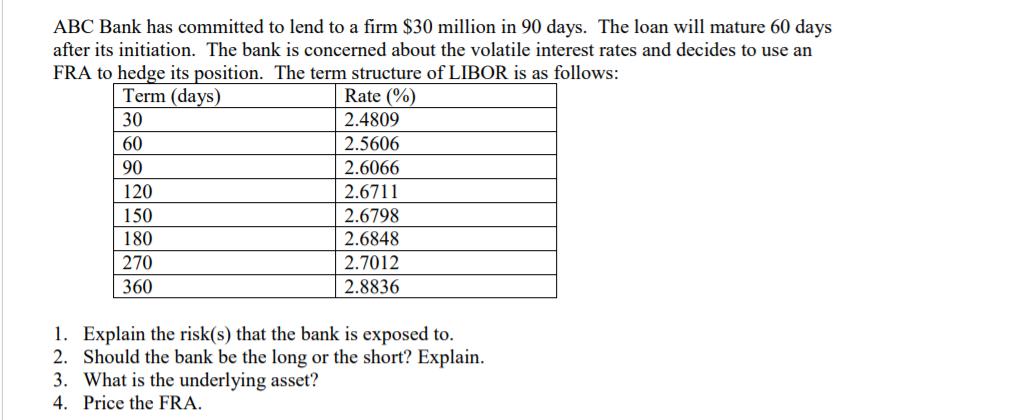

ABC Bank has committed to lend to a firm $30 million in 90 days. The loan will mature 60 days after its initiation. The bank is concerned about the volatile interest rates and decides to use an FRA to hedge its position. The term structure of LIBOR is as follows: Term (days) Rate (%) 30 2.4809 60 2.5606 90 2.6066 120 2.6711 150 2.6798 180 2.6848 270 2.7012 360 2.8836 1. Explain the risk(s) that the bank is exposed to. 2. Should the bank be the long or the short? Explain. 3. What is the underlying asset? 4. Price the FRA.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The bank is exposed to interest rate risk Given that the loan will mature 60 days after initiation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Derivatives And Risk Management

Authors: Don M. Chance, Robert Brooks

10th Edition

130510496X, 978-1305104969

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App