Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Community Health Center Case Facts: ABC Community Health Center (ABC) serves a population of approximately 30,000 people. The non-profit community clinic provides primary

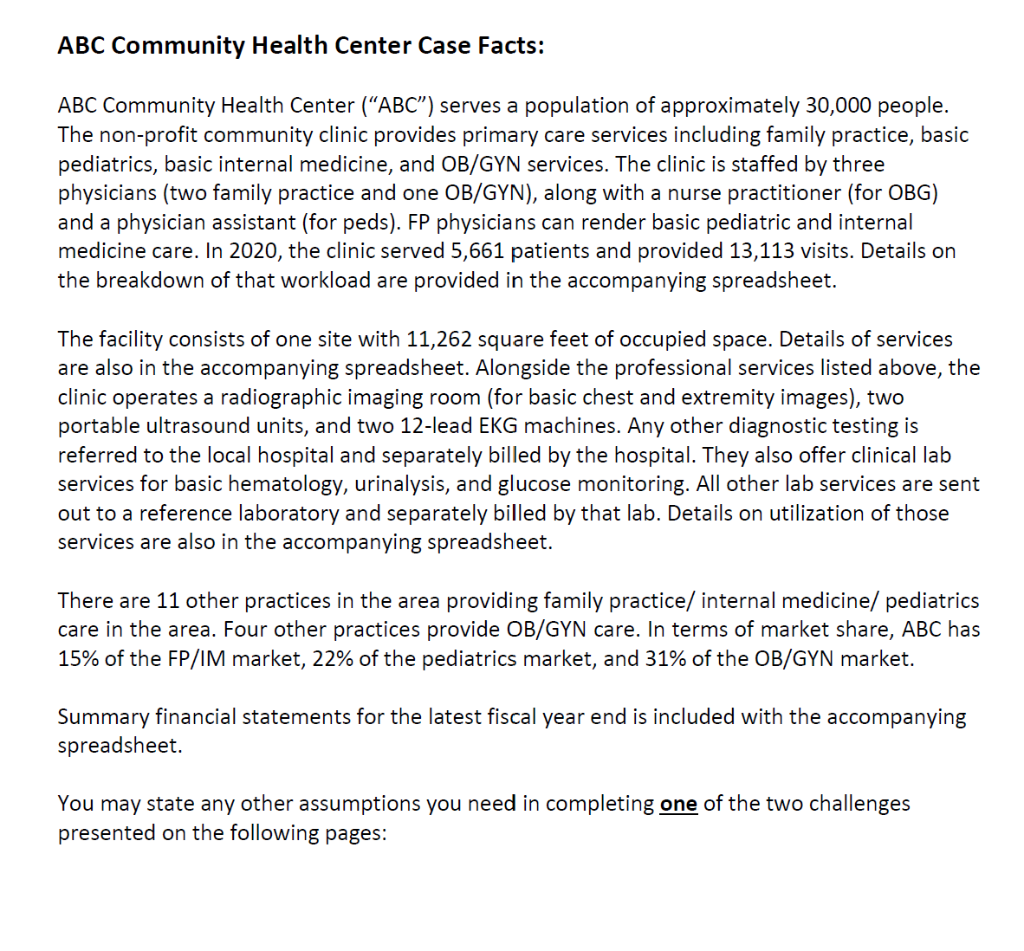

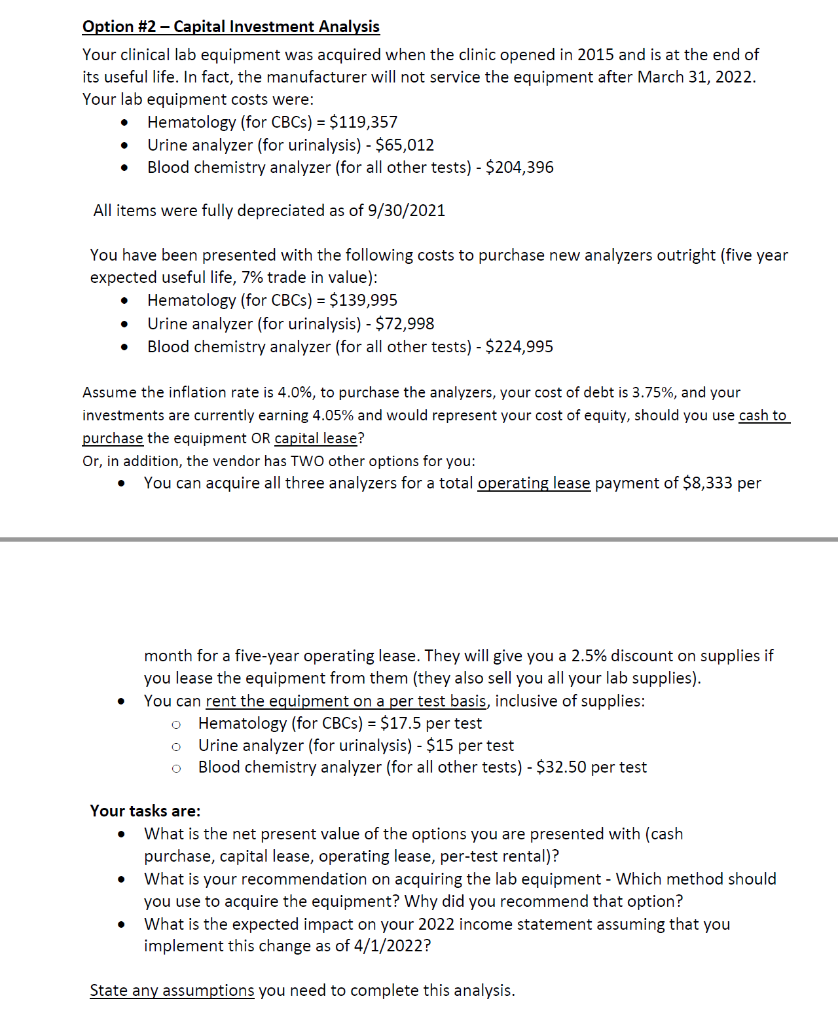

ABC Community Health Center Case Facts: ABC Community Health Center ("ABC") serves a population of approximately 30,000 people. The non-profit community clinic provides primary care services including family practice, basic pediatrics, basic internal medicine, and OB/GYN services. The clinic is staffed by three physicians (two family practice and one OB/GYN), along with a nurse practitioner (for OBG) and a physician assistant (for peds). FP physicians can render basic pediatric and internal medicine care. In 2020, the clinic served 5,661 patients and provided 13,113 visits. Details on the breakdown of that workload are provided in the accompanying spreadsheet. The facility consists of one site with 11,262 square feet of occupied space. Details of services are also in the accompanying spreadsheet. Alongside the professional services listed above, the clinic operates a radiographic imaging room (for basic chest and extremity images), two portable ultrasound units, and two 12-lead EKG machines. Any other diagnostic testing is referred to the local hospital and separately billed by the hospital. They also offer clinical lab services for basic hematology, urinalysis, and glucose monitoring. All other lab services are sent out to a reference laboratory and separately billed by that lab. Details on utilization of those services are also in the accompanying spreadsheet. There are 11 other practices in the area providing family practice/ internal medicine/pediatrics care in the area. Four other practices provide OB/GYN care. In terms of market share, ABC has 15% of the FP/IM market, 22% of the pediatrics market, and 31% of the OB/GYN market. Summary financial statements for the latest fiscal year end is included with the accompanying spreadsheet. You may state any other assumptions you need in completing one of the two challenges presented on the following pages: Option #2 - Capital