Answered step by step

Verified Expert Solution

Question

1 Approved Answer

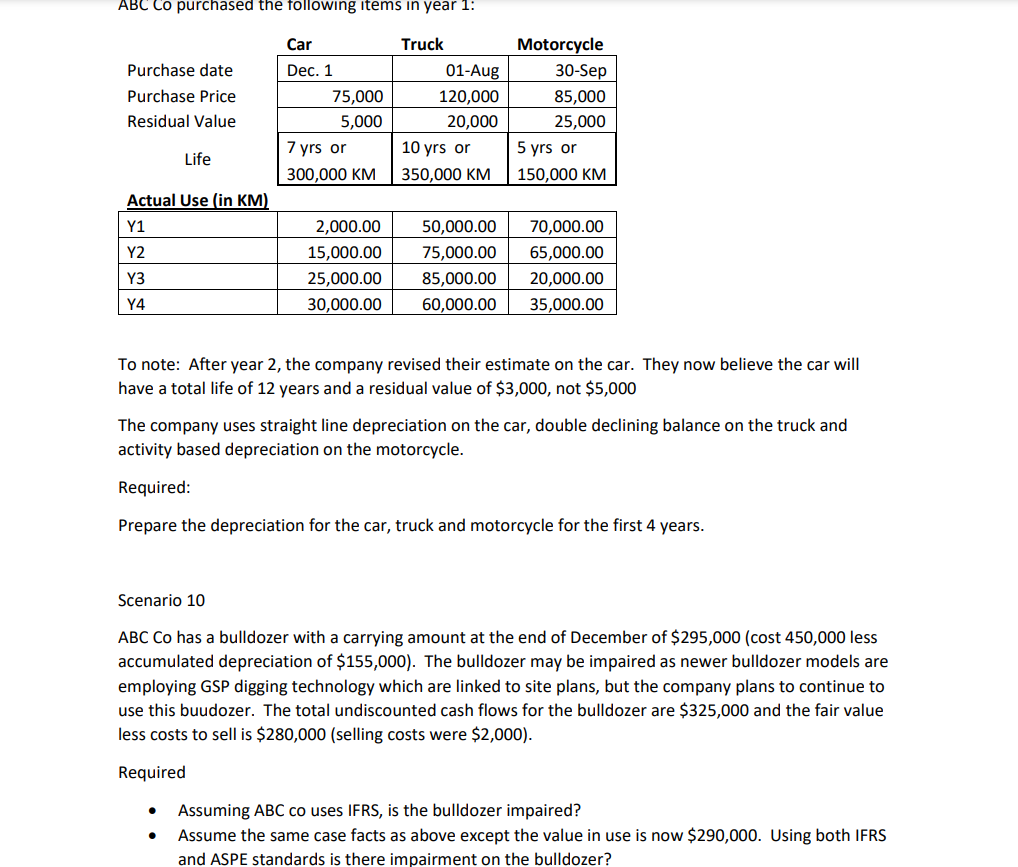

ABC Co purchased the following items in year 1: Car Truck Motorcycle Purchase date Dec. 1 01-Aug 30-Sep Purchase Price 75,000 120,000 85,000 Residual

ABC Co purchased the following items in year 1: Car Truck Motorcycle Purchase date Dec. 1 01-Aug 30-Sep Purchase Price 75,000 120,000 85,000 Residual Value 5,000 20,000 25,000 7 yrs or 10 yrs or 5 yrs or Life 300,000 KM 350,000 KM 150,000 KM Actual Use (in KM) Y1 Y2 Y3 Y4 2,000.00 15,000.00 25,000.00 30,000.00 50,000.00 70,000.00 75,000.00 65,000.00 85,000.00 20,000.00 60,000.00 35,000.00 To note: After year 2, the company revised their estimate on the car. They now believe the car will have a total life of 12 years and a residual value of $3,000, not $5,000 The company uses straight line depreciation on the car, double declining balance on the truck and activity based depreciation on the motorcycle. Required: Prepare the depreciation for the car, truck and motorcycle for the first 4 years. Scenario 10 ABC Co has a bulldozer with a carrying amount at the end of December of $295,000 (cost 450,000 less accumulated depreciation of $155,000). The bulldozer may be impaired as newer bulldozer models are employing GSP digging technology which are linked to site plans, but the company plans to continue to use this buudozer. The total undiscounted cash flows for the bulldozer are $325,000 and the fair value less costs to sell is $280,000 (selling costs were $2,000). Required Assuming ABC co uses IFRS, is the bulldozer impaired? Assume the same case facts as above except the value in use is now $290,000. Using both IFRS and ASPE standards is there impairment on the bulldozer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

First lets calculate the depreciation for the car truck and motorcycle for the first 4 years based on the given information Car Purchase price 5000 Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started