Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company acquired an asset by way of a six year term finance lease on 1* January 2016. The asset had a fair value

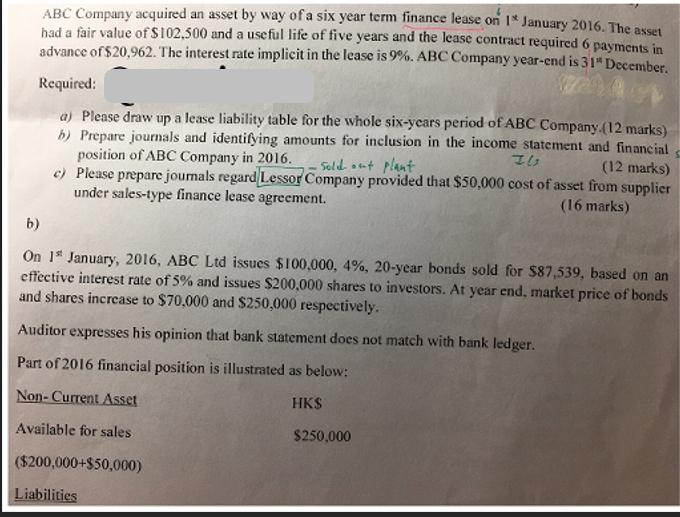

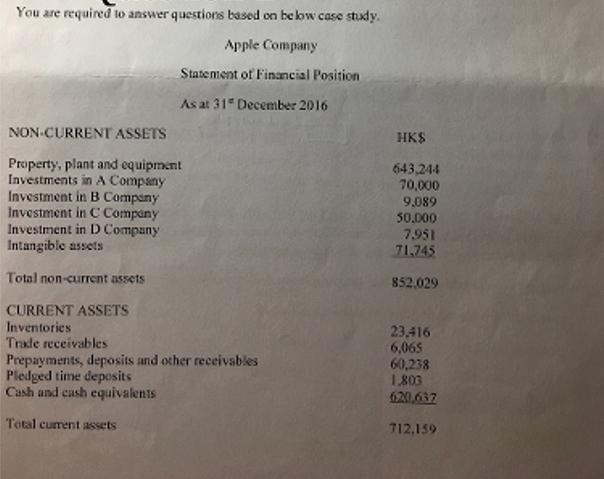

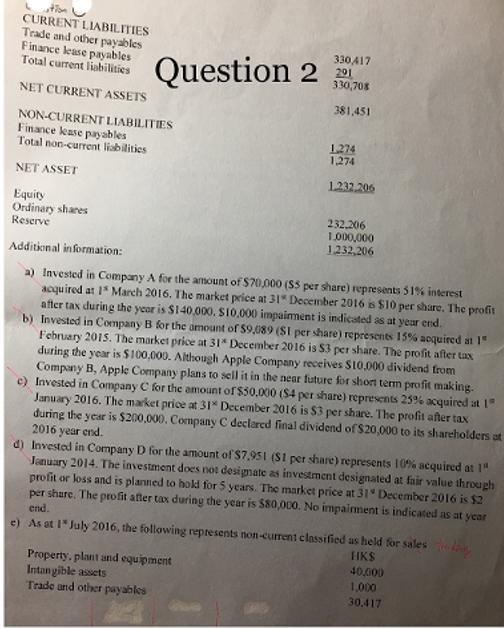

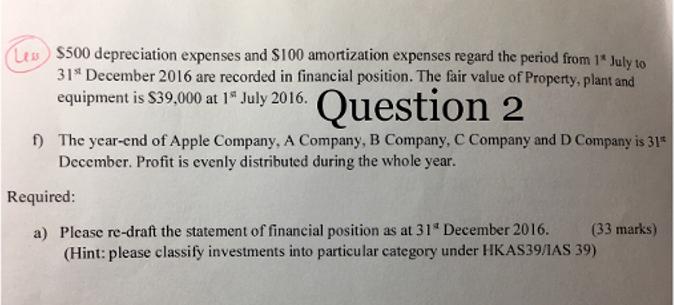

ABC Company acquired an asset by way of a six year term finance lease on 1* January 2016. The asset had a fair value of $102,500 and a useful life of five years and the lease contract required 6 payments in advance of $20,962. The interest rate implicit in the lease is 9%. ABC Company year-end is 31 December. Required: a) Please draw up a lease liability table for the whole six-years period of ABC Company (12 marks) b) Prepare journals and identifying amounts for inclusion in the income statement and financial position of ABC Company in 2016. Ils (12 marks) Sold out plant c) Please prepare journals regard Lessor Company provided that $50,000 cost of asset from supplier under sales-type finance lease agreement. (16 marks) b) On 1st January, 2016, ABC Ltd issues $100,000, 4%, 20-year bonds sold for $87,539, based on an effective interest rate of 5% and issues $200,000 shares to investors. At year end, market price of bonds and shares increase to $70,000 and $250,000 respectively. Auditor expresses his opinion that bank statement does not match with bank ledger. Part of 2016 financial position is illustrated as below: Non-Current Asset HKS Available for sales $250,000 ($200,000+$50,000) Liabilities S Bank overdraft ($200,000-$4,000-$100,000) Bonds ($100,000+$4,000-$4,377) Equity Revaluation surplus $104,000 $99,623 $50,000 Required: Question 1 Prepare adjusted journals regard shares and bonds if you disagree the above accounting record. (8 marks) You are required to answer questions based on below case study. Apple Company Statement of Financial Position As at 31 December 2016 NON-CURRENT ASSETS Property, plant and equipment Investments in A Company Investment in B Company Investment in C Company Investment in D Company Intangible assets Total non-current assets CURRENT ASSETS Inventories Trade receivables Prepayments, deposits and other receivables Pledged time deposits Cash and cash equivalents Total current assets HK$ 643,244 70,000 9,089 50.000 7.951 71,745 852,029 23,416 6,065 60,238 1,803 620,637 712,159 tion CURRENT LIABILITIES Trade and other payables Finance lease payables Total current liabilities NET CURRENT ASSETS NON-CURRENT LIABILITIES Finance lease payables Total