Investment Analysis Your clinical lab equipment was acquired when the clinic opened in 2015 and is at the end of its useful life. In fact, the manufacturer will not service the equipment after March 31, 2022. Your lab equipment costs were: Hematology (for CBCs) = $119,357 Urine analyzer (for urinalysis) - $65,012 Blood chemistry analyzer (for all other tests) - $204,396 All items were fully depreciated as of 9/30/2021 You have been presented with the following costs to purchase new analyzers outright (five year expected useful life, 7% trade in value): Hematology (for CBCs) = $139,995 Urine analyzer (for urinalysis) - $72,998 Blood chemistry analyzer (for all other tests) - $224,995 Assume the inflation rate is 4.0%, to purchase the analyzers, your cost of debt is 3.75%, and your investments are currently earning 4.05% and would represent your cost of equity, should you use cash to purchase the equipment OR capital lease? Or, in addition, the vendor has TWO other tions for you: You can acquire all three analyzers for a total operating lease payment of $8,333 per month for a five-year operating lease. They will give you a 2.5% discount on supplies if you lease the equipment from them (they also sell you all your lab supplies). You can rent the equipment on a per test basis, inclusive of supplies: o Hematology (for CBCs) = $17.5 per test Urine analyzer (for urinalysis) - $15 per test Blood chemistry analyzer (for all other tests) - $32.50 per test Your tasks are: What is the net present value of the options you are presented with (cash purchase, capital lease, operating lease, per-test rental)? O What is your recommendation on acquiring the lab equipment - Which method should you use to acquire the equipment? Why did you recommend that option? What is the expected impact on your 2022 income statement assuming that you implement this change as of 4/1/2022? State any assumptions you need to complete this analysis.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Net Present Value NP V of Cash Purchase The net present value of the cash purchase option is the cost of the three analy zers 5 39 992 minus the trade ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started