Question

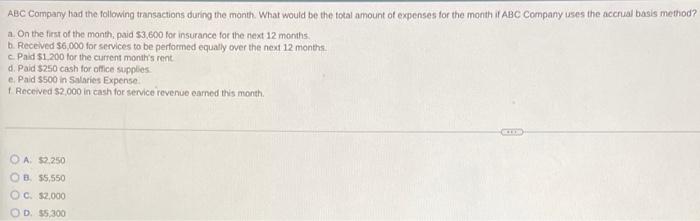

ABC Company had the following transactions during the month. What would be the total amount of expenses for the month il ABC Company uses

ABC Company had the following transactions during the month. What would be the total amount of expenses for the month il ABC Company uses the accrual basis method? a. On the first of the month, paid $3,600 for insurance for the next 12 months. b. Received $6,000 for services to be performed equally over the next 12 months. c Paid $1.200 for the current month's rent d. Paid $250 cash for office supplies e. Paid $500 in Salaries Expense. f Received $2,000 in cash for service revenue earned this month. O A. $2.250 OB. S5,550 OC. S2.000 OD. $5,300

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Ask To calculate expenses for month as per accrual basis method Solution Accrual basis method says t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

26th edition

128574361X, 978-1305446052, 1305446054, 978-1285743615

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App