non-current liabilities NET ASSET 330,417 Question 2 201 330,70% 381,451 1,274 1,274 1.232.206 Equity Ordinary shares Reserve Additional information: a) Invested in Company A for the amount of $70,000 ($5 per share) represents 51% interest acquired at 1 March 2016. The market price at 31 December 2016 is $10 per share. The profit after tax during the year is $140,000, $10,000 impairment is indicated as at year end. b) Invested in Company B for the amount of $9,089 ($1 per share) represents 15% acquired at 1 February 2015. The market price at 31* December 2016 is $3 per share. The profit after tax during the year is $100,000. Although Apple Company receives $10,000 dividend from Company B, Apple Company plans to sell it in the near future for short term profit making. Invested in Company C for the amount of $50,000 ($4 per share) represents 25% acquired at 1 January 2016. The market price at 31 December 2016 is $3 per share. The profit after tax during the year is $200,000. Company C declared final dividend of $20,000 to its shareholders at 2016 year end. Property, plant and equipment Intangible assets Trade and other payables 232,206 1,000,000 1.232,206 d) Invested in Company D for the amount of $7,951 ($1 per share) represents 10% acquired at 1" January 2014. The investment does not designate as investment designated at fair value through profit or loss and is planned to hold for 5 years. The market price at 31 December 2016 is $2 per share. The profit after tax during the year is $80,000. No impairment is indicated as at year end. e) As at 1* July 2016, the following represents non-current classified as held for sales HK$ 40,000 1,000 30.417 Les $500 depreciation expenses and $100 amortization expenses regard the period from 1* July to 31st December 2016 are recorded in financial position. The fair value of Property, plant and equipment is $39,000 at 1 July 2016. Question 2 f) The year-end of Apple Company, A Company, B Company, C Company and D Company is 315 December. Profit is evenly distributed during the whole year. Required: a) Please re-draft the statement of financial position as at 31 December 2016. (Hint: please classify investments into particular category under HKAS39/1AS 39) (33 marks)

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Lease Liability Table for the SixYear Period Year Opening Lease Liability Lease Payments Interest Expense Reduction in Lease Liability Closing Lease Liability 2016 102500 20962 9225 11737 90763 2017 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started